An employee puts gold bullions into a safe deposit box at Degussa shop in Singapore

Edgar Su | Reuters

Gold prices hit another record high this week after a roaring 2023, and a combination of geopolitical tensions and continued central bank buying should see demand remain resilient next year, according to the World Gold Council.

The yellow metal broke through $2,100 per ounce on Monday before moderating slightly, and spot prices were hovering at around $2,030 per ounce early Friday.

In its Gold Outlook 2024 report published Thursday, the World Gold Council noted that many economists now anticipate a “soft landing” in the U.S. — the Federal Reserve bringing inflation back to target without triggering a recession — which would be positive for the global economy.

The industry body (which represents gold mining companies) noted that historically, soft landing environments have “not been particularly attractive for gold, resulting in flat to slightly negative average returns.”

“That said, every cycle is different. This time around, heightened geopolitical tensions in a key election year for many major economies, combined with continued central bank buying could provide additional support for gold,” the WGC added.

Its strategists also noted that the likelihood of a soft landing is “by no means certain,” while a global recession is still not off the table.

“This should encourage many investors to hold effective hedges, such as gold, in their portfolios,” the WGC added.

The two most significant events for gold demand in 2023 were the collapse of Silicon Valley Bank and the Hamas attack on Israel, the WGC said, estimating that geopolitical events added between 3% and 6% to gold’s price over the year.

“And in a year with major elections taking place globally, including in the U.S., the EU, India, and Taiwan, investors’ need for portfolio hedges will likely be higher than normal,” the report said, looking ahead to 2024.

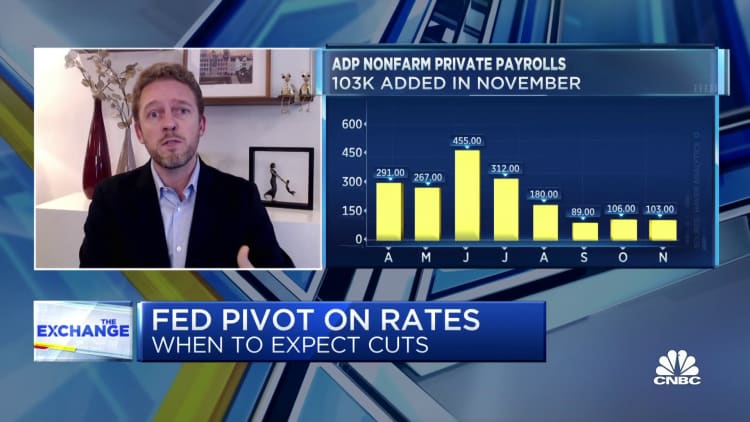

All eyes on the Fed

WGC Chief Market Strategist John Reade told CNBC on Thursday that gold prices would likely remain range-bound but choppy next year. He expects them to react to individual economic data points that inform the likely trajectory of Fed policy until the first interest rate cut is in the bag.

Markets are currently pricing the first 25-basis-point cut to the Fed funds rate as early as March next year, according to CME Group’s FedWatch tool.

However, although rate cuts are usually seen as good news for gold (as cash returns fall and savers look elsewhere for high-yielding investments), Reade highlighted that two factors could mean that “expected policy rate easing may be less sanguine for gold than it appears on the surface.”

Firstly, if inflation cools more quickly than rates — as it is largely expected to do — then real interest rates remain elevated. And secondly, lower-than-expected growth could hit gold consumer demand.

“I’m not saying interest rates have to go back to 0 to reignite the demand, but that combination I think of the first cut in the States and cuts elsewhere in other important economies, will I think change a bit of the sentiment towards gold,” Reade said.

Central bank buying to continue

One other supporting factor for the yellow metal looking ahead is further central-bank buying, according to the World Gold Council.

Central banks have been a major source of demand in the global gold market over the last couple of years and 2023 is likely to be a record year. The WGC expects this to continue in 2024.

Reade said the organization was surprised by the significant increase in central bank purchases in 2022 and that the pace of buying continued this year.

In its report, the WGC estimated that central bank demand added 10% or more to gold’s performance in 2023, and noted that even if 2024 does not reach the same heights, above-trend buying should still offer an extra boost to gold prices.

“Our expectations are that central bank purchases will continue next year on a net basis, and that’s pretty much the case since the global financial crisis,” Reade said.

“My own expectation is that central banks are very much going to be again, the sort of prominent story in the gold market in 2024, but I think that it would be optimistic of us to say that it’s going to be another record year or a record-matching year.”