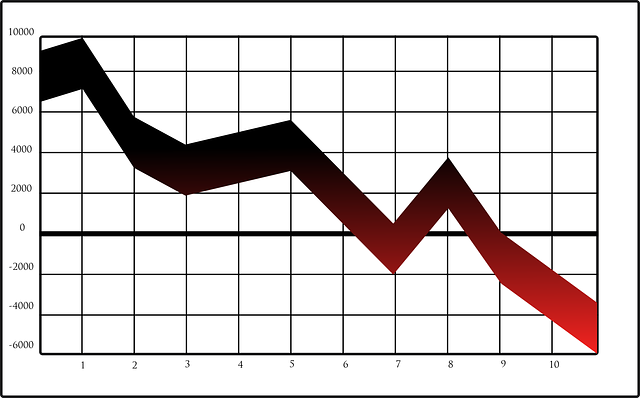

The use of “green” electricity as an energy source is set to rise — and that could save consumers some money, according to Goldman Sachs. “We believe the coming century could witness the rise of (green) electricity, thanks to attractive economics, rising social acceptance and growing policy support,” Goldman wrote in a late September report. That’s especially the case for Europe, where such electricity could exceed 50% of primary energy consumption by the end of this decade, up from 20% in 2000, the bank said in a recent report. Goldman Sachs included wind and solar, heat pumps, electric vehicles, storage, electrolysis and carbon capture in its list of electrification technologies. “Electrification in Europe is largely deflationary,” Goldman analysts wrote. “On our estimates, the full electrification of a typical household (heating and mobility) would lower its overall monthly energy bill by more than 50%.” That electrification process addresses three needs, according to Goldman: decarbonization, energy security, and a “re-industrialization” process that could “foster a ‘Made in Europe’ supply chain for clean tech.” In the United States, however, electrification could be much less deflationary, the bank said. “The more muted deflationary effect is the result of much lower gas prices in the US vs. Europe, the absence of carbon levies and a more underdeveloped supply chain in clean energy,” it added. Nevertheless, related markets in both regions are likely to benefit from the electrification theme, Goldman said. “Although returns, margins and opportunities may vary, according to the specific stage in the cycle of each segment, we believe that electrification is likely to prove a positive secular driver for all of these stocks, by virtue of solid policy support and the c.$6 trn addressable market we estimate for energy transition across Europe and the US,” the bank’s analysts wrote, highlighting a list of stocks in each market. They said the U.S. Inflation Reduction Act and the European Union’s RePowerEU plan combined could mobilize nearly $6 trillion of capital in clean energy over the next 10 years. “This would suggest very fertile ground for the Green Energy Majors,” they said, referring to the major stocks. The bank cited the following factors as potential drivers: rising investment in renewables and power grids in the U.S. and Europe until 2032; its estimates of double-digit organic earnings growth for at least a decade; and higher returns. Revisiting green energy stocks Goldman said these buy-rated stocks are among the “most interesting names”: German offshore wind power generation company RWE . Goldman’s price target: 54 euros ($56.60), giving it an implied upside of about 58%. Portuguese electric utilities company EDP . Goldman’s price target: 5.25 euros, giving it an implied upside of about 37%. Spanish renewable energy firm EDPR . Goldman’s price target: 21.5 euros, giving it an implied upside of about 42%. Spanish solar energy firm Solaria : Goldman’s price target: 17.5 euros, giving it an implied upside of about 24%. The bank said it’s time to revisit European green energy major stocks, saying most current valuations — which price in zero or negative growth — reflect an “unreasonable outcome” in the years to come. It added that renewables appear undervalued, even on traditional metrics such as price-to-earnings ratios. “Considering our work on pricing power and returns, the optionality of a change in capital allocation – and in light of the fact that most stocks price in zero or negative value for future growth – we think it is time to revisit the renewable industry,” the analysts said. They explained that investors may tweak their capital allocations in light of those “deeply discounted valuations.” — CNBC’s Michael Bloom contributed to this report.