Rumours are circulating in Whitehall that Fuel Duty will be increased by 5p per litre, undoing Rishi Sunak’s temporary cut for Ukraine in the 2022 Spring Budget. Other rumours include 3p pay-per-mile for EVs and the return of the fuel price escalator.

So here we go again: the needless prerequisite in the lead-up to the Winter Budget to convince the Treasury of the economic and social case for reducing fuel duty, or at least maintaining it at the current level.

Despite all Labour MPs being invited by an average of 30 of their constituents to FairFuelUK’s pre-Budget walk-in parliamentary reception, only one attended and refused to say whether they supported an increase, freeze, or cut in Fuel Duty.

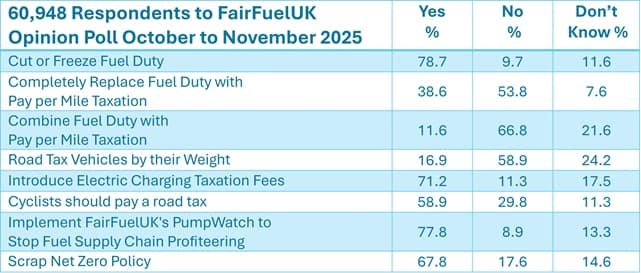

Labour remains anti-driver and continues to ignore its own voters. In FairFuelUK’s 15th annual ‘open to all’ pre-Budget opinion poll, which has received over 60,000 responses so far, three out of four voters who voted Labour in 2024 support either a cut in Fuel Duty or keeping it frozen.

And remarkably, in the same poll, one in ten Labour voters even want Fuel Duty scrapped. How can Rachel Reeves ignore the wants and opinions of the people who gave her political power?

Once in Government, a form of collective fiscal amnesia seems to take hold, undermining the Cabinet’s long-term understanding that road transport taxes are indeed regressive and significantly impact the UK’s GDP, inflation, job creation, business investment, low-income families and society’s freedom of movement.

Howard Cox, Founder of FairFuelUK, said: “Keeping Fuel Duty frozen at the very least will be one of the best fiscal stimuli for this unpopular government’s chances of restoring faith in its leadership. In contrast, hiking it could be the final political blow in Labour’s succession of self-inflicted disasters.”

“Fuel duty has remained frozen for the past 15 years, currently standing at 6p below its level when the Labour Party was last in power. This has been of immense benefit to Britain’s motorists and has significantly strengthened the Treasury’s finances by reducing inflationary pressure.”

With this much beleaguered Chancellor’s second Budget on November 26, we must debate sensibly, yet again, whether cutting fuel duty could provide meaningful relief to households and stimulate economic growth, versus Ed Miliband’s myopia to stop us all driving and to be imprisoned in the unelected globalists’ 15-minute cities, to progress Labour’s bankrupting journey to a pointless Net-Zero.

But this time, maybe Sir Keir Starmer’s ill-informed Cabinet and the cash-grabbing, tax-raising Treasury should listen to their constituents, many of whom took part in FairFuelUK’s Opinion Poll, and, last year, gave this Government a substantial parliamentary majority.

The cost-of-living crisis is deepening and continues to hurt families and small businesses across the United Kingdom, regardless of their political views. The country’s current financial doom and gloom seems to be less of a priority in the media, overshadowed by issues like immigration, digital ID, the newfound obsession with Reform UK, Starmer’s unpopularity, and the Ukraine war—only occasional mentions of a regressive tax affecting all areas of our lives have appeared.

Fuel prices remain a significant part of household spending, especially for those who depend on personal vehicles for work, commuting, caring responsibilities, or living in rural areas. Reducing fuel duty would directly lower the cost of petrol and diesel at the pump, providing immediate financial relief to millions of drivers and helping ease pressure on household budgets.

It cannot be made more evident to the Chancellor from FairFuelUK’s annual survey that a reduction in fuel duty in the November 26th budget will provide tangible benefits for households, businesses, and communities across the country. It would help to address the cost-of-living crisis, support economic growth, assist rural areas, and ease inflationary pressures. It will also generate more profits for businesses and increase corporate tax revenue for the Treasury. While fiscal considerations must be weighed, the case for cutting fuel duty is massively compelling, provable and merits serious consideration by policymakers.

Two-thirds of poll respondents want Net Zero scrapped, and nearly 60% want cyclists to pay for upkeep of the roads they use freely. Over half of respondents oppose pay-per-mile taxation, with more than 70% of commercial vehicle respondents opposing it.

Rural and remote communities are also disproportionately affected by high fuel costs, as public transportation options don’t compare to those enjoyed by politicians in major cities. For these communities, private vehicles are more than essential for accessing work, education, healthcare, and other services. A cut in fuel duty would help to alleviate the financial burden faced by rural residents, promoting greater social and economic inclusion.

Lower fuel costs can also make the UK a more attractive destination for investment, particularly in sectors such as logistics, delivery, and manufacturing. By cutting fuel duty, the government would signal its commitment to supporting enterprise and innovation, potentially encouraging businesses to expand and create new jobs.

The Centre for Economic and Business Research predicted for FairFuelUK that raising fuel duty would bring only very short-term, minimal benefits to the Treasury. They also strongly suggested that raising fuel duty would result in a decline of more than 60% in tax revenue to the Treasury within five years. Any short-term gain is just not worth the long-term fiscal pain.

In addition, the Chancellor must announce that her Government will continue the entire delivery and roll-out of FairFuelUK’s and the Conservative government’s PumpWatch scheme to stop the unchecked years of opportunistic profiteering in the fuel supply chain.

Supermarket fuel margins averaged circa 9 per cent in the three months to June, according to the CMA. Compared to just 4 per cent in 2017. Non-supermarket forecourts too, also increased their margins, earning nearly 11 per cent in the three months to June. The margin in 2017 was much less at 6.4 per cent.

In fact, current petrol and diesel prices at the pumps, according to FairFuelUK’s analysis, are currently 5p and 9p per litre higher, respectively, than they should be.

Through FairFuelUK’s PumpWatch, the Conservative government was focused on protecting motorists, families and small businesses across the United Kingdom. FairFuelUK respectfully urges Labour to do the same and reimplement PumpWatch, but ensure it has real legislative teeth to stop these unchecked rip-offs.