UK interest rates are set to fall sooner and faster than markets currently expect, predicts the CEO of one of the world’s largest independent financial advisory organizations, as fiscal clarity and cooling inflation align for decisive action from the central bank.

deVere Group now forecasts a Bank of England rate cut in December, followed by three further reductions next year, as Britain’s economic trajectory shifts more decisively toward slower growth and easing price pressures.

The turning point is the Budget delivered by Rachel Reeves, which removed the final major uncertainty preventing the Bank of England from restarting its easing cycle.

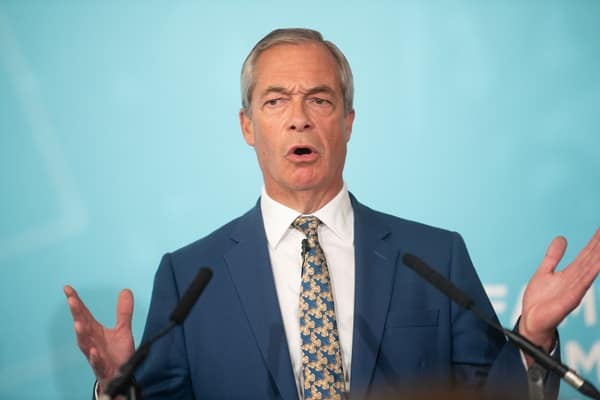

Nigel Green, CEO of deVere Group, says: “While the Chancellor stepped back from the more aggressive tax rises that had been discussed earlier, the overall package is the highest tax burden on record, lower near-term inflation, and weaker already-fragile growth momentum.

“We now expect the Bank of England to cut rates in December and then follow with three more reductions in 2025.

“The data now supports it, the fiscal picture allows it, and the growth outlook increasingly demands it.”

Official figures underline that shift. Measures announced in the Budget, including rail fare freezes, fuel duty relief and steps to lower household energy bills, are projected to shave as much as half a percentage point off inflation in the second quarter of next year.

This comes as price growth had already begun to cool, with October data showing inflation easing for the first time in seven months.

“The significance of the Budget lies less in dramatic tax changes and more in what it removes — policy uncertainty,” continues the deVere CEO.

“With fiscal risks clearer, the Bank can refocus on the direction of inflation and growth, both of which point toward lower rates.”

Importantly, the inflation impact extends beyond headline numbers. Central bank officials have repeatedly stressed the importance of household inflation expectations.

Fiscal measures that directly lower everyday costs help anchor those expectations, easing pressure on wage demands and pricing decisions across the economy. That dynamic strengthens the case for rate cuts without reigniting inflationary momentum.

At the same time, the growth picture is deteriorating. The UK is one of the few G7 economies actively consolidating its finances, with higher taxes and tighter public spending weighing on activity.

Forecasts for medium-term growth are being cut back, reinforcing the view that interest rates are now restrictive relative to economic conditions.

Markets have moved quickly. Expectations for a December cut surged immediately after the Budget.

Even so, deVere believes markets still underestimate the extent of rate reductions required as slower growth feeds through the economy.

“We think three cuts next year is now realistic, not aggressive,” says Nigel Green. “Rates have already done their job on inflation. Keeping them too high for too long risks unnecessary damage to growth, employment and investment.”

Sterling weakness since the Budget reflects that reassessment. Softer growth prospects, combined with expectations of faster easing, have embedded a risk premium in the currency.

This trend supports the view that rate cuts will be front-loaded rather than delayed.

“The pieces are now firmly in place: inflation is cooling, expectations are stabilising, growth is slowing, and fiscal uncertainty has lifted.

“We believe the Bank of England’s next cut is coming next month — and there will be three in 2026.”