Specialist asset manager Gresham House has been snapped up by private equity group Searchlight Capital, the £11.05 per share, all cash, deal values Gresham at £440.6 million.

Gresham House manages £8 billion of assets, of which nearly £7 billion is real assets or private equity – including important Forestry and VCT businesses.

Nicholas Hyett, Investment Manager at Wealth Club said, “The acquisition of the UK’s largest forestry investment manager, and second largest VCT manager, is a big vote of confidence in the UK’s alternative investment industry.

“As a booming alternative asset manager, Gresham has been an important driver of capital behind major government initiatives to decarbonise the economy and spur innovation through investment in start-ups. Those investment categories have struggled a bit in a rising interest rate environment, but Searchlight clearly sees the long-term potential.”

In fact, “opportunistic acquisition of a temporarily out of favour investment” sums up this deal all over.

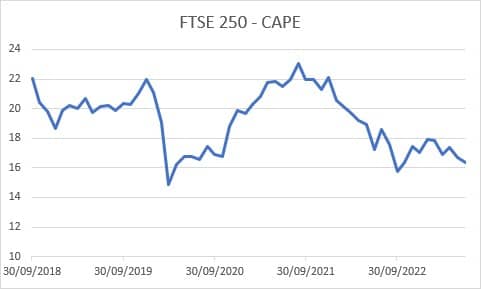

Gresham shares were down around 20% over the year to yesterday, reflecting a sell-off across the UK’s smaller and mid-sized companies, where cyclically adjusted PE have fallen 5-10% in 12 months.

“That’s despite Gresham reporting rising revenues and an improved operating margin of 35% at its last set of full year results. With organic AUM growth of 17%, or £1.1 billion, Gresham is the go-go face of an asset management industry that has otherwise struggled to raise actively managed funds.

Given that success, it’s no surprise Searchlight is said to be supportive of the current structure and management team at Gresham. That means in the short-term, clients should see little change – important given the very long-term nature of many of the investments Gresham manages.

Given that success, it’s no surprise Searchlight is said to be supportive of the current structure and management team at Gresham. That means in the short-term, clients should see little change – important given the very long-term nature of many of the investments Gresham manages.

“However, the new owners have likely been eyeing up Gresham’s debt free balance sheet with interest. Asset management is a cash generative, capital light business – and we wouldn’t be surprised if the business was leveraged up in the future to help pay for the acquisition.”