Average rents in Scotland for new tenancies in the private sector have increased by double digits for the fourth consecutive month since the introduction of rent controls, the latest data from letting portal Citylets shows.

The figures re-inforce industry beliefs that the current policy on rent controls, introduced as part of the Cost of Living (Tenant Protection) (Scotland) Act 2022, providing for caps within tenancies, have led to hikes on the open market attracting or accelerating further legislative attention with proposals for full market controls.

The existing emergency legislation is due to expire on March 31st 2024 and is widely expected to be supplanted with wider, more permanent legislation.

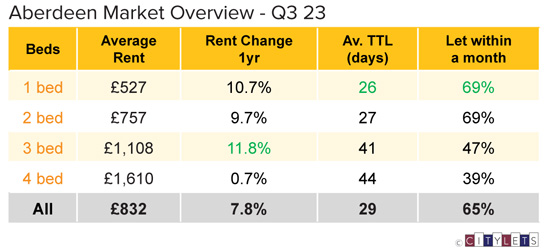

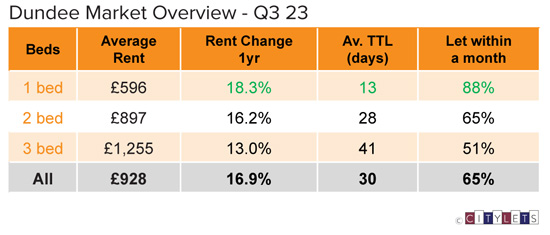

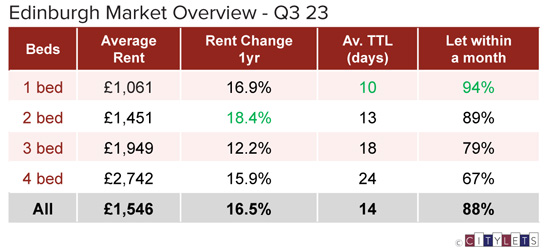

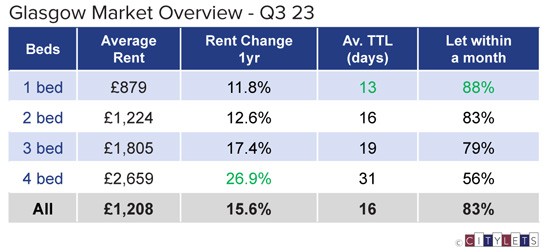

Almost all major regions witnessed double digit annual growth, up to 19%, in the third quarter of 2023 with the market moving at frenetic pace for would-be renters.

Citylets MD, Thomas Ashdown, said: “It is clear from the latest government consultation that future policy for Scotland’s private rented sector will likely take the form of the current legislation with a further capping of rents, now including the open market. Indeed many would argue that the current legislation has accelerated and/or shaped the forthcoming regulations.

“Whilst it is of course understandable that the headline figures for the continued sharp rise in open market rents will be causing unease, it remains a statement of fact that expanding the number of homes in the sector will have the natural cooling affect desired.

“A larger number of available homes will see more people housed at more affordable rents.”

Commenting on the Scottish Market, Karen Turner of Rettie & Co said: “Scotland’s two mains cities are still feeling the aftermath of the busy summer months with tenant demand far outstripping supply. There remains huge disparity between supply and demand. The impending short let regulations have further hampered this issue across the whole of Scotland. These landlords in the main won’t revert into the PRS as was hoped.

“We urgently require Scottish government to do a big U-turn and address the housing crisis over all sectors. More encouragement, not barriers for landlords to enter the market whether they are private or institutional. We have a beautiful country and people want to live here but are increasingly finding it difficult.”

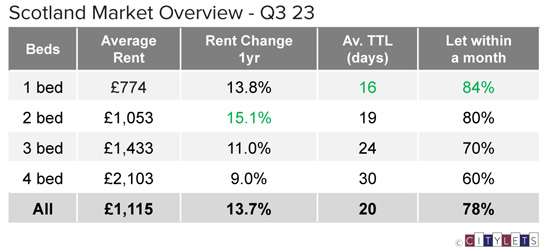

The average property to rent in Scotland, having surpassed the £1,000 mark for the first time in Q1 2023, continued to rise to average £1115 per month with the rate of growth accelerating to 13.7% Year on Year (YOY).

Gillian Semmler, PR Manager at Citylets, noted: “Finding a property to rent in Scotland hasn’t been easy for would-be tenants in recent times with the third quarter of 2023 being no different. We need to be encouraging more individual and corporate entrants to the market in order to increase supply to better meet demand. An expanded PRS will likely be a better result than a smaller, tightly controlled sector in terms of positive outcomes for those seeking homes.”