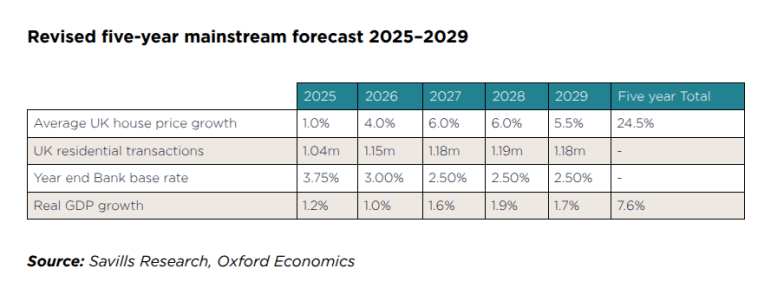

UK house prices are now expected to rise by just 1% in 2025, with growth of 24.5% forecast over the next five years, according to the latest analysis from Savills.

The revised outlook, down from a predicted 4%, follows a slower-than-anticipated start to 2025, with economic and geopolitical turbulence weighing on buyer sentiment and transaction volumes. While interest rates have fallen as expected – with two base rate cuts so far this year – Savills says the market remains “delicately balanced”, citing both global instability and domestic policy changes as key influences.

When Savills published its previous forecasts in November 2024, the firm predicted that falling interest rates and improving sentiment would underpin a period of steady price growth, with house prices rising 23.4% by 2029. While some of those expectations remain, the picture has become more complicated in recent months.

Geopolitical developments – including the introduction of new US tariffs and rising international tensions – have added unpredictability to the outlook for interest rates. Meanwhile, changes to stamp duty relief earlier in the year prompted a rush of activity in March, when transaction volumes reached their second-highest level since 2006, before dropping sharply in April.

Recent months have also seen a slowdown in house price growth. Annual price rises fell to 2.1% in June, according to Nationwide, compared to 4.7% in December 2024. Monthly price movements have been volatile, with increases in January, February and May, but declines in other months.

In light of these trends, Savills has revised its UK forecast for 2025 down to 1.0%. The company expects concerns over the prospect of future tax increases to weigh most heavily on the top end of the market.

However, there are reasons for optimism. Oxford Economics forecasts further base rate cuts totalling 175 basis points by the end of 2027, improving mortgage affordability.

Savills also notes that more relaxed approaches to mortgage regulation and affordability stress tests are likely to boost transaction volumes, reducing deposit hurdles for first-time buyers. Wage growth of over 22% is forecast over the next five years, while a strengthening economy in 2027-29 should boost confidence. By 2027, transaction numbers are expected to approach the post-financial crisis average of 1.2 million per year.

Short-term indicators remain mixed. The latest RICS survey points to weak demand and slow market conditions, though sales agreed in May were the highest in several years according to Zoopla and Rightmove.

Savills expects activity to pick up going into autumn, helped by further base rate cuts and a competitive mortgage market, though high levels of supply are likely to keep price growth limited for the rest of the year.

Looking further ahead, house price growth will continue to be shaped by affordability and lending conditions. While Savills expects continued caution given ongoing risks to the global and UK economic outlook, it maintains that the potential for house price growth has been boosted by changes to lending rules and a more supportive interest rate environment.

The firm’s central forecast is for UK mainstream house prices to rise by 24.5% over the next five years, though significant risks remain on both sides of the equation.