Morgan Stanley is expected to price at least $2 billion in bonds in four tranches on Monday, according to a market source, in the latest bank to wade into the capital markets.

The size of the deals will be determined by demand for the debt, but each tranche has been categorized as benchmark size, which is typically at least $500 million, according to the source.

Morgan Stanley

MS,

is offering three-year fixed rate notes, with an expected rating of Aa3/A+/AA- with a minimum investment of $250,000 backed by the bank’s parent company, also known as bank notes.

It’s also offering three-year floating rate notes with an expected rating of Aa3/A+/AA-, also at the bank level.

The third tranche is comprised of five-year “bullet” fixed-floating rate notes due Nov. 1, 2029, at the broker-dealer level, with a $1,000 minimum, with expected ratings of A1/A-/A+

The fourth tranche is an 11-year non-call 10, also known as a 10-year bullet, with a minimum $1,000 investment, issued at the broker-dealer level, with an expected rating of A1/A-/A+.

Morgan Stanley bond holders have been net buyers in the last 10 days ahead of this latest bond offering, as shown by the green bars with shorter maturities . The longer maturities have had more selling in recent days. (See chart below)

Buyer have outnumbered sellers in recent sessions for Morgan Stanley bonds, except for longer-dated securities.

BondCliQ Media Services

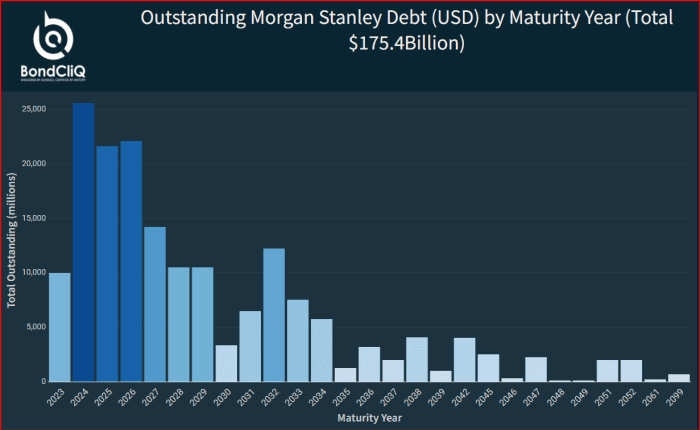

The deal comes as Morgan Stanley faces maturity dates on about $25 billion in debt in 2024. (See chart below).

Morgan Stanley has about $175B of debt outstanding including $25B that matures in 2024.

BondCliQ Media Services

Morgan Stanley’s stock was up 0.4% in on Monday.

Last week, Truist Financial Corp.

TFC,

raised $1.75 billion as banks wade into the bond market to raise capital.