The world of cryptocurrency trading continues to grow rapidly, attracting beginners and experienced investors who are eager to explore its potential. However, the crypto market can be unpredictable, with prices changing quickly and trends shifting overnight. That’s why creating a balanced and well-thought-out portfolio is essential. CW-Management experts explain how traders can use diversification and CFD trading to manage risk and build a more stable crypto strategy without relying on luck or guesswork.

The role of diversification in managing risk

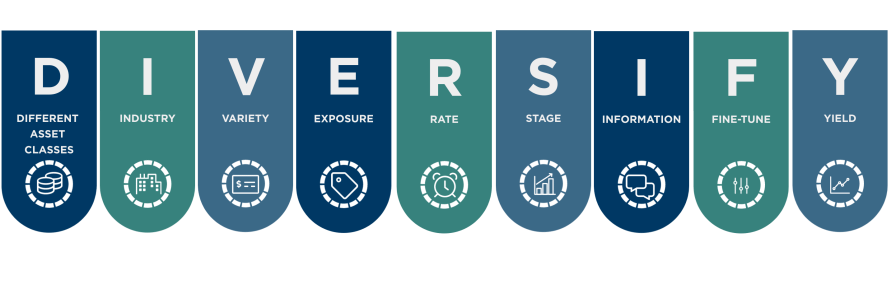

Diversification is one of the most discussed ideas in the world of trading, and for good reason. In simple terms, it means not putting all your eggs in one basket. By dividing your investments among different assets or sectors, you reduce the chance that one bad move will wipe out your entire portfolio.

Source: https://www.sec.gov/resources-small-businesses/capital-raising-building-blocks/diversifying-risk

In the cryptocurrency market, diversification can extend beyond owning multiple coins. Traders might also choose to spread their exposure across other financial instruments or sectors connected to blockchain technology. According to the brand, diversification works best when the assets you hold don’t always move in the same direction. For example, while some coins react strongly to Bitcoin’s price changes, others may be influenced more by technology updates or local regulations.

It’s also worth remembering that diversification is not about quantity, as holding dozens of coins doesn’t mean you’re diversified. What truly matters is the variety of risk sources in your portfolio and how they interact with one another.

Using CFDs to trade crypto more flexibly

CFDs, or Contracts for Difference, are financial instruments that allow traders to speculate on price movements without owning the underlying asset. This means you can trade rising or falling prices, depending on your market outlook.

CW-Management explains that CFD trading can give traders more flexibility in managing their crypto portfolios. For example, if you believe Bitcoin might temporarily fall in price, you can open a short position through a CFD instead of selling your actual holdings. This approach enables you to react to market trends without directly transferring or storing crypto assets.

However, CFDs also come with their own risks, such as leverage, which can amplify gains and losses. That’s why it’s important to fully understand how they work before using them as part of your strategy. For many traders, CFDs serve as a tool for hedging, protecting their portfolios against unexpected price changes rather than pure speculation.

Building confidence through knowledge and caution

The cryptocurrency market is still young and fast-moving, making education and awareness vital for anyone involved. The broker emphasizes that understanding how markets behave, how CFDs function, and how diversification affects your portfolio can help traders make more informed decisions.

A balanced crypto portfolio isn’t built overnight. It takes time, observation, and a willingness to adjust as markets evolve. Although no strategy can eliminate risk completely, employing a combination of diversification, careful asset selection, and flexible tools like CFDs can help you navigate the world of crypto with greater confidence.

As CW-Management experts highlight, diversification and CFD trading are practical methods to help manage risk and adapt to market changes, not shortcuts to quick profit. In the end, a thoughtful approach to crypto trading means focusing less on short-term excitement and more on long-term strategy, knowledge, and discipline.