Rolex move hits Watches of Switzerland shares, Tesco leads FTSE 100

Shares in Watches of Switzerland have fallen 26% after an acquisition by Rolex set alarm bells ringing for investors.

The slump came even though luxury watches firm Rolex said the purchase of Swiss retailer Bucherer would have no bearing on its current distribution arrangements.

It made the move because the 86-year-old grandson of founder Carl Bucherer has no direct descendants and it wanted to preserve the ties that have existed since 1924.

However, the purchase of a business with 100 sales outlets worldwide unnerved investors as Watches of Switzerland suffered its worst session on record, down 185.75p to 508p.

Broker Peel Hunt said the Rolex concerns would be a cloud over shares in the retail chain for the foreseeable future as it ditched its “buy” recommendation and cut its target price from 900p to 600p.

At the other end of the FTSE 250, Aston Martin Lagonda accelerated 5% or 16.4p to 337.2p after analysts at Jefferies lifted their estimate on shares by 26% to 420p.

They said the operating outlook was “more encouraging than ever” amid a renewed focus on the core strength of front engine vehicles and a rise in average selling price.

The FTSE 250 stood 15.16 points lower at 18,179.41, while the FTSE 100 index edged 18.27 points higher at 7351.90 in a lacklustre session prior to a speech by Federal Reserve chair Jerome Powell at the Jackson Hole symposium.

Tesco led the top flight with a rise of 4.7p to 259.9p, while among the minnows DFS Furniture cheered 4.1p to 114.1p after GfK reported that consumers are showing improved appetite for major purchases.

Heineken sells Russian business at loss of £256m

Brewing giant Heineken has completed its exit from Russia, around 18 months after the invasion of Ukraine.

The Dutch firm, which also makes Amstel and Birra Moretti beers, said it has now secured the sale of the business, which includes seven breweries, to Russian company Arnest Group for 1 euro.

It said it expects to incur a total loss of 300 million euro (£256 million) as a result.

Bosses at the brewer admitted it “took much longer than we had hoped”, after it faced criticism for the slow pace of its exit in the wake of the outbreak of war.

Read more here

Profit falls at law firm DWF ahead of private equity takeover

The boss of listed law firm DWF today warned of “turbulent times” for the sector as profits fell ahead of the company’s takeover by private equity firm Inflexion.

Profit dropped by 23.2% to £17.2 million, amid higher salary costs.

Marylebone-based Inflexion is set to take DWF private in a deal agreed last month. CEO Sir Nigel Knowles told shareholders today that without the offer, dividends may have been at risk.

Shares were steady at 97p, close to the offer price.

Market snapshot with FTSE flat ahead of Powell speech.

London’s top flight is close to unchanged so far today, ahead of Federal Reserve chair Jerome Powell’s Jackson Hole speech this afternoon.

Take a look at our full market snapshot.

Oil giants boost FTSE 100, Aston Martin leads FTSE 250

The FTSE 100 index is 18.90 points higher at 7352.53, although most investors appear content to sit on the sidelines until Federal Reserve chair Jerome Powell’s speech at 3pm.

A rise in the Brent Crude price to $83.86 a barrel meant BP and Shell shares were about 0.5% higher, while there was also support from Tesco after its shares rose 3.7p to 258.9p.

Shares in JD Sports Fashion were back under pressure with a decline of 1.1p to 138.75p and B&M European Value Retail dipped 1.2p to 568.4p.

The FTSE 250 index dipped 11.47 points to 18,183.10, but Aston Martin Lagonda made strong progress after analysts at Jefferies lifted their price target to 420p. The shares were 12.8p higher at 333.6p.

CMC Markets warns of slow trading in August

City trading house CMC Markets warned today that profit could be £30m less than previously thought, amid sharp drop in retail trading.

The business founded by Tory peer Lord Cruddas said it had seen “subdued market conditions” this month, with revenue set to be down 20% on last year. Retail trading in particular has fallen off, leading to a greater reliance on lower-margin institutional investors.

