As 2024 comes to an end, it has generally been a strong year for equity investors.

However, the year has also highlighted significant geographical disparities, with US equities being clear winners for investment portfolios.

The iShares Core S&P 500 ETF has delivered a return of nearly 34% in 2024, while the iShares STOXX Europe 600 ETF achieved just over 9%.

Globally, U.S. equities now make up nearly 74% of the MSCI World Index, meaning that a balanced global equity portfolio inherently holds a substantial share of U.S equities.

But looking across Saxo Bank’s more global clients, many of whom are based in Europe, portfolios reveal a pronounced overweight in European equities.

Investors shows strong overweight in European equities

Data from Saxo shows that global clients (all non-Danish clients), many of whom are based in Europe, allocate 46% of their equity exposure to European equities and only 36% to U.S. equities, reflecting the famous “home-bias” tendency.

But despite the “home-bias” tendency, this could also be seen as a sign that investors believe that the U.S. market is topping soon and there is a turning point ahead.

But is pro- Europe a good or bad investment strategy?

Nordic Investment Strategist at Saxo, Oskar Bernhardtsen, said, ”Given the significant geographical differences in returns, underweighting U.S. equities relative to European and Danish stocks has not been the most effective investment strategy in 2024.

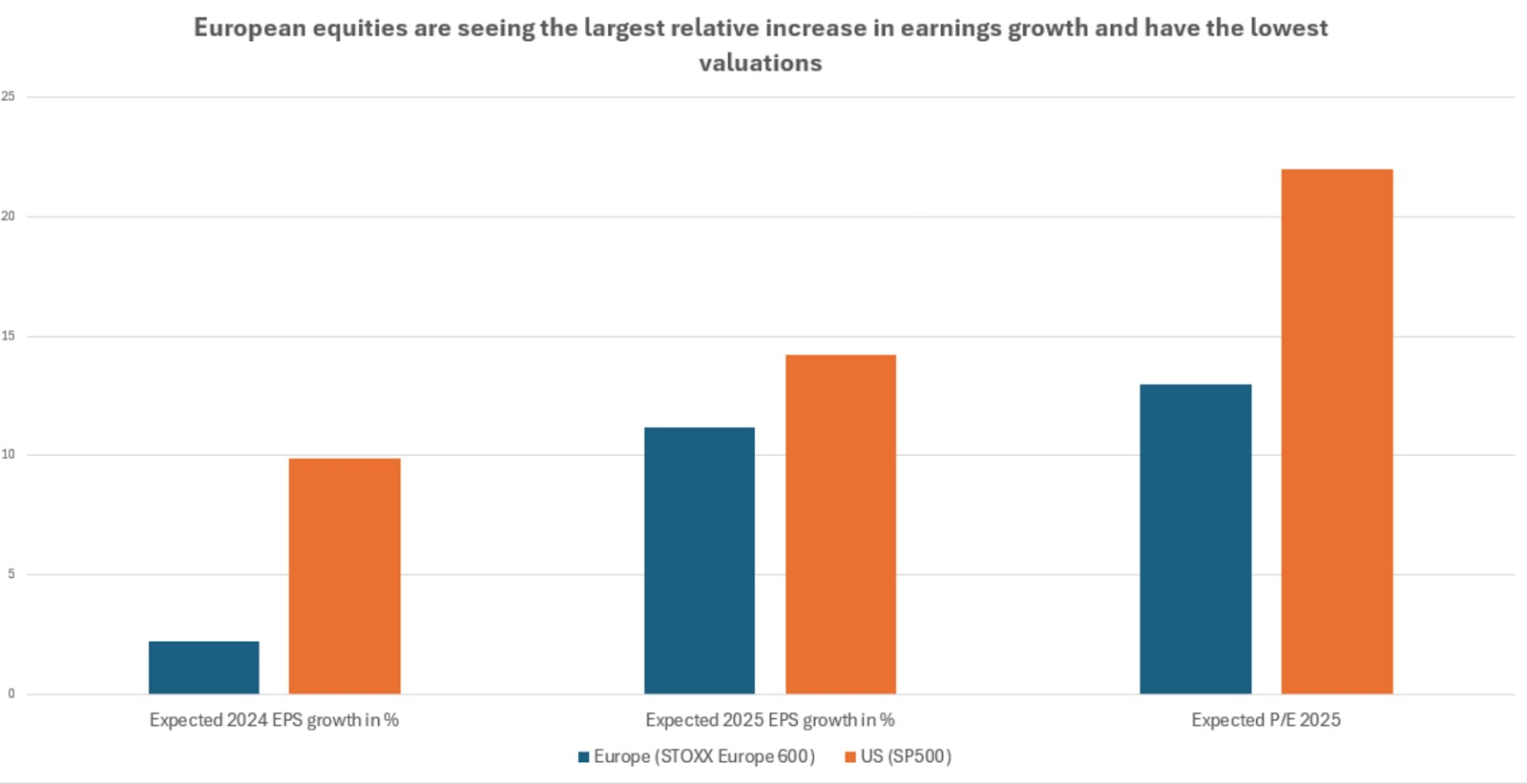

Much of this return disparity can be attributed to earnings-per-share (ESP) growth. In 2024, the S&P 500 is expected to deliver an EPS growth of approximately 10%, compared to just 2% for companies in the STOXX 600 Europe Index.”

“However, holding European equities may not necessarily be a poor decision for 2025. EPS growth in Europe is expected to rise significantly next year, narrowing the gap with U.S. equities. Moreover, European stocks are currently trading at much lower valuations relative to their expected 2025 earnings compared to U.S. stocks, making them potentially attractive for the upcoming year.”