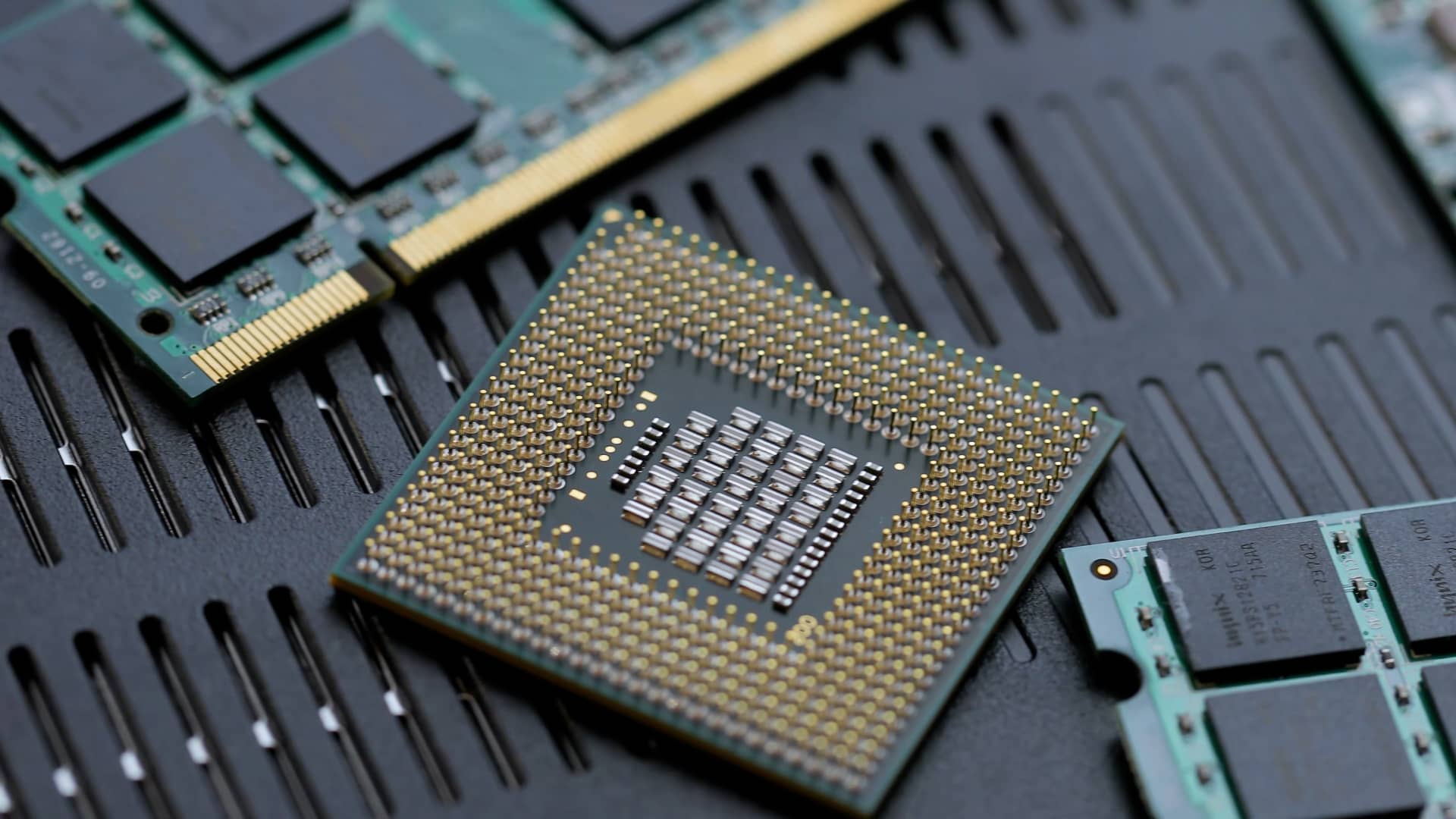

A chip made by Taiwan Semiconductor Manufacturing Company

TSMC

Taiwan, the world’s semiconductor powerhouse, is facing a power crunch — and this could spell trouble for chipmakers.

