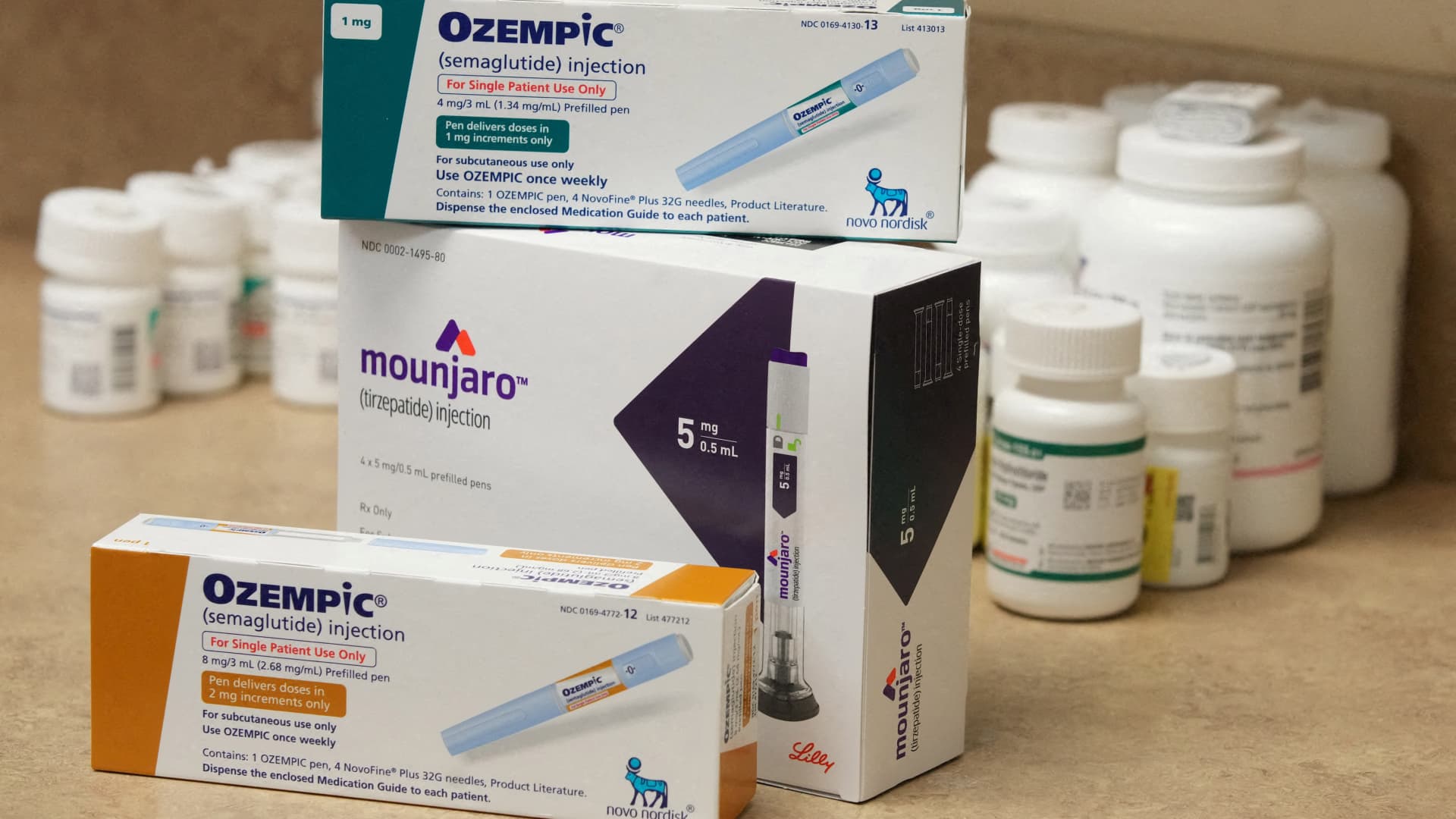

Good afternoon! All eyes are on Novo Nordisk and Eli Lilly again as Wall Street looks for signs that they can address one of the biggest hurdles they faced last year. Neither company has enough supply to meet the insatiable demand for their weight loss and diabetes drugs.

One month into 2024, the two drugmakers still haven’t fully resolved those supply issues. They don’t expect to soon. Still, Eli Lilly and Novo Nordisk appear to be making some encouraging progress.

Eli Lilly achieved its goal of doubling its capacity for producing injectable incretin drugs by the end of 2023, the company’s Chief Financial Officer Anat Ashkenazi said during an earnings call Tuesday. Incretin drugs, such as Eli Lilly’s weight loss treatment Zepbound and diabetes injection Mounjaro, mimic hormones produced in the gut that suppress a person’s appetite and regulate blood sugar.

