Tesla (TSLA) will release its Q4 2025 and full-year 2025 financial results on Wednesday, Jan. 28, after the markets close. As usual, a conference call and Q&A with Tesla’s management are scheduled after the results.

Here, we’ll look at what the street and retail investors expect for the quarterly results.

Tesla Q4 2025 deliveries and energy deployment

Even though CEO Elon Musk and his loyal shareholders like to claim that Tesla is now an AI/Robotics company, the reality is that the company’s automotive business still drives the vast majority of its financial performance.

Tesla’s revenue remains tied mainly to the number of vehicles it delivers.

Earlier this month, Tesla disclosed its Q4 2025 vehicle production and deliveries:

| Production | Deliveries | Subject to operating lease accounting | |

|---|---|---|---|

| Model 3/Y | 422,652 | 406,585 | 3% |

| Other Models | 11,706 | 11,642 | 5% |

| Total | 434,358 | 418,227 | 3% |

Year-over-year, it represents a 16% drop in deliveries compared to Q4 2024.

For the full year 2025, Tesla delivered 1.636 million vehicles, down 8.6% from last year. That’s now two consecutive years of declining vehicle deliveries for a company that not long ago anticipated selling closer to 5 million cars this year.

The only silver lining is the energy division.

Tesla also disclosed having deployed a record 14.2 GWh of energy storage during the quarter. For the full year, Tesla deployed 46.7 GWh, up 49% year-over-year. It’s the one consistent bright spot in Tesla’s business right now.

Tesla Q4 2025 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers and now the energy storage deployment data.

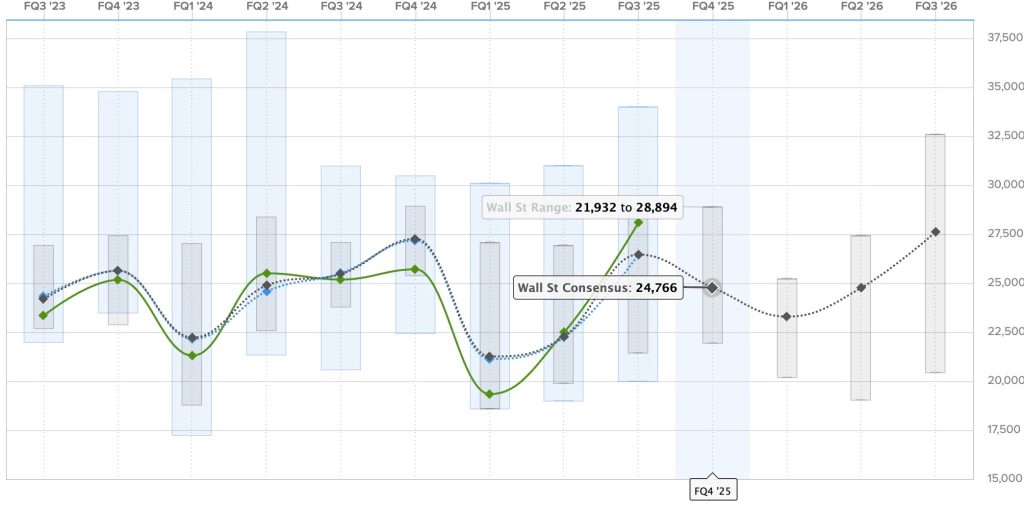

The Wall Street consensus for this quarter is $24.766 billion.

Here are the predictions for Tesla’s revenue over the past two years, with Estimize predictions in blue, Wall Street consensus in gray, and actual results in green:

If Tesla meets expectations, it would report lower revenue year-over-year for the second consecutive year, despite the growing contribution from energy storage.

For the full year 2025, analysts expect revenue of around $95 billion, down about 3% from 2024.

Tesla Q4 2025 earnings

Tesla claims to consistently strive for marginal profitability every quarter, as it invests the majority of its funds in growth, but its growth has disappeared from its automotive business, and its gross margin is going in the same direction.

Analysts are trying to estimate Tesla’s gross margin with lower deliveries and intensifying price competition to figure out its actual earnings per share.

The loss of incentives and subsidies in the US is also having an impact.

