General Motors Co.’s stock soared 9% Wednesday, after the car maker unveiled plans to reward its shareholders generously now that labor strikes are out of the way.

The company

GM,

said it’s reinstating 2023 guidance that it pulled in the third quarter amid the uncertainty about the strikes, planning a $10 billion accelerated share-buyback program and a 33% increase in its dividend starting with the January declaration.

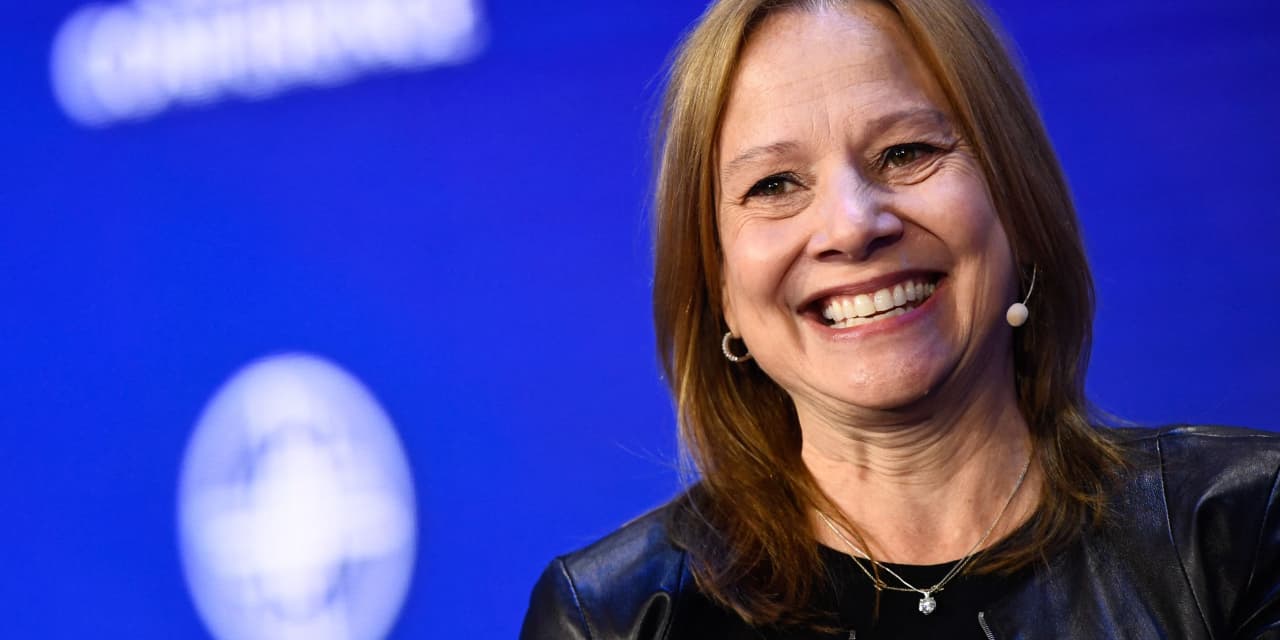

The move comes as Chief Executive Mary Barra seeks to reassure shareholders who were unsettled by the strikes and by operational struggles including with electric vehicles, which have proved less popular with consumers than car makers were expecting, and driverless cars.

The $10 billion share-buyback plan was a “colossal … blanket to stem EV/AV fires,” Evercore ISI analyst Chris McNally said. “The capital return is a welcomed catalyst given recent sentiment freefall but will only band-aid GM’s needed strategy path back to investor favor.”

While GM said it will “materially” reduce spending on driverless-car unit Cruise, questions remain “how AV/ADAS/EV will be fixed,” McNally said. The questions are likely to be deferred and be a focus on GM’s scheduled analyst day in March, the analyst said.

The buyback also surprised Deutsche Bank analyst Emmanuel Rosner, who said he expected a program of around $5 billion.

On the other hand, the increase in labor costs came in a bit higher than the analyst expected, at $1.5 billion vs the Deutsche Bank expectations around $1 billion, Rosner said.

“The company remains on track to execute its net [$2 billion] fixed cost reduction program, though provided no detail on cost actions to offset higher labor costs,” the analyst said.

Itay Michaeli with Citi said that GM’s business update “contained a number of positives that inject the much-needed visibility and reassurance” about the business.

GM didn’t provide a formal 2024 guidance, but the update “suggests upside to current consensus estimates,” Michaeli said. Moreover, comments around current-quarter dealings “confirms resilient underlying business trends,” the analyst said.

“Net-net, today’s update should address UAW-related uncertainty and lift investor confidence on the back of the accelerated buyback and 2024 commentary,” Michaeli said.

Read now: GM becomes first of Detroit automobile makers to seal new deal with union workers

In a statement, Barra said that GM was “finalizing a 2024 budget that will fully offset the incremental costs of our new labor agreements and the long-term plan we are executing includes reducing the capital intensity of the business, developing products even more efficiently, and further reducing our fixed and variable costs.”

GM twice raised its guidance for all of 2023 but withdrew it in the third quarter while workers were striking. It expects the labor disruption to shave $1.1 billion off adjusted EBIT, or earnings before interest and taxes, due to lost production.

But the company lowered its guidance for net income to $9.1 billion to $9.8 billion, which compares with a previous range of $9.3 billion to $10.7 billion.

It expects adjusted per-share earnings of $6.52 to $7.02, compared with prior guidance of $7.15 to $8.15. The company expects capex of $11.0 billion to $11.5 billion, the low end of its prior range of $11.0 billion to $12.0 billion.

The company has also canceled a $6.0 billion revolving-credit facility it entered in October and plans to enter a new 364-day $3.0 billion committed-credit facility with the banks executing the accelerated share buyback.

GM is expecting to increase its quarterly dividend by 3 cents to 12 cents a share starting in January.

The stock has fallen 14% in the year to date, while the S&P 500

SPX,

has gained 18.6%.

Read now: Ford and GM inventories rise despite UAW strike, but demand concerns linger