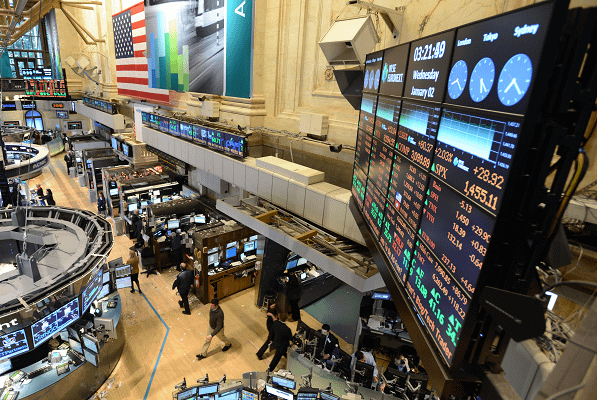

As the first-quarter earnings season kicks into overdrive, Piper Sandler shared some stocks that could surpass investors’ expectations. Blockbuster names slated to report this week include Netflix , American Express , UnitedHealth , D.R. Horton and Charles Schwab . With this earnings season falling in a time of extreme market uncertainty, investors may get their first clues on how President Donald Trump’s new tariffs might affect companies going forward. “Earnings season is always important for investors, but given that today’s political climate is in unchartered territory and with extreme uncertainty, this earnings season will be particularly telling,” wrote Piper Sandler chief investment strategist Michael Kantrowitz in a recent note. He shared a basket of stocks most likely to beat analysts’ estimates in this reporting season, which included the following names: One name on the list was health-care technology manufacturer Medtronic , up nearly 5% this year. Citi analyst Joanne Wuensch recently upgraded the stock to a buy rating from neutral. “The next catalyst for the stock will likely be the FY26E guidance delivered in May, when these growth drivers are anticipated to ramp more meaningfully,” she wrote. “Yet as investors do their homework on renal denervation, and many look for more ‘value’ names with a catalyst we suspect MDT will trade well.” Wuensch’s updated price target of $107, up from $92, implies shares of Medtronic could rise nearly 30% from Tuesday’s close. Another name Piper Sandler’s Kantrowitz highlighted was Ross Stores . Shares of the off-price retailer have slipped 7% in 2025. Last week, Wells Fargo analyst Ike Boruchow upgraded the stock to an overweight rating from equal weight. “In conjunction with today’s deep dive into down cycles and the ramifications on our space, we are upgrading ROST to OW due to its more defensive nature, downside support on valuation and levers in place to sustain/beat current Street forecasts,” the analyst wrote. “While ROST is clearly dealing with more volatility than is typical for their model, we see today’s valuation as near-trough and would also expect a much better relative performance in a slower macro tape.” Boruchow raised his price target for the stock to $150 per share from $140. This updated price forecast is approximately 6% above where shares of Ross closed on Tuesday. Aerospace and defense company Northrop Grumman , up 15% this year, is another name that could exceed analysts’ expectations this earnings season. In March, RBC Capital Markets upgraded the stock to an outperform rating from sector perform. “We believe the positive shift in NOC sentiment has significant room to run as the company is well positioned relative to shifting DoD priorities, execution on the B-21 remains strong, which could support an improved funding outlook, and the perception of NOC relative to defense peers has improved,” wrote analyst Ken Herbert. The B-21 Raider is a strategic bomber that the company is developing for the U.S. Air Force. Herbert’s price target of $575, up from $500, implies shares of Northrop Grumman could rise 8%. Other names from Piper Sandler’s list include Microsoft , Clorox and Walmart . Get Your Ticket to Pro LIVE Join us at the New York Stock Exchange! Uncertain markets? Gain an edge with CNBC Pro LIVE , an exclusive, inaugural event at the historic New York Stock Exchange. In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12. Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!