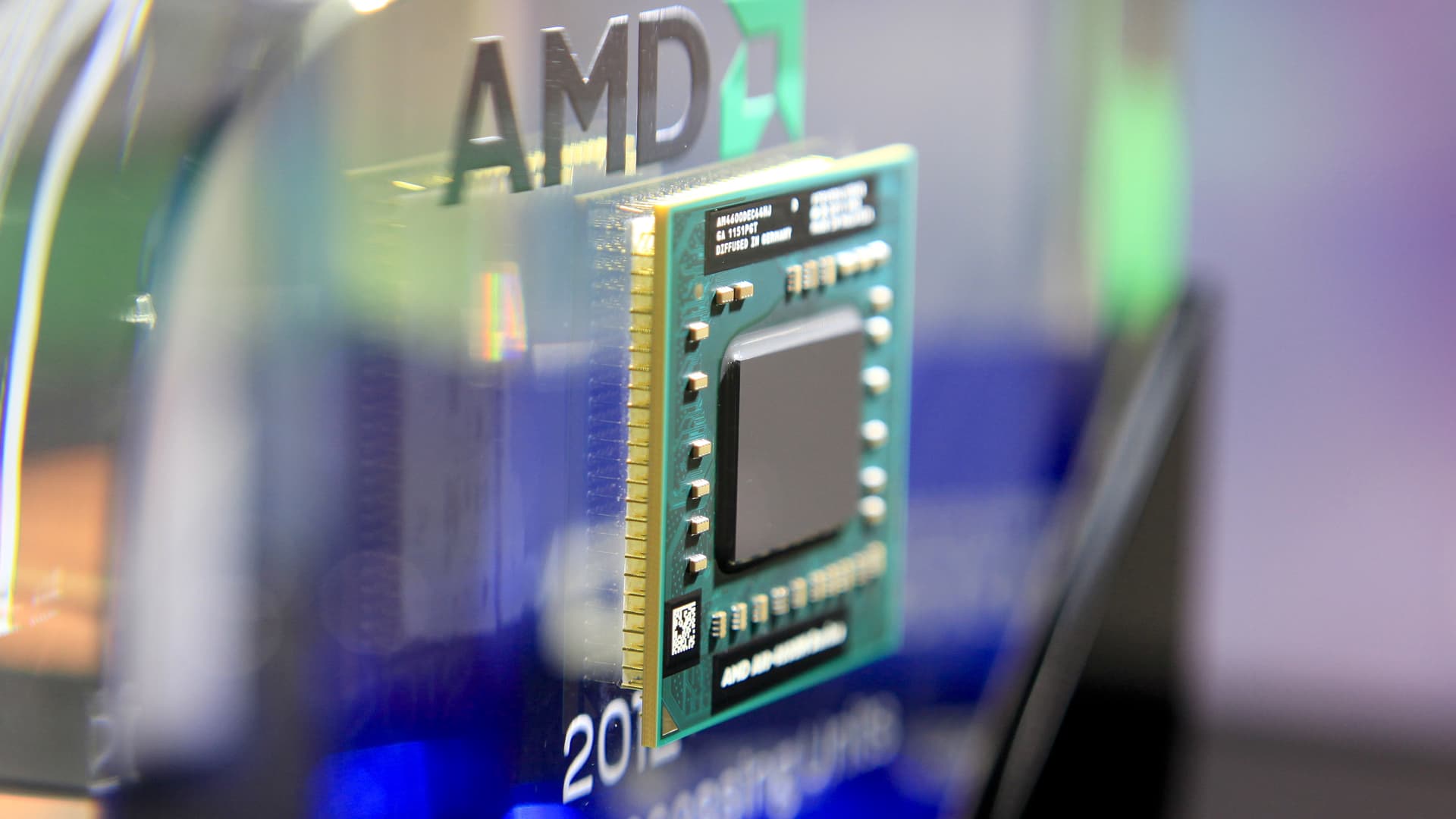

Despite continued dominance in the server space, Bernstein said sliding computer and new parts demand has made Advanced Micro Devices hard to be excited about. Analyst Stacy Rasgon downgraded the semiconductor stock to market perform from outperform. He also cut the price target by $15 to $80, implying a more modest 4.5% upside from where the stock closed Monday. The downgrade comes as demand for personal computers has fallen over recent months. That’s a result of consumers shifting spending from goods to services and rethinking big-ticket purchases altogether amid inflationary pressures. “It must be said that the PC environment has grown considerably worse since then,” Rasgon said in a note to client. “And our belief that AMD would prove relatively more immune to channel degradation proved unfortunately incorrect, and in recent months we have been growing more wary of potential PC dynamics.” The stock lost 2.5% in the premarket. AMD shares are off to a strong start for the year, gaining 18.2%. However, they dropped 55% in 2022. Rasgon said AMD’s new client parts have been available at deeper discounts in less time than the prior generation because Intel ‘s “semidestructive behavior” resulted in an oversaturated parts market. He said AMD has potential for some risk to growth margins beyond what was expected to come as a result of broader market worries because of the sliding demand paired with rising costs. The analyst added Wall Street expectations for gross margin expansion in the second half of 2023 are “somewhat optimistic” unless current client trends become transitory, which he does not believe they are. Though he said the current price-to-earnings multiple is not “hugely aggressive,” he doesn’t expect multiple expansion until investors have a better sense of where the bottom is for the stock. Still, he noted the company has continued to outperform Intel on servers and expects its position to grow even stronger with the Genoa offering. Rasgon said the downgrade pains him specifically because of AMD’s strong datacenters. — CNBC’s Michael Bloom contributed to this report.