Manufacturing chips requires a lot of energy and electricity, and the government is struggling to meet the island’s energy needs.

“Concerns over potential power shortages and the deterioration of power quality and reliability could pose operational risks for the semiconductor industry,” Chen Jong-Shun, assistant research fellow at Chung-Hua Institution for Economic Research, told CNBC.

There were three major outages in Taiwan in the past seven years, and the island has experienced a slew of smaller disruptions in the past year.

As recently as April, in Northern Taiwan alone, multiple power shortages were recorded over three days, according to local reports.

In 2022, there were 313 power outage incidents. A big power outage that year affected more than 5 million households, while another massive blackout in 2017 hit almost 7 million households.

“Taiwan has both an energy crunch and, even more importantly, an electricity crunch,” said Joseph Webster, senior fellow at the Atlantic Council’s Global Energy Center.

Electricity squeeze

More than 97% of Taiwan’s energy needs are imported, and come primarily from coal and gas. The heavy reliance on other countries renders the island vulnerable to energy supply disruptions, experts told CNBC.

While the outages are partly due to an aging grid, the electricity crunch is largely the result of Taiwan’s underpriced electricity bills, which drives up demand and leads to supply shortfalls, Webster added.

While Taiwan recently hiked electricity rates by 15% for large industrial users, the rates for residential consumption remain unchanged.

Today’s electricity bills are cheaper than what they were 20 years ago, according to Taiwan’s Economic Ministry. Meanwhile, global commodity prices have soared.

As a result, Taiwan Power Company, or Taipower, has been racking up losses. The state-owned company reported a pre-tax loss of $6.3 billion in 2023, after an even bigger loss was recorded in 2022.

“Taipower has been losing money, which also raises concerns about potential power disruptions for both the semiconductor industry and the overall Taiwanese economy,” Michelle Brophy, director of research at market intelligence platform AlphaSense.

For one, with electricity prices rising for semiconductor firms, the higher costs are expected to be passed on to consumers, according to Brophy.

Chip giant Taiwan Semiconductor Manufacturing Company has disclosed it will will pass on cost increases to customers, in order to protect the company’s profit margin.

Implications for the chip sector

Taiwan’s industrial consumers accounted for over 55% of its electricity consumption in 2023, according to the Atlantic Council’s Webster. These consumers, including semiconductor firms, often require constant and reliable access to electricity.

“If Taiwan is forced to ration electricity more frequently in the future due to limited supplies, its semiconductor firms will suffer,” he added.

Any energy disruption will slow down chipmaking and raise global semiconductor prices, Webster said.

“Taiwan’s electricity crunch could throw a wrench in global semiconductor markets,” he said, adding that interruptions could reverberate across the global industry.

TSMC, the world’s largest manufacturer of advanced chips, accounts for about 60% of the global foundry revenue. The company is integral in the ongoing generative AI boom, and counts tech giants like Apple and Nvidia as clients.

The global semiconductor manufacturing industry is estimated to double its market size in revenue by 2030, and is poised to consume 237 terawatt hours (TWh) of electricity by then, a Greenpeace report said.

If Taiwan is forced to ration electricity more frequently in the future due to limited supplies, its semiconductor firms will suffer.

Joseph Webster

Atlantic Council’s Global Energy Center

Electricity consumption from Taiwan’s semiconductor manufacturing industry is set to increase 236% between 2021 and 2030, the same report found.

“The global electricity industry has been surprised by the pace and scale of electricity demand from artificial intelligence’s data centers,” said Webster, adding that Taiwan’s future electricity consumption is subject to “considerable uncertainty.”

Taiwan’s government plans electricity supply based on the needs of a few major companies, said Chen from Chung-Hua Institution.

Still, meeting Taiwan’s energy needs is an uphill task.

“Taiwan has struggled to meet its power infrastructure goals due to land constraints, overly ambitious and rigid policies, and a lack of understanding and ability to address power shortages,” Chen added

This raises further concerns among businesses about the reliability of future power supply commitments to major tech firms.

“Power is an ongoing issue in the sector,” especially due to Taiwan’s outsized influence on the semiconductor industry, said Brophy.