Measuring decentralization in blockchain

Decentralization involves spreading control and decision-making across a network instead of a single authority.

Unlike centralized systems, where one entity controls everything, decentralized blockchains distribute data among participants (nodes). Each node holds a copy of the ledger, ensuring transparency and reducing the risk of manipulation or system failure.

In blockchain, a decentralized network provides significant advantages:

- Security: Decentralization reduces vulnerabilities associated with central points of attack. Without a single controlling entity, malicious actors find it more challenging to compromise the network.

- Transparency: All transactions are recorded on a public ledger accessible to all participants, fostering trust through transparency. This openness ensures that no single entity can manipulate data without consensus.

- Fault tolerance: Decentralized networks are more resilient to failures. Data distribution across multiple nodes ensures that the system remains operational even if some nodes fail.

So, decentralization is good, but it’s not a fixed state. It’s more of a spectrum, constantly shifting as network participation, governance structures and consensus mechanisms evolve.

And yes, there’s a ruler for that. It’s called the Nakamoto coefficient.

What is the Nakamoto coefficient?

The Nakamoto coefficient is a metric used to quantify the decentralization of a blockchain network. It represents the minimum number of independent entities — such as validators, miners or node operators — that would need to collude to disrupt or compromise the network’s normal operation.

This concept was introduced in 2017 by former Coinbase chief technology officer Balaji Srinivasan and was named after Bitcoin’s creator, Satoshi Nakamoto.

A higher Nakamoto coefficient indicates greater decentralization and security within the blockchain network. In such networks, control is more widely distributed among participants, making it more challenging for any small group to manipulate or attack the system. Conversely, a lower Nakamoto coefficient suggests fewer entities hold significant control, increasing the risk of centralization and potential vulnerabilities.

For example, a blockchain with a Nakamoto coefficient of 1 would be highly centralized, as a single entity could control the network. In contrast, a network with a coefficient of 10 would require at least 10 independent entities to collude to exert control, reflecting a more decentralized and secure structure.

