Blackstone Inc. said Thursday it has outpaced other private-equity firms, along with its own internal projection, in reaching $1 trillion in assets under management. The alternative-investment firm points to its quick growth to distinguish itself from the pack.

The update from Blackstone

BX,

did not manage to extend its stock’s five-day winning streak, as shares dropped back by 0.3% after it reported segment revenue that fell more than expected.

Net distributable income fell to $1.21 billion, or 93 cents a share, from $1.99 billion, or $1.49 a share, in the year-ago period, to top the FactSet consensus for earnings per share of 92 cents.

Segment revenue dropped 43.4% to $2.35 billion, to miss the FactSet consensus of $2.43 billion.

Total assets under management increased 6% to $1 trillion, with fee-earning AUM up 7% to $731.1 billion.

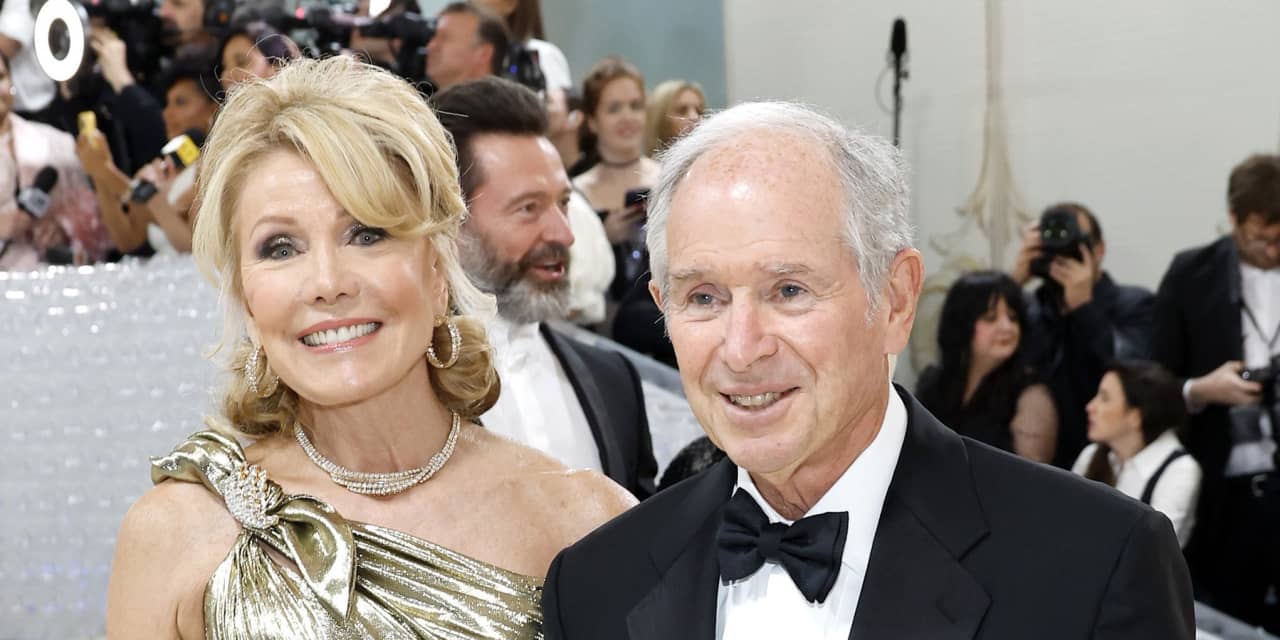

Blackstone co-founder and CEO Stephen Schwarzman said on the firm’s quarterly call with analysts that the $1 trillion AUM figure was achieved three years ahead of schedule. The company launched its first fund in 1986 with a $1 billion target.

“We’ve established an unparalleled global platform of leading business lines, offering over 70 distinct investment strategies,” Schwarzman told analysts, according to a transcript of the call. “We believe our clients view us as the gold standard in alternative asset management.”

The company has grown AUM partly through diversification into strategies including a hedge-fund-of-funds unit in 1990, real-estate investing in 1991, credit in 1998 and expanded credit in 2008, a private-wealth unit in 2011 and tactical opportunities in 2012, followed by the launch of secondary private-equity-fund investing in 2013.

Blackstone branched into infrastructure in 2017, followed by the introduction of its life-sciences unit and its insurance-solutions-management unit in 2018. The firm launched its first growth equity fund in 2020.

The company declared a quarterly dividend of 79 cents a share, payable on Aug. 7, down from the dividend of 82 cents paid in late April.

The stock, which had run up 10.2% over the past five sessions to close Wednesday at the highest price since Nov. 11, has soared 45.4% year to date, while the S&P 500

SPX,

has gained about 18.5%.

“We never rest on our achievements and we’re always looking ahead, striving to lift the firm to new heights,” Schwarzman said. “I strongly believe the best is ahead for Blackstone, investors in our funds and our shareholders.”

Blackstone COO Jonathan Gray said the private-equity firm’s drawdown funds have generated 15% net returns annually in corporate private equity and opportunistic real estate for more than 30 years, as well as 15% in secondaries, 12% in tactical opportunities and 10% in credit.

Gray said the firm is in negotiations with banks about helping them manage aspects of their balance sheets as one growth driver.

“We … have a decent pipeline behind that,” Gray said. “We’re involved in a number of discussions with banks who want to maintain their relationships with customers, but either shrink their balance sheet or do other things to create capacity.”

While Blackstone’s AUM has topped $1 trillion, its market capitalization remains lower, at about $130 billion.

Including Thursday’s trades, the stock is up 45.3%, outpacing the 18.4% rise by the S&P 500.

Also read: Treasury Secretary Yellen warns of commercial real estate ‘issues’ that could strain banks