Banking isn’t what it used to be. From digital disruption to economic uncertainty, today’s financial institutions are operating in one of the most unpredictable environments we’ve seen in decades. But despite the rapid changes, one principle remains non-negotiable: trust. And that trust is rooted in how well banks manage risk.

For the average banking customer, it’s easy to overlook what’s happening behind the scenes. We deposit money, make transfers, apply for loans. But the reality is that every transaction carries risk. That’s where risk management software comes in. It’s not just about compliance anymore, it’s also about creating a safer, more resilient banking experience that protects both the institution and its customers.

At its fundamental level, risk management of banks involves identification of possible threats to the financial health and reputation of a bank and declaring wards against it. Risks could manifest in many forms—credit risk, operational risk, market risk, cyber risk, and even reputational risk arising from bad customer service or unethical service.

In their mismanagement, these risks have, in the past, been able to bring even the grandest of banks into disrepute. When managed well, however, they become tactical; they become manageable. These days, banks can usually deploy integrated systems with data-driven tools to glean early warning signs and proactively modify their policies to secure the interests of all their stakeholders from the top executives to their ordinary customers.

Let’s take a real-life scenario. Assuming you chose to open up your banking application and find that your account has been blocked on suspicion of fraud. If indeed the bank has a reliable risk management system, it would most probably find a solution easily and quickly. But if this company had a poorly designed and partially responsive system, you could have found yourself stuck, grumbling, and beyond any doubt questioning your trust in this institution.

Consumer behavior nowadays is influenced very much by the security and responsiveness of the banks. They want to feel secure and expect their bank to stay ahead of all threats. And that anticipation is literally forcing the banks to use ever-increasing numbers of tools and software to monitor, assess, and respond to risks in real-time, ensuring that the experience of the user is never disrupted.

Risk management had once been transformed solely to guarantee compliance within the banks. Saying what boxes to tick for the satisfaction of the regulators, but that is not enough. Within that quickened pace in banking, banks should act proactively. One data breach, one slip-off in terms of regulatory compliance, and one sudden market dip, everything else becomes instant, far, and wide-ranging.

This transition can be observed in the movement of financial institutions from a fairly static approach to risk management toward one more dynamic, continuous, software-augmented approach. Banks can visually recognize those possible risks to various functions and departments and be able to plan appropriate response motions before those threats turn into missions.

And here is where it becomes complicated: the risk is not to eliminate all; that is impossible. It is to have a clear view of which risks can be taken, which ones considered mitigated, and which ones totally avoided.

Today, modern banking customers are assumed to be more informed and digitally savvy than before. They demand total transparency and live feeds. They want to be kept in the loop, whether it is through fraud alerts, suspicious login notifications, or credit monitoring tools.

Because of this, banks are pushed to include tools that are not merely assessing risk, but that also develop the capacity for communicating risk: dashboards, automated alerts, intuitive interfaces, and user-focused platforms that keep both internal teams and customers informed. It’s moving out of the boardrooms and into everyone’s lives. For example, risk management isn’t just associated with the board room anymore. It’s visible and integrated into the customer experience.

Thus, stability is not only about internal structure but also about agility and responsiveness. The banks that can respond quickest to the dangers that emerge in the financial landscape will be best able to build and maintain customer trust and loyalty.

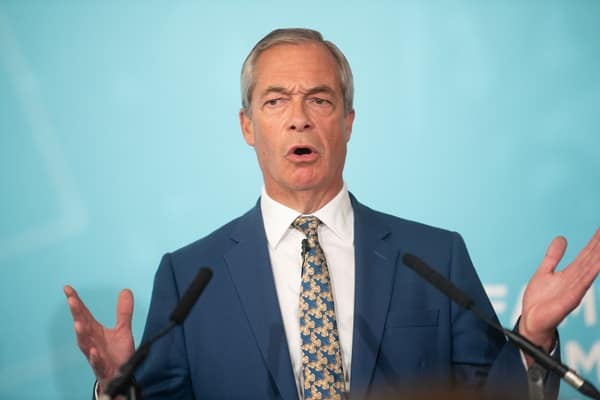

Shutterstock / Newscom / Avalon

Let’s face it, banks have tons of data. The question is: are they making use of it? Machine learning and artificial intelligence these days enable tools or software to sift through complex data sets to detect patterns, identify anomalies, and forecast with intelligence.

This means less false positives on fraud alerts to consumers, a more substantial credit evaluation, and faster loan approval processes. This means that banks are better able to mobilize resources against real threats that may require immediate action instead of wasting time on expectations grounded in routine noise.

AI-powered risk instruments are capable of learning from the history of incidents, evolving their reasoning as new risks come to the fore. When the financial landscape varies with unpredictable risks, this adaptability becomes priceless.

Technology is only part of the solution. The rest accounts for a culture whose foundations are foresight, collaboration, and ethical decision-making that supports a robust risk management practice. That culture must permeate through every level of the organization, from IT and compliance organizations to customer service organizations.

Banks that train their employees to understand risk, ask questions, and raise concerns will identify vulnerabilities before they escalate into a full-blown crisis. Ensuring that technology and human intelligence work in synergy creates a feedback loop.

At the end of the day, the goal of any risk management effort isn’t just regulatory compliance or operational efficiency—it’s trust. And in the world of banking, trust is everything. Whether someone is opening their first savings account or investing millions, they want to know that their money—and their data—is safe.

The banks that succeed in today’s market are those that view risk not as a roadblock, but as a responsibility. They use the tools at their disposal to anticipate challenges, protect customers, and keep the financial ecosystem stable.

Risk management may not be the flashiest part of banking, but it’s arguably the most essential. From fraud prevention to data security, it plays a quiet yet powerful role in ensuring that financial institutions remain strong, responsive, and trustworthy.

As more banks embrace digital transformation, the need for advanced management software will only grow. Not because it’s trendy—but because it’s vital. For the industry, for the economy, and most importantly, for the people who trust banks with their financial lives.