Aerial view of oil and gas jack-up rig at the yard for maintenance with many vessels in Singapore. Oil prices saw three consecutive weekly declines last week, marking the longest losing run this year.

Chain45154 | Moment | Getty Images

The ongoing pressure in oil prices neglects an accelerating demand outlook and looming supply tightness, the Paris-based International Energy Agency warned on Tuesday.

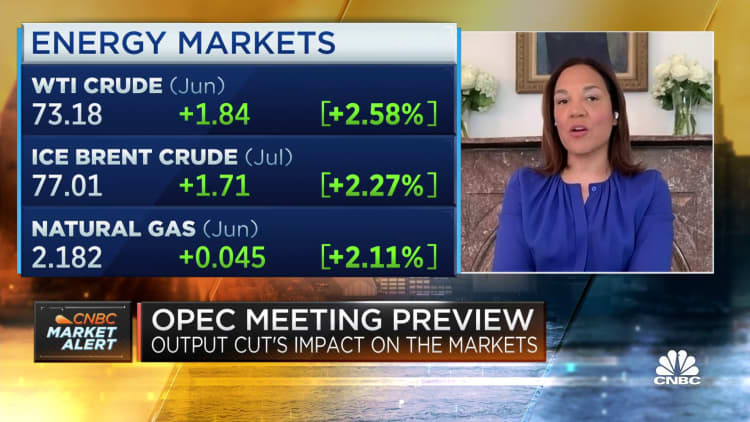

Financial turbulence in the banking sector after the spring collapse of several U.S. and European banks steered investors away from historically riskier assets, such as oil. Prices fleetingly gained ground after a number of OPEC+ members announced an additional 1.6 million barrels per day of voluntary cuts at the start of April — only to rapidly surrender these gains, cooling analyst expectations of prices at $100 per barrel.

Ice Brent futures with July expiry were trading at $75.14 per barrel at 12 p.m. London time, down 9 cents per barrel from Monday’s close.

Persisting concerns over “muted industrial activity and higher interest rates … combined have led to recessionary scenarios gaining traction and worries of a downward shift in the oil demand growth,” the IEA said in its latest monthly Oil Market Report. The agency highlighted that the recent price declines reflect a growing rift between investor sentiment and a tightening supply-demand picture.

“The current market pessimism, however, stands in stark contrast to the tighter market balances we anticipate in the second half of the year, when demand is expected to eclipse supply by almost 2 mb/d,” the agency said, revising its global oil demand forecast by 200,000 barrels per day from its previous projection, to reach 102 million barrels per day in 2023.

The IEA expects demand to start exceeding supply as of this quarter, for the first time since early 2022, with this projected deficit set to deepen to nearly 2 million barrels per day by the end of the year.

The world’s largest crude oil importer, China, will account for nearly 60% of global demand growth in 2023, the IEA anticipates, after Bejing’s consumption set its all-time record of 16 million barrels per day in March.

“Record demand in China, India and the Middle East at the start of the year more than offset lacklustre industrial activity and oil use in the OECD,” the IEA said.

Chinese crude oil purchases were curtailed by spartan zero-Covid-19 restrictions that were in place for the majority of last year, with analysts widely expecting Beijing’s economic reopening to kickstart a surge in oil prices.

Vienna in sight

The OPEC+ group has in the past proven wearier to trust a resurgence of Chinese demand, with one delegate, who could only speak under condition of anonymity, previously underlining the pace of Bejing’s rebound has been at times overstated.

In its own Monthly Oil Market Report of May 11, OPEC acknowledges that “looking ahead, oil demand for most products in China has been increasing,” assessing Chinese domestic mobility and air travel have now recovered close to 80% of pre-pandemic levels, with oil demand set to experience 1 million barrels per day of year-on-year growth in the second quarter.

The IEA and White House have criticized the OPEC+ alliance’s early-April voluntary cuts decision, stressing the strain on consumers.

OPEC+ and the Paris-based agency have progressively diverged in their analysis of the global energy picture, from their outlook on oil prices and supply requirements, to their longer-term view on hydrocarbon investment.

The IEA in 2021 warned against brokering new fossil fuel projects thereon, if the world is to achieve its net-zero targets. OPEC+ officials have meanwhile advocated for simultaneous investment in hydrocarbons and renewables, to avoid energy shortages throughout the green transition.

The OPEC group and its non-OPEC partners — critically, including sanctions-struck Russia — will adjourn in Vienna to review their crude oil production policy at the start of next month. OPEC’s second-largest producer, Iraq has so far dismissed the possibility of further reductions.

“At the next meeting, which will be held on the 3rd and 4th (of June), there will be no additional reduction, and as for Iraq, we cannot reduce further,” Iraqi Oil Minister Hayan Abdel-Ghani said last week, in comments reported by Reuters.