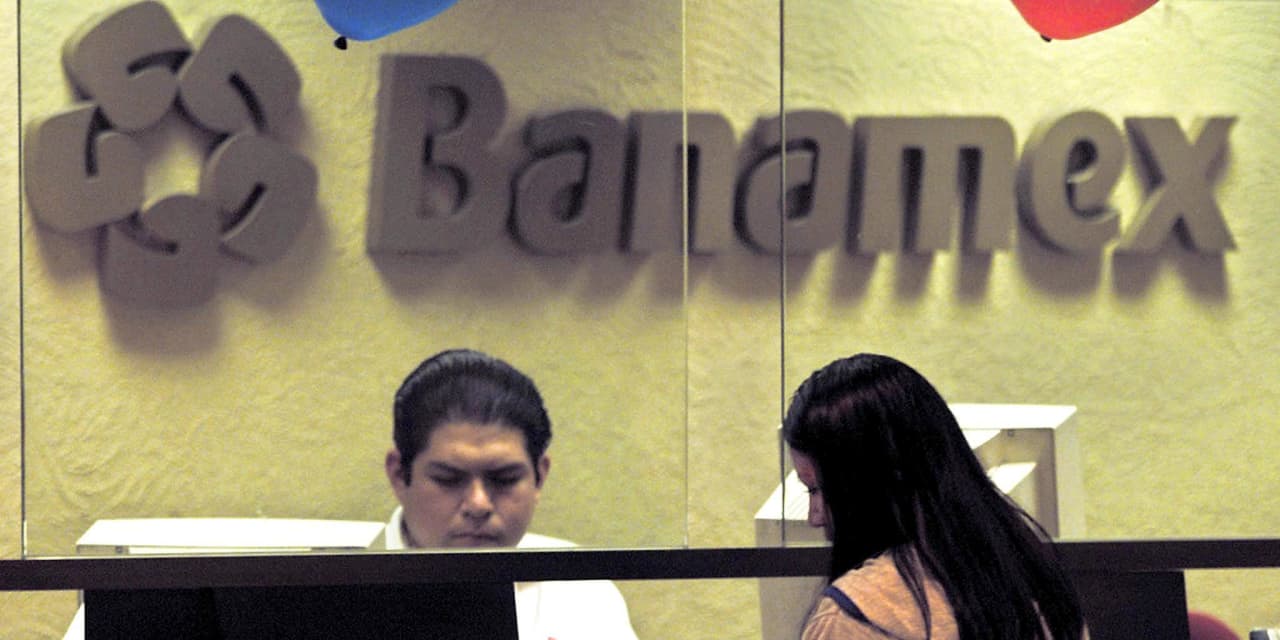

Citigroup Inc. announced Wednesday that it decided to pursue an initial public offering (IPO) of its “Banamex” consumer, small business and middle-market banking operations in Mexico.

The banking giant said the business will keep its name Banco Nacional de México (Banamex) after the IPO, which is expected to take place in 2025.

The IPO will follow the planned separation of its institutional business, which will remain part of Citi.

“After careful consideration, we concluded the optimal path to maximizing the value of Banamex for our shareholders and advancing our goal to simplify our firm is to pivot from our dual path approach to focus solely on an IPO of the business,” said Citi Chief Executive Officer Jane Fraser.

Citi’s stock

C,

dropped 1.7% in premarket trading, after being down 0.5% just before the planned IPO announcement.

The decision follows Citi’s announcement in January 2022 that it planned to exit the consumer, small business and middle-market banking operations of Citibanamex as part of a strategic refresh.

Citi said Banamex will retain credit cards, retail banking, consumer loans, residential mortgage lending, insurance, annuities, pension assets management, deposits and other commercial banking products.

And the business will continue to be reported as part of Citi’s continuing operations until Citi’s ownership falls below a 50% voting interest.

Separately, Citi said it expects to resume a “modest level” of share repurchases in the current quarter, but will continue to assess buybacks on a quarter-by-quarter basis given uncertainty regarding regulatory capital requirements.

Earlier in May, Citi said it continued to pause share buybacks “in anticipation of any temporary capital impacts related to any potential signing of a sale agreement for its Mexico Consumer/SBMM businesses…and to continue to have ample capital to serve its clients.”

Citi’s stock has edged up 1.5% year to date through Tuesday, while the Financial Select Sector SPDR exchange-traded fund

XLF,

has dropped 5.6% and the S&P 500 index

SPX,

has gained 8.0%.