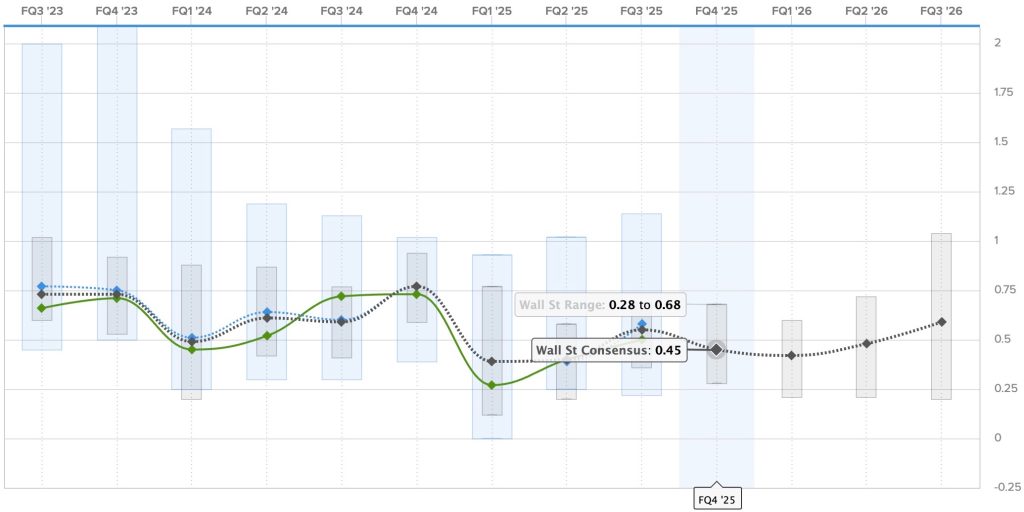

For Q4 2025, the Wall Street consensus is a gain of $0.45 per share.

Here are the earnings per share over the last two years, where Estimize predictions are in blue, Wall Street consensus is in gray, and actual results in green:

If Tesla meets expectations, it would be a 40% drop in earnings from $0.73 per share in Q4 2024.

For the full year 2025, analysts expect earnings of $1.63 per share, down 33% from 2024.

Most Upvoted Tesla Shareholders Questions for Q4 2025

To put that in perspective: Tesla’s earnings have now been declining for two years while the global EV market continues to grow at a record pace.

But I expect Musk to have Tesla shareholders focus on future revenue prospects from robotaxi and robots, something he has been promising for years without delivering any tangible results.

Tesla will also take questions from retail shareholders based on the most popular ones on Say. Here are the top 5 questions and my thoughts on them:

1. You once said: Loyalty deserves loyalty. Will long term Tesla shareholders still be prioritized if SpaceX does an IPO?

There’s so little to get excited about Tesla’s business right now that the most upvoted question for the shareholders meeting is for Tesla shareholders to get a piece of the SpaceX IPO, a company with about $15 billion in revenue, and it is rumored to have a public offering for $800 billion.

I always said, Musk’s true superpower is raising money.

2. When is FSD going to be 100% unsupervised?

There’s always a version of that question asked, and Musk always says the same thing: “By the end of the year or next year,” and it never happens.

3. What is the current bottleneck to increased Robotaxi deployment & personal use unsupervised FSD? The safety/performance of the most recent models or people to monitor robots robotaxis in-car or remotely? Or something else?

The naivety of those questions is depressing. Of course, it’s safety, or rather, from Tesla’s perspective, mitigating the risk of financial impact of accidents.

The reason why Tesla is running only a few cars at a time in its Robotaxi in Austin is that it helps maintain the illusion that Tesla is leading in autonomous driving while reducing the risk of accidents by keeping the mileage low.

4. Regarding Optimus, could you share the current number of units deployed in Tesla factories and actively performing production tasks? What specific roles or operations are they handling, and how has their integration impacted factory efficiency or output?

I’d actually be curious to hear the answer to that question. Not that I would necessarily trust it, but I’d like to know where the goalpost has been moved.

For context, Musk said that Tesla would have between 5,000 and 10,000 Optimus robots in 2025. We reported that it’s nowhere near that number.

5. Are there still plans to launch new models to address different price segments and vehicle types which could materially expand the TAM for Tesla?

I only planned to do 5 questions for this earnings preview, and for a second, I thought none of them would have anything to do with Tesla’s business.

Again, I’m curious to know the answer here. My guess is that it would be something like: “we are coming out with the Cybercab soon,” and then maybe he teases the Roadster again, but I don’t know of any active program at Tesla for actual consumer vehicles in new segments to expand Tesla’s addressable market.

Electrek’s Take

Tesla is reporting its second consecutive year of declining deliveries and earnings while the global EV market continues to grow. The company lost its crown as the world’s largest EV maker to BYD. Its once-industry-leading margins are under pressure from Chinese competition.

Meanwhile, Musk continues to push the narrative that none of this matters because Tesla is really an AI and robotics company now. He’s been making these promises since 2016, and every timeline he’s given has been wrong.

I expect more of that during this earnings release and the call.

The energy storage business is genuinely impressive and growing, but it’s not enough to offset the decline in the automotive business that still accounts for the vast majority of Tesla’s revenue.

I would expect Tesla to focus a lot on it on this call as it is an actual tangible business that is going fairly well, even though I think it will realistically start showing lower margins this year.

Unless you are a true believer that unsupervised robotaxis and mass-produced humanoid robots are right around the corner, despite a decade of failed predictions, there’s legitimate reason for concern about Tesla’s trajectory.

Tune in with Electrek after market close Wednesday to get all the latest news from Tesla’s earnings and conference call.

FTC: We use income earning auto affiliate links. More.