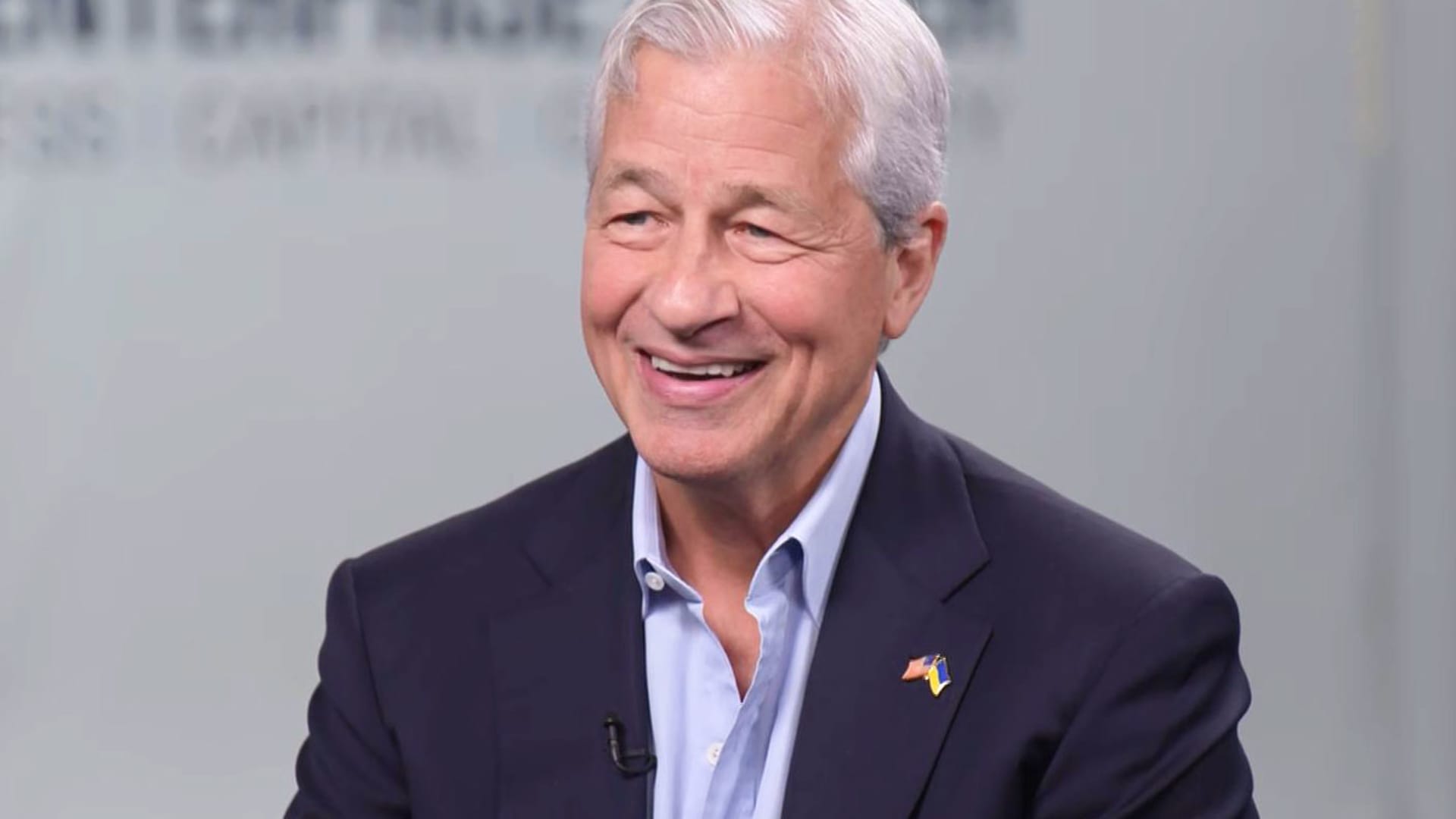

Jamie Dimon, CEO, JP Morgan Chase, during Jim Cramer interview, Feb. 23, 2023.

CNBC

The biggest U.S banks including JPMorgan Chase, Wells Fargo and Morgan Stanley said Friday they plan to raise their quarterly dividends after clearing the Federal Reserve’s annual stress test.

JPMorgan plans to boost its payout to $1.05 a share from $1 a share starting in the third quarter, the New York-based bank said in a statement.

“The Federal Reserve’s 2023 stress test results show that banks are resilient – even while withstanding severe shocks – and continue to serve as a pillar of strength to the financial system and broader economy,” JPMorgan CEO Jamie Dimon said in the release. “The Board’s intended dividend increase represents a sustainable and modestly higher level of capital distribution to our shareholders.”

Wells Fargo said it will increase its dividend to 35 cents a share from 30 cents a share, and Morgan Stanley said it would boost its payout to 85 cents a share from 77.5 cents a share.

On Wednesday, the Fed released results from its annual exercise, saying that all 23 of the banks that participated had cleared the regulatory hurdle. The test dictates how much capital banks can return to shareholders via buybacks and dividends. In this year’s exam, the banks underwent a “severe global recession” with unemployment surging to 10%, a 40% decline in commercial real estate values and a 38% drop in housing prices.

While higher dividends are welcomed by investors, the banks held back on announcing specific plans to boost share repurchases.

This story is developing. Please check back for updates.