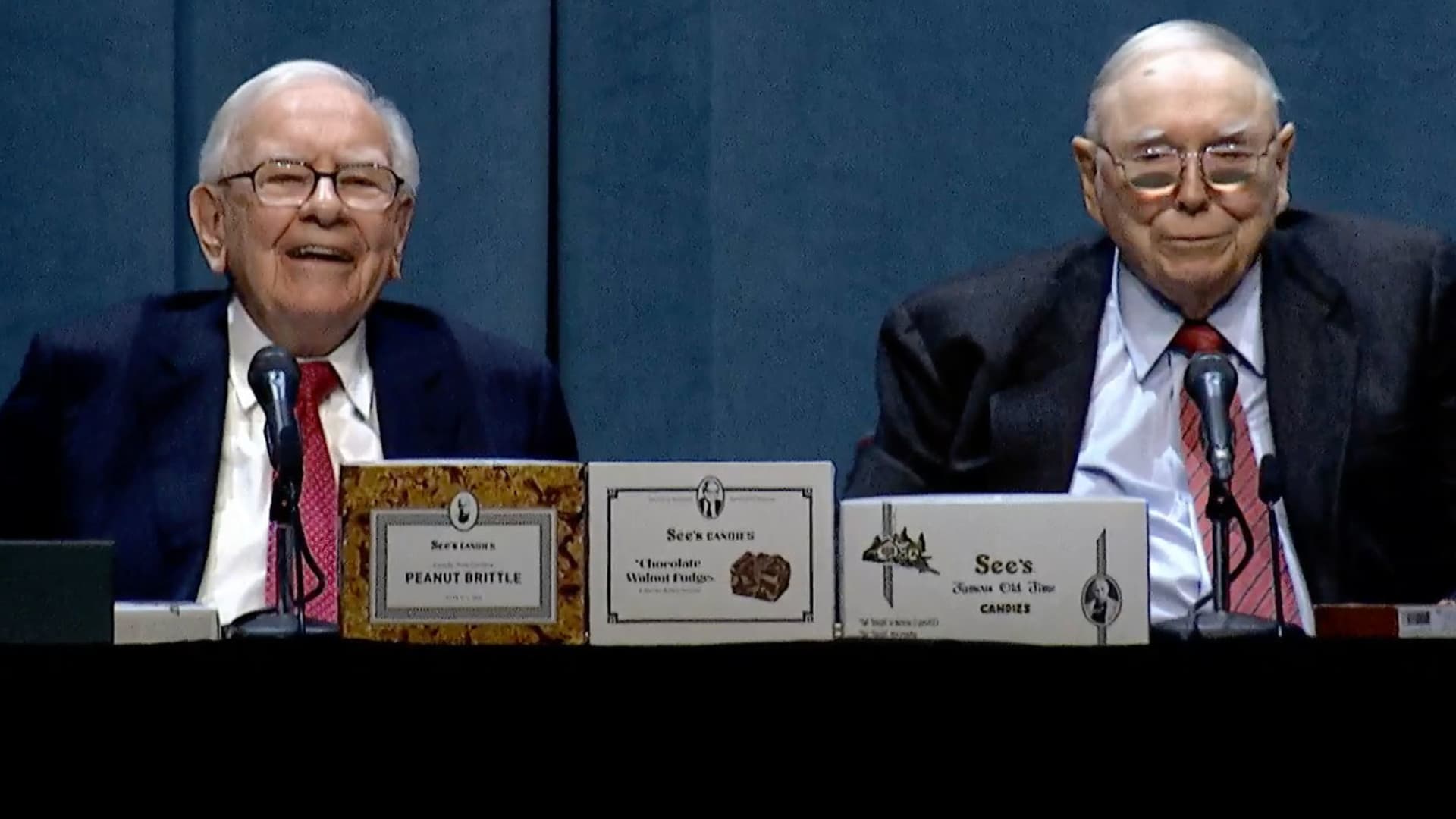

OMAHA, Neb. — Warren Buffett struck a pessimistic tone about Berkshire Hathaway‘s myriad of businesses on Saturday, saying he expects an earnings decline in light of an economic slowdown.

“In the general economy, the feedback we get is that, I would say, perhaps the majority of our businesses will actually report lower earnings this year than last year,” the “Oracle of Omaha” told tens of thousands of shareholders at Berkshire’s 2023 annual meeting.

related investing news

Berkshire has fared well so far despite a challenging macro environment with operating earnings jumping 12.6% in the first quarter. The strong performance was driven by a rebound in the conglomerate’s insurance business. Overall earnings also rose sharply thanks in part to gains its equity portfolio, led by Apple. Berkshire’s railroad business, BNSF, along with its energy company did see year-over-year earnings declines last quarter.

The 92-year-old investing icon believes that some of his managers at Berkshire subsidiaries were caught off guard by the swift change in consumer behavior, as they put the Covid-19 pandemic behind them. This led them to overestimating demand for certain products, and now they will need sales to get rid of the excess inventory.

“It is a different climate than it was six months ago. And a number of our managers were surprised,” Buffett said. “Some of them had too much inventory on order, and then all of a sudden it got delivered, and people weren’t in the same frame of mind as earlier.”

The U.S. economy is grappling with a series of aggressive rate hikes, which partly triggered three bank failures in the span of just a few weeks due to mismatched assets and liabilities. The Federal Reserve just approved its 10th rate hikes since 2022, taking the fed funds rate to a target range of 5%-5.25%, the highest since August 2007.

“It was more extreme in World War II, but this was extreme this time,” Buffett said.

-(2).jpeg?width=1200&auto=webp&quality=75)