Summer markets’ appear to have arrived, a time characterised by thin volumes, and relatively low volatility; characteristics that should allow markets to continue to take the ‘path of least resistance’, barring any unexpected exogenous shocks.

Without wishing to potentially jinx things, it would appear that ‘summer markets’ are now well and truly upon us.

Barring a brief bout of volatility stemming from end of month/quarter/half-year flows, market action of late has been akin to watching paint dry.

With the economic calendar remaining relatively barren until next Friday’s US jobs report – which, of course, coming a day after Independence Day, will drop when few participants are at their desks – this relative calm looks like it may persist for some time to come.

To put some figures with the above, implied vols across all major asset classes remain at incredibly low levels. The VIX continues to trade with a 12 handle, just inches above the cycle lows seen a couple of weeks ago, while BofAML’s MOVE index of Treasury vol also remains subdued, with similar cycle low, or near cycle low, levels of implied vol also being seen in both gold, and crude.

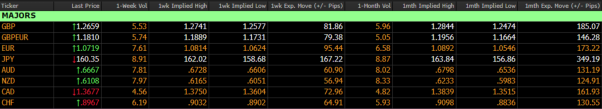

The FX market has, at the headline level, somewhat bucked this trend, with JPM’s global FX vol index trading at a 2-week high 7.65, not far off its highest levels this year. The vast majority, however, of this recent rise has stemmed from an increase in EUR vols, as a result of rising political uncertainty within the bloc. Elsewhere in G10, implieds remain below the 25th %ile of respective 52-week ranges.

Not only has implied vol fallen, but realised has also.

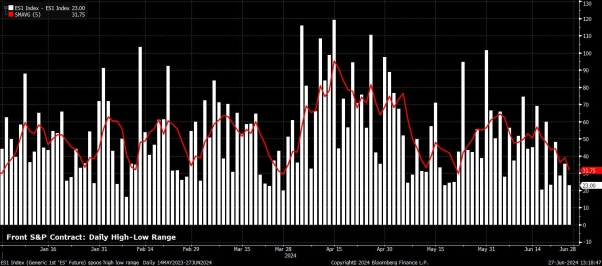

CBOE’s RVOL index, for example, trades at its lowest level of the year, and in fact its lowest since Fed Chair Powell’s dovish pivot last December. Meanwhile, the high-low daily range in the front S&P 500 future continues to tighten, with the 5-day moving average of said range now a meagre 31 points, the narrowest in about a month.

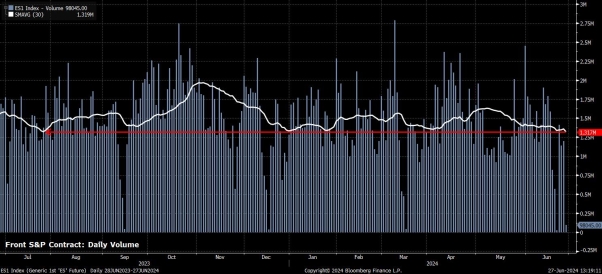

As implied and realised vol have declined, so have trading volumes.

In the front S&P 500 future, the 30-day average of daily volume now stands at around 1.3mln contracts, the lowest such level since last July. Similar is seen in the cash market, where daily volume is typically running at around 10-15% below the 20-day average.

Perhaps most importantly, this all begs the question of how market participants can adapt to these trading conditions, which – if recent years are anything to go by – are likely to persist until Labor Day in early-September.

Firstly, it’s important to recognise that while conditions may be quiet, and liquidity thinner than usual, this does not necessarily mean that markets will tread water the entire time. Were an unexpected headline, or vastly out-of-consensus data point, to cross news wires, the market reaction to said data is likely to be much more significant than in ‘typical’ times, owing to significantly fewer than usual participants engaging with markets. Naturally, proper risk management should become even more of a priority than usual in this sort of an environment.

Besides this, it is important to adapt one’s expectations for the degree of (or, lack of) market movement that is likely to be seen. Implied vols are of particular use here, given that one is able to extrapolate – to both one and two standard deviations of confidence – an asset’s likely trading range from said information. An example of this for FX majors, is below.

Overall, however, the lack of volatility, light volumes, and likely light news- and data-flow, should all combine to see markets continuing to take the ‘path of least resistance’ over the medium-term.

As has been the case for some time, said path continues to point to the upside for equities, albeit with the upcoming Q2 earnings season a risk, with growth remaining resilient, and the ‘Fed put’ set to provide additional support. Elsewhere, Treasuries seem likely to remain within a range until greater clarity on the timing of the first Fed cut is obtained, a base case which also applies to the dollar, as divergences between G10 central banks remain relatively narrow.