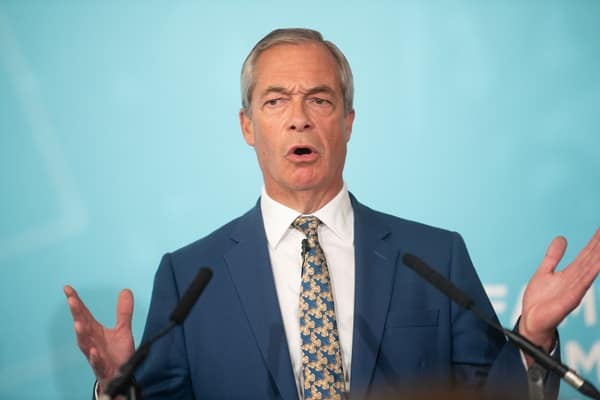

Lord Cruddas, leader of the Conservative Democratic Organisation

/ PA“Whilst underlying market activity has the potential to recover, should year-to-date market conditions continue for the remainder of FY24 then it is expected that net operating income will be between £250 and £280 million,” CMC said.

Shares were already down almost 50% this year even before today’s profit warning.

Consumer confidence picks up in August – GfK

Consumer confidence looks to have improved during August after GfK recorded a five point uptick in its monthly barometer.

Although the headline score is still strongly negative at minus 25, hopes for people’s financial situation in the coming year are close to positive territory.

There was also an eight-point advance in major purchase intentions, signalling better news for retailers ahead of the autumn period.

Today’s improvement in the overall headline score follows strong wage growth and July’s fall in the annual inflation rate to 6.8%. The index stood at minus 44 in August last year.

GfK client strategy director Joe Staton said; “While the financial pulse of the nation is still weak, these signs of optimism are welcome during this challenging time for consumers across the UK.”

LendInvest warns on data breach

London fintech LendInvest has warned it has suffered a data breach in which customer personal data had been accessible to third parties.

Investigations into the incident are ongoing and the precise number of individuals affected and the length of time that the information was compromised is to be determined, the firm said, adding it had alerted regulators.

The company said: “LendInvest takes the issue of data security extremely seriously, and any affected individuals will be notified as appropriate and in accordance with applicable regulations.”

Powell speech in focus after US sell-off, FTSE 100 seen flat

US markets finished sharply lower last night after an initial boost from Nvidia’s strong results faded on concerns over the higher-for-longer interest rate outlook.

The S&P 500 fell 1.35%, the tech-focused Nasdaq Composite by 1.9% and the Dow Jones Industrial Average by 1% as traders focused on the likely comments of Federal Reserve chair Jerome Powell at the Jackson Hole symposium in Wyoming.

Even Nvidia failed to survive the sell-off as its shares retreated from a record level above $500 to finish the session broadly unchanged at $471.6.

The jitters were not helped by more signs of a tight US jobs market after weekly figures showed an unexpected fall in the number of people claiming unemployment.

Powell, who is due to speak at 3.05pm, is likely to reinforce the message that the fight against inflation is not over and that the next move by Fed policymakers is data dependent.

However, traders will be looking for guidance over whether Powell believes getting inflation back to target will require a period of weakness for the US economy.

Asia markets tracked Wall Street lower, with Japan’s Nikkei 225 the hardest hit after falling 2%. The FTSE 100 index, which clung to positive territory in yesterday’s session, is forecast by CMC Markets to open five points lower at 7328.

Energy price cap cut to £1,923

Regulator Ofgem has cut the energy price cap for the last three months of the year by £150, but the end to support schemes means many households are still set to pay more for energy than in 2022.

The new cap of £1923 per year will apply from October to December, when households are likely to turn their heating back on. It is almost £600 lower than the £2500 Energy Price Guarantee that superseded the cap last winter.

However, the energy support scheme that provided customers with an extra £66 a month last winter will no longer apply. With the new cap being around £50 a month lower than last year, this means the amount a typical customer will pay over the next cap period is actually set to be around £15 a month higher in 2023.

Read more here