Halfpoint Images | Moment | Getty Images

1. Investment fees

Investment fees are a big consideration for rollovers, advisors said.

Investment funds in 401(k) plans are generally less costly than their IRA counterparts.

That’s largely because IRA investors are “retail” investors while 401(k) savers often get access to more favorable “institutional” pricing. Employers pool workers into one retirement plan and have more buying power; those economies of scale generally yield cheaper annual fees.

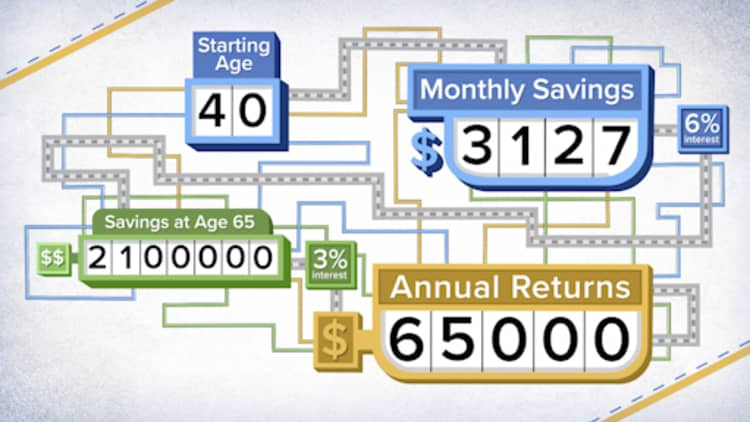

Rollovers to an IRA in 2018 will cost investors an estimated $45.5 billion over a 25-year period due to higher fund fees, according to a study by The Pew Charitable Trusts.

Of course, not all 401(k) plans are created equal. Some have better governance than others, and fees are generally cheaper for retirement plans sponsored by large companies rather than small businesses.

“Are you able to pay less by staying in your 401(k) plan?” said Ellen Lander, founder of Renaissance Benefit Advisors Group. “The larger the plan, the more resounding that ‘yes’ will be.”

The bottom line: Compare annual 401(k) fees — like investment “expense ratios” and administrative costs — to those of an IRA.

2. Investment options

Savers may benefit from leaving money in a 401(k) if they’re happy with their investments.

Certain investments — like guaranteed funds or stable value funds, which are kind of like high-earning cash or money market funds — aren’t available in IRAs, Lander said.

But 401(k) options are limited to those selected by your employer. With an IRA, the menu is often much broader.

Integrity Pictures Inc | The Image Bank | Getty Images

Certain retirement investments like annuities, physical real estate or private company stock are generally unavailable to 401(k) savers, said Ted Jenkin, a certified financial planner and CEO of oXYGen Financial, based in Atlanta.

Another consideration: While the options may be fewer in a 401(k), employers have a legal obligation to curate and continually monitor a list of funds that’s best suited to their workers.

Unless you’re working with a financial advisor who acts as a “fiduciary” and helps vet your investments, you may not be putting money in a good IRA fund. Too many choices may also lead to choice paralysis, advisors said.

3. Convenience

Having multiple 401(k) accounts scattered among multiple employers may be a challenge to manage, said Jenkin, a member of CNBC’s Advisor Council.

Aggregating assets in one IRA may simplify management of your nest egg relative to factors like asset allocation, fund choice, annual RMDs in retirement and account beneficiaries, he said.

“If you’re babysitting three kids in three different backyards, it would be tough to keep your eye on all three,” Jenkin said. “By getting them in one, it’s a lot easier to watch them all.”

4. Creditor protection

Investors generally get stronger creditor protections in a 401(k) than an IRA, courtesy of federal law, advisors said.

Your 401(k) money would generally be protected from seizure in the event of bankruptcy or if you faced a civil suit from someone who fell and got injured in your home, for example, Lander said.

IRA assets may not be protected, depending on the strength of state laws.

Exceptions to 401(k) protection may occur during divorce proceedings or for taxpayers who owe a debt to the IRS, Lander said.

5. Flexibility

Many 401(k) plans may not allow retirees much flexibility around withdrawing money.

For example, more than 30% of 401(k) plans disallow periodic or partial withdrawals by retirees, and about 36% disallow installment payments, according to the Plan Sponsor Council of America, a trade group.

If this is the case, Lander advises workers to ask their employer’s human resources department about the policy and whether it can be amended.

“That’s a quick fix,” she said.

6. Company stock

Workers who own company stock in their 401(k) can get a tax benefit for keeping those holdings in-plan rather than rolling them to an IRA, Jenkin said.

“That’s a big advantage for people who believe in their company stock and leave it in for a long period of time,” Jenkin said.

7. Loans

There’s sometimes an ability for 401(k) savers who part from an employer to keep taking loans from the 401(k) account they left behind, advisors said. However, you can’t borrow money or take a loan from an IRA.

While the provision is generally rare, those who have access and find themselves in a financial pinch can take a 401(k) loan and — assuming they follow the repayment rules — don’t suffer adverse tax consequences, Lander said.