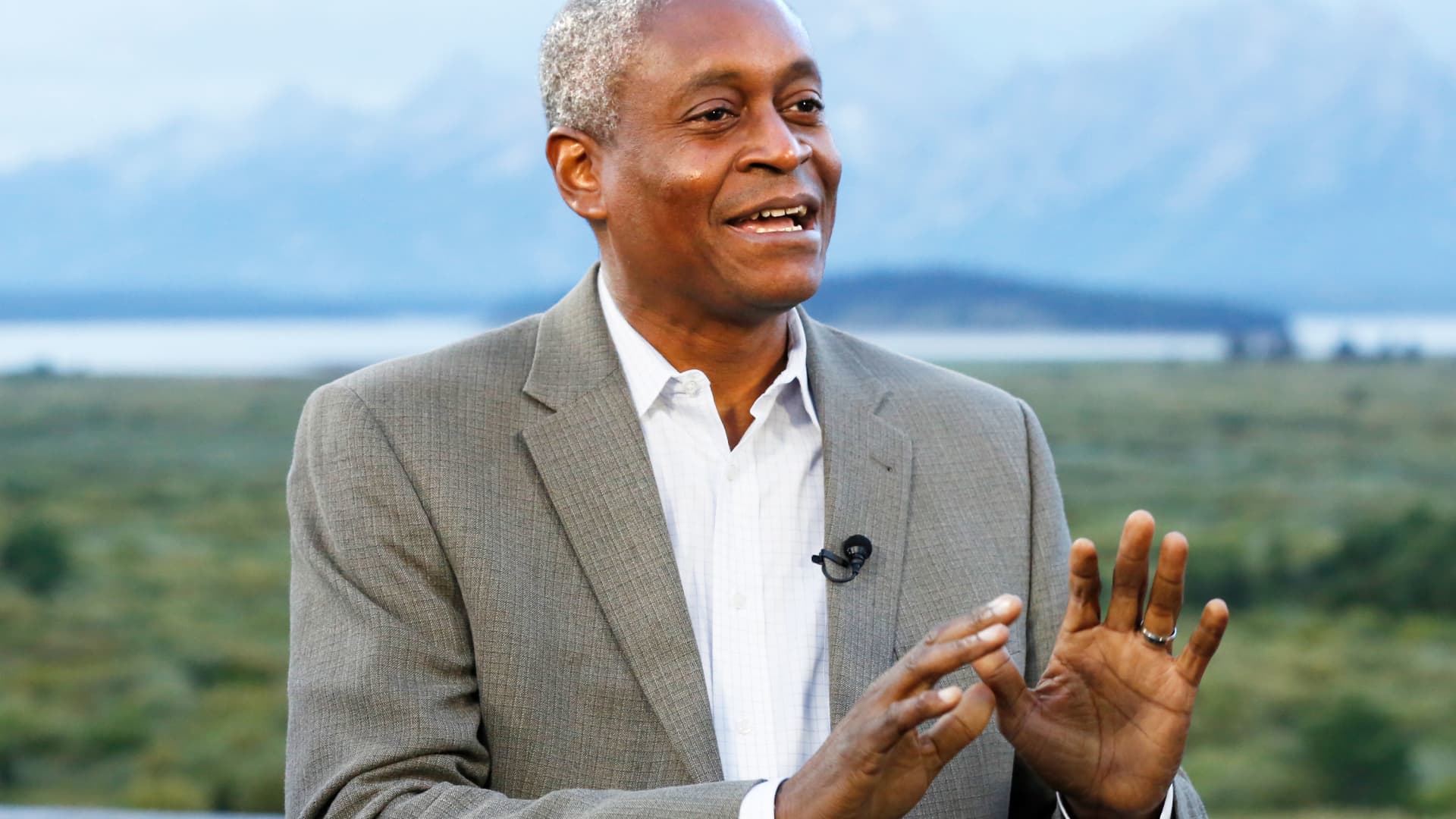

Atlanta Federal Reserve President Raphael Bostic said Tuesday he envisions the central bank approving one more interest rate increase before pausing to see how policy tightening is impacting the economy.

“One more move should be enough for us to then take a step back and see how our policy is flowing through the economy, to understand the extent to which inflation is returning back to our target,” Bostic said during a live interview on CNBC’s “Squawk on the Street.”

That 0.25 percentage point increase likely will come at the rate-setting Federal Open Market Committee’s May 2-3 meeting.

If a majority of the committee has the same view as Bostic, who is a nonvoting member this year, that would take the federal funds rate to a target range of 5%-5.25%, the highest since August 2007.

From there, Bostic said he thinks the FOMC can watch as the lags that come with monetary policy work their way through inflation, employment and the broader U.S. economic picture.

“If the data come in as I expect, we will be able to hold there for quite some time,” he said. “Once we get to that point, I don’t have us really doing anything but monitoring the economy for the rest of this year and into 2024.”

Markets, however, disagree that the Fed will be in a hold posture.

Current pricing indicates an 87% chance of a quarter-point hike next month, a pause for a few months, then a half percentage point cut by the end of 2023 as the economy slows, according to CME Group estimates. Bostic said inflation is still running too strong to consider cuts.

“Part of this is really about … inflation’s returning back to our 2% target. I don’t think that’s going to happen as quickly as some of the markets do. And it seems that the question is who’s right on this?” he said. “I don’t see it coming down below maybe three and a half. And three and a half is still well above our 2% target.”

He also noted that he does not foresee the economy tilting into recession, even though Fed economists warned at the March FOMC meeting that a mild contraction is likely later in the year.

Bostic added that tight monetary policy is likely to persist despite the recent troubles in the banking industry that are forecast to trigger the recession.

He described the state of banking in his district as “stable,” though he noted that “you never know when the next shoe might drop,” adding that the Fed will remain vigilant “to make sure that we’re ready.”