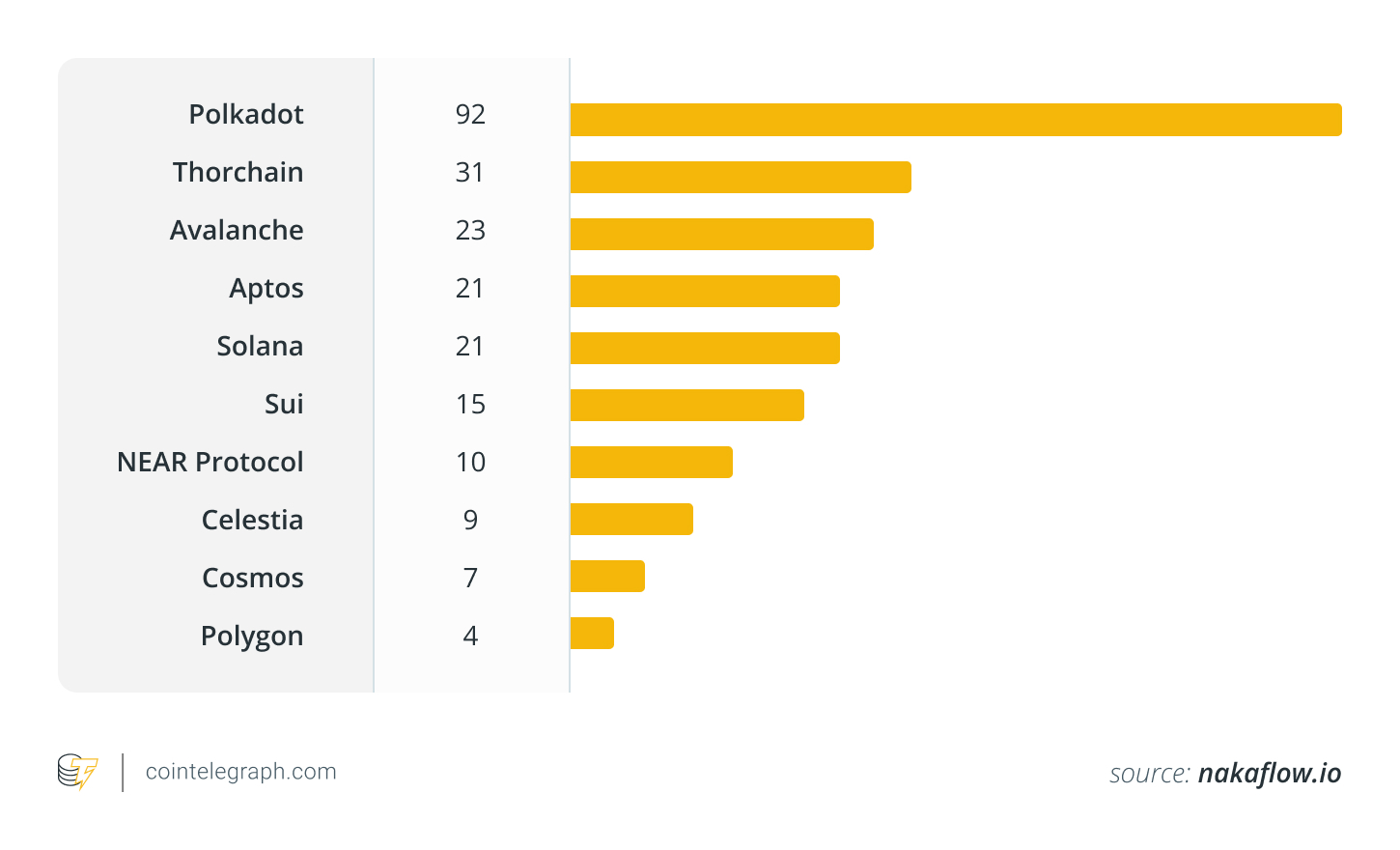

Did you know? Polkadot’s high score on the Nakamoto coefficient is largely due to Polkadot’s nominated proof-of-stake (NPoS) consensus mechanism, which promotes an even distribution of stakes among a large number of validators.

Calculating the Nakamoto coefficient

Calculating this coefficient involves several key steps:

- Identification of key entities: First, determine the primary actors within the network, such as mining pools, validators, node operators or stakeholders. These entities play significant roles in maintaining the network’s operations and security.

- Assessment of each entity’s control: Next, evaluate the extent of control each identified entity has over the network’s resources. For instance, in proof-of-work (PoW) blockchains like Bitcoin, this involves analyzing the hashrate distribution among mining pools. In proof-of-stake (PoS) systems it requires examining the stake distribution among validators.

- Summation to determine the 51% threshold: After assessing individual controls, rank the entities from highest to lowest based on their influence. Then, cumulatively add their control percentages until the combined total exceeds 51%. The number of entities required to reach this threshold represents the Nakamoto coefficient.

Consider a PoW blockchain with the following mining pool distribution:

- Mining pool A: 25% (of the total hashrate)

- Mining pool B: 20%

- Mining pool C: 15%

- Mining pool D: 10%

- Others: 30%

To determine the Nakamoto coefficient:

- Start with mining pool A (25%).

- Add mining pool B (25% 20% = 45%).

- Add mining pool C (45% 15% = 60%).

In this scenario, the combined hashrate of mining pools A, B and C reaches 60%, surpassing the 51% threshold. Therefore, the Nakamoto coefficient is 3, indicating that collusion among these three entities could compromise the network’s integrity.

Did you know? Despite Bitcoin’s reputation for decentralization, its mining subsystem is notably centralized. The Nakamoto coefficient is currently 2 for Bitcoin. This means that just two mining pools control most of Bitcoin’s mining power.

Limitations of the Nakamoto coefficient

While the Nakamoto coefficient serves as a valuable metric for assessing blockchain decentralization, it possesses certain limitations that warrant careful consideration.

For example:

Static snapshot

The Nakamoto coefficient provides a static snapshot of decentralization, reflecting the minimum number of entities required to compromise a network at a specific point in time.

However, blockchain networks are dynamic, with participant roles and influence evolving due to factors like staking, mining power shifts or node participation changes. Consequently, the coefficient may not accurately capture these temporal fluctuations, potentially leading to outdated or misleading assessments.

Subsystem focus

This metric typically focuses on specific subsystems, such as validators or mining pools, potentially overlooking other critical aspects of decentralization. Factors like client software diversity, geographical distribution of nodes and token ownership concentration also significantly impact a network’s decentralization and security.

Relying solely on the Nakamoto coefficient might result in an incomplete evaluation.

Consensus mechanism variations

Different blockchain networks employ various consensus mechanisms, each influencing decentralization differently. The Nakamoto coefficient may not uniformly apply across these diverse systems, necessitating tailored approaches for accurate measurement.

External Influences

External factors, including regulatory actions, technological advancements or market dynamics, can influence decentralization over time. For example, regulatory policies in specific regions might affect the operation of nodes or mining facilities, thereby altering the network’s decentralization landscape.

The Nakamoto coefficient may not account for such externalities, limiting its comprehensiveness.

To sum up, the Nakamoto coefficient is useful for assessing certain aspects of blockchain decentralization. It should be used alongside other metrics and qualitative assessments to gain a comprehensive understanding of a network’s decentralization and security.