Bitcoin is entering a decisive phase following a significant correction in the final quarter of 2025.

After reaching a peak around USD 126,000 in approximately October this year, the market corrected sharply by nearly 35% to around USD 80,000 before the downward momentum temporarily paused.

This pullback reflects an important shift in Bitcoin’s investor structure.

Bitcoin is no longer driven primarily by retail speculative flows as in previous cycles, but is increasingly influenced by macroeconomic factors, institutional capital flows, and the regulatory framework. Therefore, the outlook for Q1 2026 needs to be assessed on a more systematic fundamental basis.

The most important underlying factor influencing Bitcoin during this period is the global monetary policy environment, particularly the policy direction of the U.S. Federal Reserve.

At present, interest rates remain elevated at 3.5% – 3.75%, while the market has begun to price in the possibility of Fed policy easing in the second half of 2026 rather than at the beginning of the year. This is highly relevant for Bitcoin, as real interest rates and opportunity costs remain relatively high in Q1. When liquidity conditions have not yet improved materially, Bitcoin is unlikely to enter a strong growth phase driven purely by macro factors. Instead, the current monetary environment may keep the cryptocurrency trading in a cautious and stable manner.

Alongside monetary policy, institutional capital flows through spot Bitcoin ETFs represent a structural pillar of the current cycle.

As of December 18, 2025, according to Sosovalue, total assets under management of Bitcoin ETFs had surpassed USD 110 billion, highlighting the deep involvement of institutional capital in the market. However, recent data also indicate that ETF flows are no longer consistently strongly net positive as in the early phase of the cycle, but have become more volatile, with some weeks even recording net outflows amid portfolio rebalancing and holiday-related liquidity conditions.

In my view, this does not imply that Bitcoin’s long-term trend has turned bearish, but rather suggests that institutional demand in Q1 2026 is likely to be more selective and cautious, instead of acting as a catalyst for a sharp breakout in Bitcoin prices.

Next is the regulatory environment, particularly in the United States. In 2025, the regulatory framework for crypto became clearer than in previous years. This provides an important foundation for long-term capital inflows, as large financial institutions can only expand allocations when legal risks are under control. However, the regulatory framework is still not fully finalized, and the market may continue to face certain institutional-related risks.

Also in 2025, the market showed that Bitcoin increasingly exhibits the characteristics of a risk asset within the global financial system, with a notable correlation to the U.S. equity market during multiple periods. The upcoming Q1 2026 is likely to be a phase in which markets reassess growth prospects and corporate earnings following a highly volatile year for equities in 2025. If global risk appetite remains neutral, Bitcoin is more likely to continue consolidating rather than breaking out decisively.

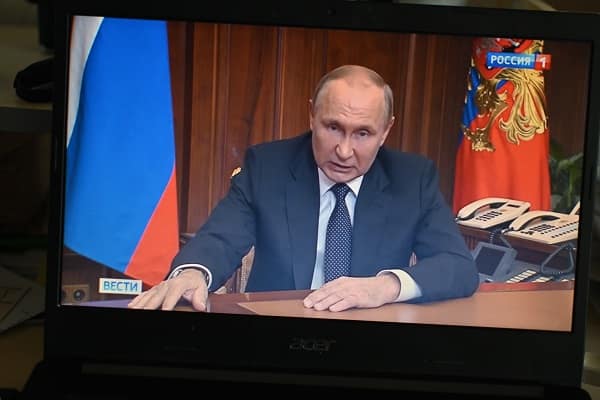

Alongside these factors, geopolitical risks will also influence trends in the cryptocurrency market, including Bitcoin. Positive diplomatic signals related to Russia–Ukraine negotiations, as well as discussions aimed at stabilizing the situation in the Middle East, have reduced the probability of major geopolitical shocks in the coming quarter. In this context, market sentiment tends to shift toward a more balanced state, thereby supporting risk assets.

In my view, Bitcoin’s outlook for Q1 2026 leans more toward a scenario of stability and renewed accumulation rather than a strong growth phase at the beginning of the year. Price fluctuations may remain within a range of approximately USD 80,000 to USD 100,000. Monetary policy is not yet sufficiently accommodative, ETF flows remain selective, and the regulatory environment is still in a phase of consolidation, all of which limit the market’s ability to rapidly enter a new bullish cycle.

However, on the positive side, Bitcoin’s underlying structure is significantly more solid than in previous cycles, thanks to institutional participation and broader acceptance within the financial system. If institutional flows return, the regulatory and geopolitical environment becomes more supportive, and the Fed’s policy stance begins to signal that rate cuts are approaching earlier in the year, this combination could create an ideal environment for Bitcoin to recover and reclaim the USD 100,000 level.