Demand for rental properties continues apace in Scotland’s private rental sector as legislation to control rents in market hotspots continues through parliament. The rate of annual rental growth however continues to ease within major cities, now settled at single digits, whilst a cacophony of voices call for rent controls to be scrapped citing economic evidence of their overall detrimental impact.

The Bill, often regarded as being driven by the Scottish Greens on PRS matters who no longer share power with SNP, moves forward with no signs as yet that the administration will change course on this aspect.

A once unassailable confidence in the SNP legislative position north of the border came to an abrupt end in Q2 2024 with the dissolution of the Bute House Agreement and a disastrous Westminster election signalling what may lie ahead at next Holyrood election.

A recent report by the IEA, which studied the impact of rent controls in multiple countries, concluded that rent controls had an overall negative net impact on markets despite providing some benefits. The report highlighted a reduction in the quality and quantity of supply as well as wider socio-economic concerns such as labour mobility.

The report was an analysis of 196 studies on the subject already undertaken.

Citylets MD, Thomas Ashdown, observed: “It is unlikely that the authoritative and independent economic findings on rent controls across nations has been overlooked by the administration which begs the question as to why there has been no clear response. Perhaps vote winning soundbite politics is deemed paramount with ‘rent control’ such an obvious winner but what is the point of retaining power if it comes at a cost to those it purports to serve.

“We have a housing emergency. There is an absolute duty to the people of Scotland that good intentions do not make things worse. To that end there must be clear, immediate open engagement with the facts from independent industry experts.”

Landlords may finally have reason to believe that, in addition to interest rates moving downwards, there may be some respite in the relentless change which many argue is deterring those from entering or remaining in the sector. Official figures from Scottish Government underline the number of households in the PRS is declining in recent years along with numbers in social housing.

Census figures indicate a rise over the past decade but mask a clear slowdown in growth followed by stasis before stating to fall from peak PRS in 2022.

Gillian Semmler, PR manager at Citylets, commented: “Census figures were widely reported in recent days, however, the real story is the stasis and then decline of the market size in recent years as indicated by the Scottish Household Survey which is compiled every year, albeit with some interruptions over the pandemic period.”

The supply in Scotland’s PRS is declining and rent controls, however well intent, have deterred landlords big and small from entering or remaining in the sector.

With a national housing emergency declared, the question so clearly being asked is where are those who cannot afford to buy supposed to go?”

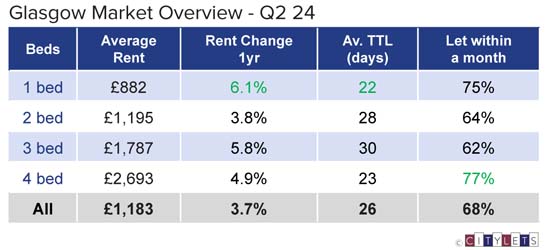

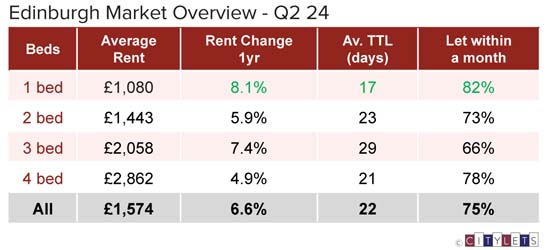

David Alexander of DJ Alexander said: “Demand remains extremely high across Scotland but particularly in Edinburgh and Glasgow with rents rising substantially in the second quarter. The number of applications per property is at record levels and this is likely to continue throughout the year.

“Uncertainty over the Housing Scotland Bill continues to produce some concern, but the returns on investment remain very good, resulting in many landlords remaining committed to staying in the market until some clarity emerges about the direction of travel. Overall, the Scottish market is resilient and extremely buoyant, and this is likely to remain the case for some time to come.”