The Halifax will from today use a property’s Energy Performance Certificate (EPC) rating in its affordability calculations.

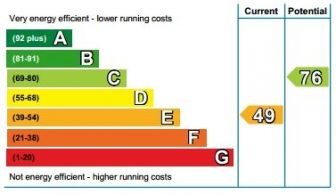

A property’s energy efficiency is rated with an EPC, ranging from A to G, with A being the most efficient. Customers with a high EPC rating, such as A or B, are assumed to have lower energy costs, and therefore may see a small increase in the maximum loan available.

Meanwhile, those buying a property with a low rating, such as F or G, may see a decrease in the available loan, according to Halifax.

For new build properties Halifax will accept a ‘predicted’ EPC rating keyed (based on a Predicted Energy Assessment (PEA) or Standard Assessment Procedure (SAP) rating).

But EPCs have been criticised as “inaccurate” by some commentators, while former housing secretary, Michael Gove, said there were “weaknesses” in the ratings system that drove “perverse outcomes”.

The move has also sparked fears among some that buyers and sellers of older properties will be unfairly penalised.

Alice Haine, at Bestinvest by Evelyn Partners, said: “Green upgrades can be very expensive and while incentivising homeowners to make better choices is beneficial for the overall energy efficiency of the country’s housing stock, it risks creating a two-tier market where only those with the deepest pockets or those owning the newest houses can benefit.”

Alice Haine, at Bestinvest by Evelyn Partners, said: “Green upgrades can be very expensive and while incentivising homeowners to make better choices is beneficial for the overall energy efficiency of the country’s housing stock, it risks creating a two-tier market where only those with the deepest pockets or those owning the newest houses can benefit.”

It could also adversely impact the housing market, Haine has warned.

“With the risk that older properties that require more substantial investment could see their values plummet, owners may be deterred from selling for fear they won’t secure the price they want. This could create a log jam in the market,” she added.

Matt Thompson, of Chestertons, said EPCs will become a “focal point” for buyers. He highlighted how areas with a high proportion of older properties, such as London, may be harder hit.

Thompson said: “Buyers have already been squeezed with interest rates. If they’re squeezed by EPCS, they will have to compromise even further on what they can buy.”

Andrew Boast, of SAM Conveyancing, believes Halifax’s “decision will slow down the housing market”.

He said: “Older homes, which often make up the bulk of the F- and G-rated properties, are likely to be disproportionately affected. These homes already come with higher maintenance and running costs, and Halifax’s change will further compound the financial barrier for prospective buyers and sellers.”

Amanda Bryden, head of Halifax Intermediaries and Scottish Widows Bank, said: “We know that typically, more energy efficient homes are cheaper to run. Using EPC data and energy bill analysis, we’re able to reflect that in mortgage affordability.”