Lucid Group’s (LCID) stock is dropping on Wednesday after the company missed Q2 expectations. CEO Marc Winterhoff admitted during a new interview that the auto tariffs and the end of the $7,500 EV tax credit “keeps us up at night,” but promises things are looking up from here.

Lucid (LCID) CEO explains Q2 hurdles and future plans

After missing top and bottom line expectations, Winterhoff told investors on the company’s earnings call that Lucid is “entering a pivotal new phase.”

Despite the reassurance, Lucid’s CEO admitted several things negatively impacted earnings. For one, its gross margin for the quarter was -105%, due to $54 million in extra costs from tariffs.

Lucid also lowered its production goal for the year from a firm 20,000 to between 18,000 and 20,000. The company stated that the updated range reflects the changing market.

During an interview on Wednesday morning, Winterhoff told CNBC’s Phil LeBeau that changes in trade, tariffs, and tax credits are “something that, you know, keeps us up at night.”

Lucid posted revenue of $259.4 million, missing Wall Street’s estimates of around $280 million. It also reported a wider-than-expected net loss of $790 million, or a loss of $ 0.34 per share.

Winterhoff told LeBeau that the biggest challenge Lucid faced in Q2 was tariffs, which had a bigger impact on gross margins than expected. However, it should work itself out throughout the remainder of the year, Lucid’s CEO added.

The other topic that many were wondering about was the availability of Earth magnets. Winterhoff explained that, unlike most of its competitors, Lucid was able to overcome the issue.

If it weren’t for Lucid’s quick actions, the company would have had to stop production in Q2. Instead, Winterhoff said that the company now has the raw materials, earth magnets, and licensing for the remainder of the year.

Lucid’s CEO added, “We are actually in a good place right now.” The company secured a partnership with Uber and Nuro to develop and deploy 20,000 robotaxis over the next six years. As part of the agreement, Uber is investing $300 million into Lucid.

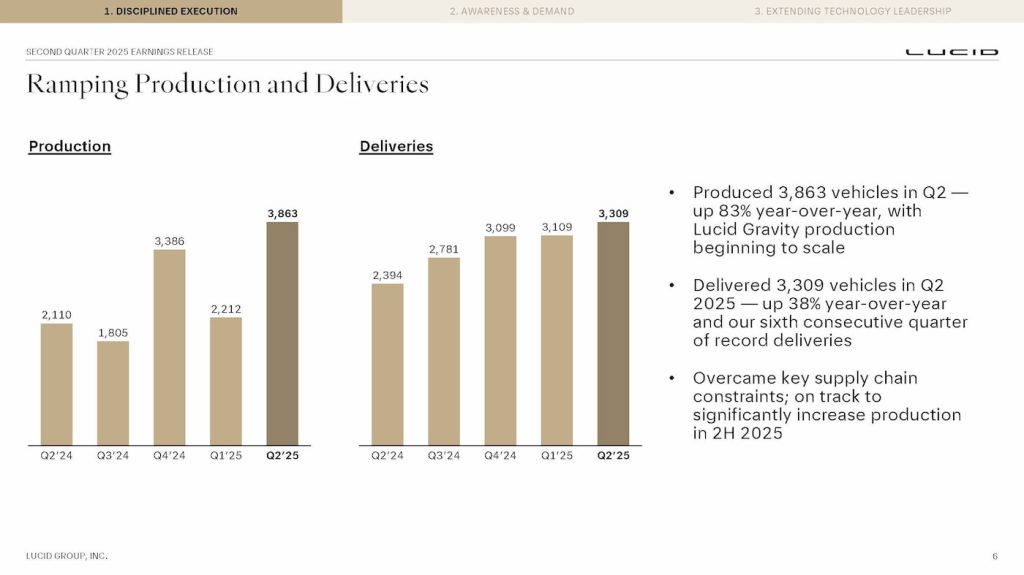

Although it missed expectations, Lucid is still making progress. The EV maker is coming off its sixth straight quarter with record deliveries. It also produced a record number of vehicles in Q2.

After overcoming supply chain issues that limited Gravity output, Lucid said it’s on track to “significantly increase production” in the second half of the year.

Lucid ended the quarter with $4.86 billion in total liquidity, which it expects will provide funding through the second half of 2026, when it plans to launch its midsize platform.

The midsize platform will have at least three “top hots,” or vehicles, including an electric SUV and Sedan. With prices expected to start at around $50,000, Lucid’s midsize EVs are expected to go head-to-head with the Tesla Model Y and Model 3.

Lucid Group’s (LCID) stock is down about 10% on Wednesday following Q2 earnings. Despite share prices surging after the Uber partnership last month, Lucid’s stock is still down nearly 30% over the past 12 months.

The company is planning a reverse stock split, which will be voted on at an upcoming investor meeting, to boost the share price and attract larger investors.