The government is reportedly considering a new national property tax as the first step towards a radical shake-up of stamp duty and council tax.

Recent discussions taking place at the Treasury include examining a potential new tax that would replace stamp duty on owner-occupied homes.

It would be paid by homeowners on properties worth more than £500,000 when they sold them, according to The Guardian. The amount paid would be determined by a property’s value.

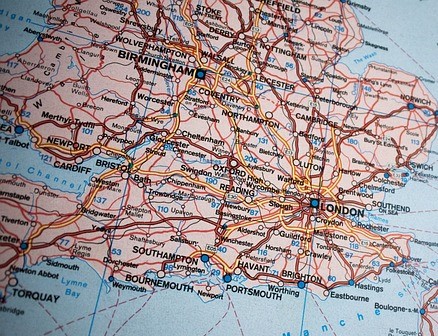

New research from eXp UK suggests that proposed reforms to replace stamp duty with a homeowner-based levy could disproportionately impact sellers in London and the South, where high property values are far more common.

According to the analysis, just 17.4% of all homes sold across England and Wales so far in 2025 have fetched £500,000 or more — the threshold reportedly under consideration for the new tax. In contrast, over half of all homes sold in London exceeded this figure, highlighting the potential regional disparities of the proposed changes.

eXp UK examined Land Registry Price Paid data covering 281,108 completed transactions across England and Wales since the start of the year. Of those, only 48,942 properties sold for £500,000 or more — suggesting that over 80% of buyers would benefit from the removal of upfront Stamp Duty costs.

However, eXp UK warns that agents and homeowners in London, the South East, and East of England will face the biggest adjustment, given the higher concentration of properties above the proposed threshold.

The South East is also heavily exposed, with 27.3% of transactions above £500,000, followed by the East of England at 20.4%.

By contrast, in Wales just 4.1% of homes sold for £500,000 or more, with even lower proportions recorded in the North East (3%) and Yorkshire and the Humber (5.4%).

Adam Day, head of eXp UK and Europe, commented: “Policy changes such as the proposed move from stamp duty to a homeowner levy would create a very different market landscape for agents across England and Wales.

“While the majority of buyers would clearly benefit from reduced upfront costs, agents in regions such as London and the South East will need to adapt quickly given the higher proportion of homes that could fall under the new system.

“As agents, it’s our responsibility to lead from the front and provide sound advice and clarity for our sellers, especially in times of notable change and at eXp, our model is designed to give agents the flexibility and support to thrive regardless of market conditions.

“By combining autonomy with industry-leading training, innovative technology, and access to a global community, we ensure our agents are equipped to meet the needs of buyers and sellers across all markets, whatever the requirements may be.”

Estate agents support stamp duty reform, urge abolition without replacement