It’s never too early to start thinking about retirement.

While the thought of funding your retirement adequately might be daunting, if you start planning now you’ll certainly be thankful later. It also might not be as difficult as you think.

Retirement usually entails replacing your annual salary from a workplace with other income sources to maintain your current lifestyle. While Social Security may cover part of your budget, the rest of your money will most likely need to come from your savings and investments.

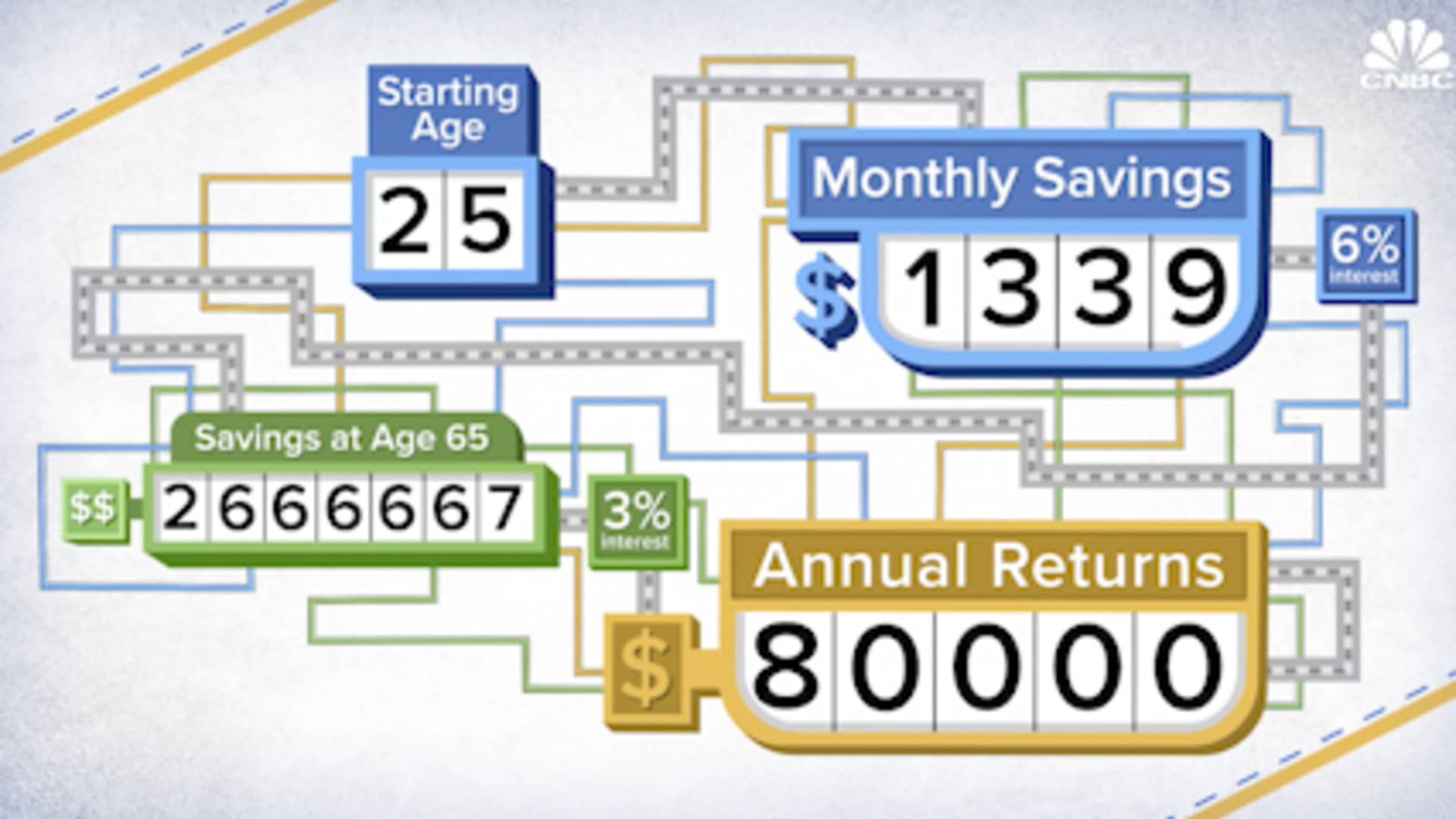

CNBC crunched the numbers, and we can tell you how much you need to save now to get $60,000, $70,000 and $80,000 every year in retirement — without taking a bite out of your principal.

First, there are some ground rules. The numbers assume you will retire at age 65 and that you currently have no money in savings.

Financial advisors typically recommend the mix of investments in your portfolio shift gradually to become more conservative as you approach retirement. But even in retirement, you’ll likely still have a mix of stocks and bonds, as well as cash. For investing, we assume a conservative annual 6% return when you are saving and an even more conservative 3% rate during your “interest-only” retirement.

We also do not factor in inflation, taxes or any additional income you may get from Social Security or your 401(k) investment plan.

We have a full breakdown of how much you need to save now if your goal is to get to $60,000, $70,000 or $80,000 every year in retirement.

Watch the video above to learn more.