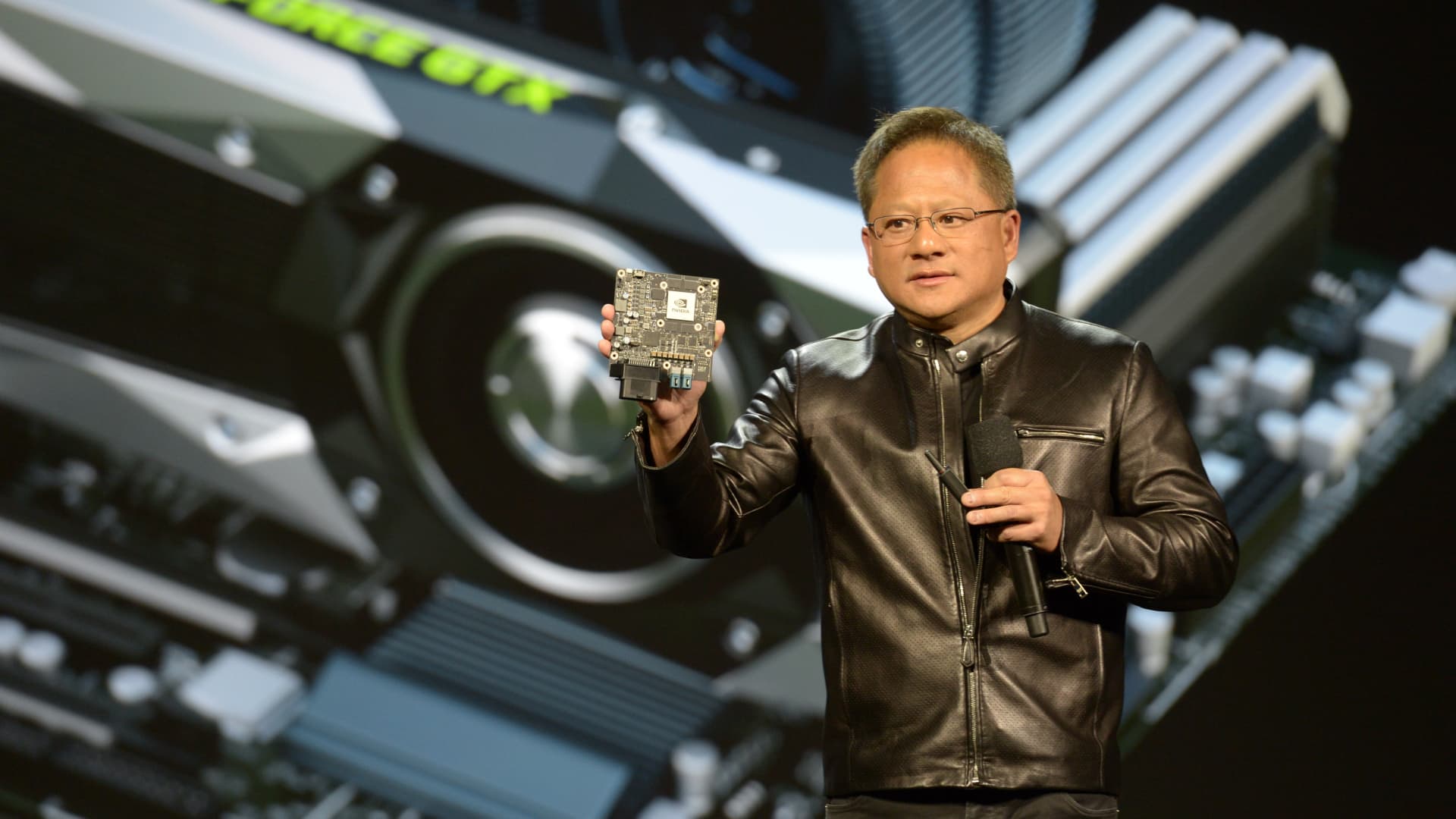

Check out the companies making headlines in midday trading. Nvidia — Nvidia fell 2% during midday trading and built on Tuesday’s more than 4% loss ahead of its quarterly print after the bell. Investors will be closely watching the chipmaker’s results for insights into how long its massive growth cycle can go. SolarEdge Technologies — Shares slid 14% after the solar company’s latest earnings report. While SolarEdge saw a smaller loss per share than Wall Street anticipated, revenue was well under analysts’ estimates. First-quarter revenue is expected to be $175 million to $215 million, far below the $406 million forecast. Teladoc — Shares dropped 24% on Wednesday, the day after the online health-care company released worse-than-expected revenue and guidance. Teladoc posted $661 million in revenue, below the $671 million consensus forecast from LSEG, formerly known as Refinitiv. The company reported a loss of 17 cents per share, narrower than the 21 cent figure anticipated by analysts. For the current quarter, Teladoc guided revenue between $630 million and $645 million, lower than the estimate of $673 million from analysts, according to LSEG. Palo Alto Networks — The cybersecurity stock dived 26.3% after cutting full-year guidance for revenue and billings . The company expects revenue growth of between 15% and 16% for the full year, down from its prior range of between 18% and 19%. RingCentral — Shares advanced 3.5% on a fourth-quarter beat on the top and bottom lines. However, the cloud company offered a weak outlook for the current quarter and a mixed forecast for the full year. Toll Brothers — The homebuilder’s shares jumped more than 5% on the back of its better-than-expected earnings report. Toll Brothers posted earnings per share of $2.25, higher than an estimate of $1.78, according to LSEG. Revenue of $1.93 billion also outpaced expectations. Norfolk Southern — Shares added 2% after Barclays upgraded the railroad operator to overweight from equal weight. As a catalyst for the change, the bank cited upcoming shake-ups in leadership, including the ousting of CEO Alan Shaw. Amazon , Walgreen Boots Alliance — S & P Dow Jones Indices announced Tuesday that Amazon would replace Walgreens Boots Alliance in the Dow Jones Industrial Average next week. Amazon was up 0.8%, while Walgreens Boots Alliance shares slipped 2% HSBC — The U.S.-traded shares of the global bank fell more than 8% Wednesday after fourth-quarter results showed falling profit and revenue. HSBC also took a $3 billion charge on a write-down of its position in China-based Bank of Communications. Wingstop — The restaurant chain slipped 4% despite reporting fourth-quarter earnings and revenue that topped analysts’ estimates. However, total revenue growth came down for the fourth consecutive quarter. Wingstop guided for mid-single-digit domestic same-store sales growth for the full year. Beyond Meat — Shares fell more than 1% after the company announced that it is launching a new version of its plant-based burger in grocery stores this spring. The move aims to lure back consumers amid waning interest. The stock is down more than 20% this year. Wix.com — Shares jumped 8% after the website builder reported quarterly earnings and revenue that beat expectations. Wix.com reported fourth-quarter earnings of $1.22 per share, more than the consensus estimate from StreetAccount of earnings of 96 cents per share. Revenue of $403.8 million topped the expectation of $402.6 million. Garmin — Shares soared 11% after the company’s fourth-quarter earnings and revenue and its full-year forecast beat expectations. Garmin also increased its quarterly dividend and announced a $300 million stock repurchase plan. International Flavors & Fragrances — Shares dropped more than 8% after the food ingredients manufacturer’s fourth-quarter earnings missed estimates and it announced a dividend cut. Full year revenue estimates were also weaker than analysts expected. — CNBC’s Hakyung Kim, Michelle Fox, Lisa Kailai Han, Jesse Pound, Samantha Subin, Yun Li and Sarah Min contributed reporting.