Ashkenazi added that Eli Lilly will try to increase capacity with “equal urgency” this year. The company expects the most significant production increases to occur in the second half of 2024.

By that point in the year, Eli Lilly expects its production of sellable doses of incretin drugs to be at least 1.5 times the production of those doses in the second half of last year, Ashkenazi added.

Among the company’s efforts to expand production is its new manufacturing facility in North Carolina. Ashkenazi said that the plant will start producing incretin drugs as early as the end of 2024, with products available to ship in 2025.

The company still expects demand for incretin drugs to outstrip supply this year as it works to increase production, Ashkenazi noted.

Eli Lilly wasn’t the only weight loss drug producer to see positive supply developments in the last week. Novo Nordisk did, as well.

Novo Holdings, which owns almost 77% of the voting shares in Novo Nordisk, said Monday it will acquire drug manufacturer Catalent in a $16.5 billion deal.

Catalent is critical to Novo Nordisk because it’s the main supplier of fill-finish work, which involves filling and packaging syringes and injection pens, for Wegovy.

Novo Nordisk will then buy three of Catalent’s manufacturing plants from Novo Holdings for $11 billion. Novo Nordisk said that purchase will gradually increase its filling capacity beginning in 2026.

“Overall, we think this will further unlock supply, which is the key bottleneck for this market,” Yuri Khodjamirian, chief investment officer at Tema ETFs, told CNBC in reaction to the Catalent deals Monday. Tema in November launched an ETF whose key holdings include companies benefiting from the hype around weight loss drugs.

The deal also means Novo Nordisk can better control the quality of Wegovy supply, which has previously been an issue at Catalent’s facilities, Khodjamirian added.

For example, Catalent’s factory in Brussels that fills Wegovy injection pens suffered several lapses in recent years and had to shut down twice, Reuters reported in July, citing FDA inspection documents.

The deal comes as Novo Nordisk tries to make broader strides toward improving supply this year.

Last week, the Danish drugmaker also said it had more than doubled its supply of lower-dose versions of its weight loss injection Wegovy in January compared to previous months. Supply shortages forced Novo Nordisk to restrict the availability of those lower doses in the U.S. since May.

But why are those lower doses important? It’s because people are supposed to start Wegovy at a low dose and gradually increase the size over time to mitigate side effects such as nausea. So, more of those low “starter” doses means more new patients can begin treatment with Wegovy.

The company plans to “gradually” increase the overall supply of Wegovy throughout the rest of the year, executives added on the company’s fourth-quarter earnings call Wednesday.

The latest in health-care technology

The brain as the next frontier

The implantable neurotechnology field is heating up.

Last week, Elon Musk announced that his startup Neuralink implanted its brain-computer interface into a human patient for the first time. Musk said the recipient is “recovering well,” according to a post on his social media site X, but the famously secretive neurotech company did not share any other details publicly.

Neuralink is developing a brain implant, called a brain-computer interface, or a BCI, designed to help patients with paralysis control external technologies using only their mind. It sounds like something out of a science fiction movie, but several companies like Synchron, Precision Neuroscience, Paradromics and Blackrock Neurotech have developed systems with these capabilities.

“Imagine if Stephen Hawking could communicate faster than a speed typist or auctioneer,” Musk wrote. “That is the goal.”

Musk’s announcement marks a major milestone for Neuralink, but it’s not unexpected. Neuralink began recruiting patients for its first in-human clinical trial in the fall after it received approval from the U.S. Food and Drug Administration to conduct the study in May, according to a company blog post.

The road to market is long for medical device companies. Neuralink will have to carry out more trials that prove the safety and efficacy of its BCI before it can clinch the final stamp of approval from regulators.

Many competing BCI companies like Synchron are also working toward bringing products to market. On Thursday, Synchron announced it has acquired a minority equity stake in the German manufacturer Acquandas, which will help the company ramp up production of its flagship BCI to prepare for commercial demand.

Synchron’s stent-like BCI is delivered to the brain via the patient’s blood vessels. The company has implanted six patients in the U.S. and four patients in Australia so far.

“There are millions of people with paralysis who we think are in need of this technology, and we’re preparing to produce in high volumes,” Synchron CEO Tom Oxley told CNBC in an interview.

Feel free to send any tips, suggestions, story ideas and data to Annika at annikakim.constantino@gmail.com and Ashley at ashley.capoot@nbcuni.com