Sales tax is a critical component of retail transactions, impacting both consumers and businesses. Levied by state and local governments, it applies to goods and some services sold within their jurisdictions.

Understanding sales tax is essential for anyone buying, selling, or managing businesses. The tax is added to the purchase price and collected by the seller, who then remits it to the taxing authority. Varying tax rates and rules across states necessitate compliance for financial management and consumer purchasing. Non-compliance can lead to penalties, fines, and legal actions by tax authorities.

1. Definition and purpose of sales tax

Sales tax is a consumption tax imposed by state and local governments on goods and some services sold within their jurisdiction. Its purpose is to generate revenue to fund government operations and services, such as infrastructure, education, and public safety. The tax is typically a percentage of the purchase price and is added at the point of sale.

2. Taxable Items: Goods and services

Sales tax applies to a wide range of goods and services, including tangible personal property (such as electronics, clothing, and furniture) and certain services (like restaurant meals and haircuts). Some states also tax digital goods and services.

3. Tax rates: State and local variations

The sales tax rate varies by state and locality. States set their own rates, which can range from 0% (in some states) to over 10%. Local jurisdictions, such as counties and cities, may impose additional sales taxes on top of the state rate, leading to varying total rates within a state.

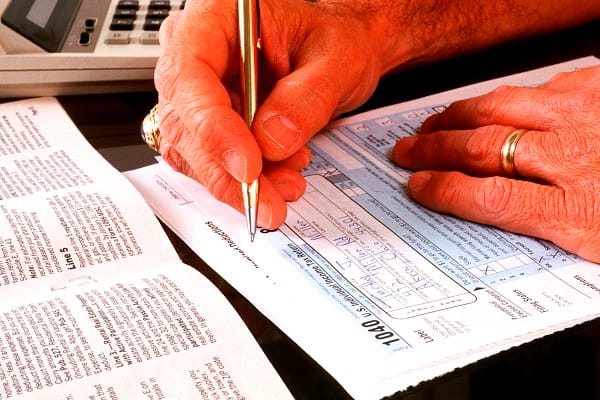

4. Collection and remittance by sellers

Sellers are responsible for collecting sales tax from customers at the time of purchase and remitting it to the appropriate taxing authority. This process involves registering with state and local tax authorities, calculating the correct amount of tax due, and filing regular sales tax returns.

5. Exemptions and special considerations

Certain items and transactions may be exempt from sales tax based on state laws. Common exemptions include groceries, prescription drugs, and resale transactions. Additionally, some states offer sales tax holidays where certain purchases are exempt from sales tax for a limited time.

6. Impact on consumers and businesses

Sales tax affects both consumers and businesses. For consumers, it increases the final cost of goods and services purchased. Businesses must navigate complex sales tax laws, ensuring compliance with different rates and exemptions. Failure to comply can result in penalties and interest. Moreover, sales tax policies can influence consumer behavior and business decisions, impacting sales volume and profitability.

In conclusion, understanding how sales tax works is essential for navigating retail transactions effectively. From its purpose in funding government services to its impact on consumers and businesses, sales tax plays a significant role in the economy and requires careful management and compliance from all parties involved. Additionally, it’s important to note that sales tax calculations can sometimes vary based on the shipping address, making accurate determinations crucial for businesses conducting interstate or international transactions.