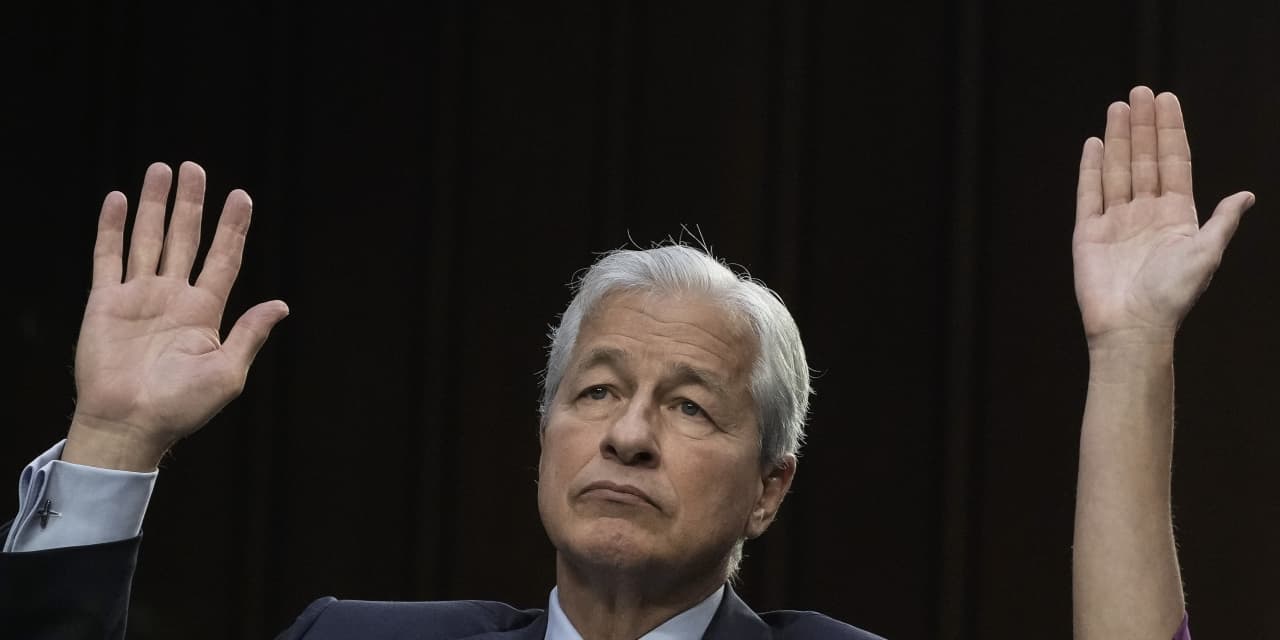

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon may be required to provide new testimony as part of a lawsuit against the bank over dealings with convicted sex offender Jeffrey Epstein, as requested by a law firm representing one of Epstein’s victims. Epstein died in 2019.

Sigrid McCawley, of law firm Bois Schiller Flexner, asked U.S. District Judge Jed S. Rakoff to order JPMorgan Chase to provide more information about a 2019 bank review of the Epstein matter as well as the results of a bank review of its relationship with its former wealth chief, Jes Staley.

Also read: JPMorgan CEO Jamie Dimon says he never heard of Jeffrey Epstein until after his 2019 arrest

McCawley’s letter, dated Friday, is part of a lawsuit, Jane Doe 1 v. JPMorgan Chase, that was filed in the Southern District of New York on Nov. 24 and that is seeking damages from the bank for its past dealings with Epstein.

Asked to comment on the letter, a JPMorgan Chase spokesperson said, “Plaintiffs like the headlines, but no amount of time on the record will change the fact that Jamie never met the man, never worked with the man, and wishes in hindsight the man had never been a client of the firm.”

Jane Doe 1’s lawyers, who deposed Dimon last month, said the bank has “failed to expeditiously produce documents” from files of key witnesses and has “strategically withheld” documents, according to documents provided in an earlier CNBC report on the lawsuit.

In late May, Dimon testified that he had never heard of Epstein or his crimes until the financier was arrested on federal sex-trafficking charges in 2019, a statement that some have disputed, as the Associated Press has reported.

In addition to the Jane Doe 1 lawsuit, at least two other legal fights regarding Epstein and JPMorgan Chase are taking place: a suit by the government of the U.S. Virgin Islands against the bank, as well as Chase’s lawsuit against Staley.

The lawsuits surrounding JPMorgan Chase’s dealings with Epstein pose a reputational risk to the bank, its board and Dimon, one expert on management and corporate governance told MarketWatch.

Professor Bill Klepper, an adjunct professor at Columbia University’s business school and the author of “The CEO’s Boss: Tough Love in the Boardroom,” said JPMorgan Chase’s board will likely push for settlements without public trials.

“The board’s reputation is on the line,” Klepper said. “In executive session, the board members are saying, ‘Guys, this is terrible … clean it up and clean it up fast. Whatever you do, don’t go to court.’”

Also read: Billionaire Bill Ackman says JPMorgan’s Jamie Dimon should run for president

Even as Dimon, one of the most prominent CEOs in the U.S. and a high-profile voice of Wall Street, has been drawn into the controversy around Epstein, JPMorgan Chase’s board has not wavered in its support of Dimon, who has said he has no specific plans to move on from the bank. He recently made headlines when he said he would potentially consider holding public office sometime in the future.

In the latest proxy filing for JPMorgan Chase in April, the bank stuck to its current backup plan of moving Chief Operations Officer Daniel Pinto into the role of CEO, as it did in 2020 when Dimon had a medical emergency.

“The board is fortunate to have Mr. Pinto as a key executive who is immediately ready to step into the role of sole CEO, should the need arise in the near-term,” the bank said in 2023 proxy statement.

With Dimon giving a deposition in the Epstein lawsuit on May 31, “he’s up to his neck” in the controversy, Klepper said.

Although the board of JPMorgan Chase is no doubt talking about the situation, Klepper said it’s “mum’s the word” because it’s a personnel matter.

“But flat out, it’s a risk in my book,” he said. “Look, you as a board need to manage the risk profile of the business. It’s a major thing for you to do. Where boards get in trouble is, when they become lax in terms of oversight, it’s a risk-profile issue — reputational risk — you’re destroying brand.”