Tesla (TSLA) will release its Q3 2025 financial results on Wednesday, October 22, after the market closes. As usual, a conference call and Q&A with Tesla’s management are scheduled after the results.

Here, we’ll look at what the street and retail investors expect for the quarterly results.

Tesla Q3 2025 deliveries and energy deployment

Even though CEO Elon Musk and his loyal shareholders like to claim that Tesla is now an AI/Robotics company, the reality is that Tesla mostly moves metals.

The company’s automotive business continues to drive the vast majority of its financial performance.

Tesla’s revenue remains tied mainly to the number of vehicles it delivers.

Earlier this month, Tesla disclosed its Q3 2025 vehicle production and deliveries:

| Production | Deliveries | Subject to operating lease accounting | |

| Model 3/Y | 435,826 | 481,166 | 2% |

| Other Models | 11,624 | 15,933 | 7% |

| Total | 447,450 | 497,099 | 2% |

That’s a record number of vehicles delivered.

Furthermore, Tesla confirmed that it deployed 12.5 GWh of energy storage capacity during the quarter.

Those two record numbers combined should result in Tesla reporting higher revenues.

Tesla Q3 2025 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers and now the energy storage deployment data.

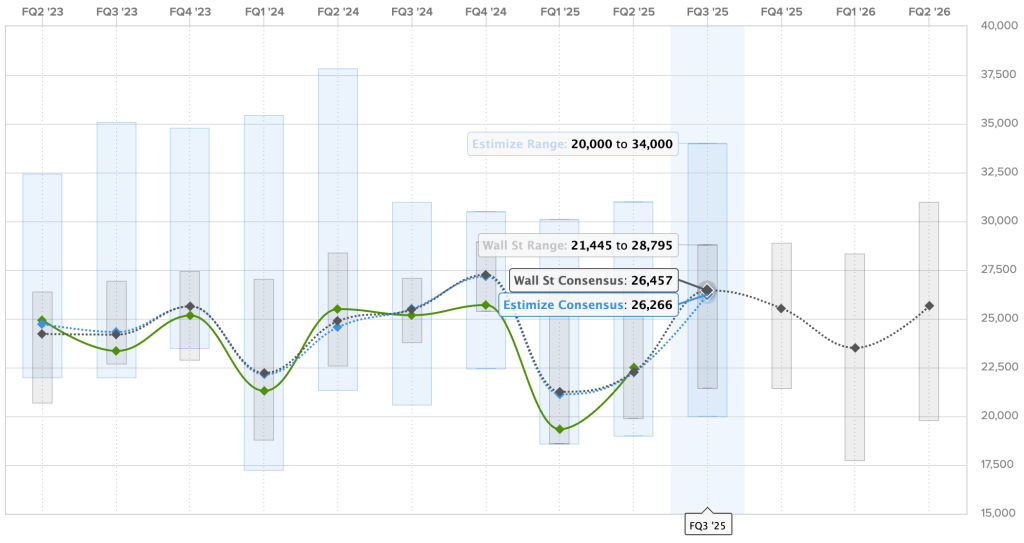

The Wall Street consensus for this quarter is $26.457 billion, and Estimize, the financial estimate crowdsourcing website, predicts a lower revenue of $26.266 billion.

Here are the predictions for Tesla’s revenue over the past two years, with Estimize predictions in blue, Wall Street consensus in gray, and actual results are in green:

If Tesla meets or beats expectations, it would report higher quarter revenue than ever before.

Tesla Q3 2025 earnings

Analysts are trying to estimate Tesla’s gross margin with a first positive reversal in deliveries this year.

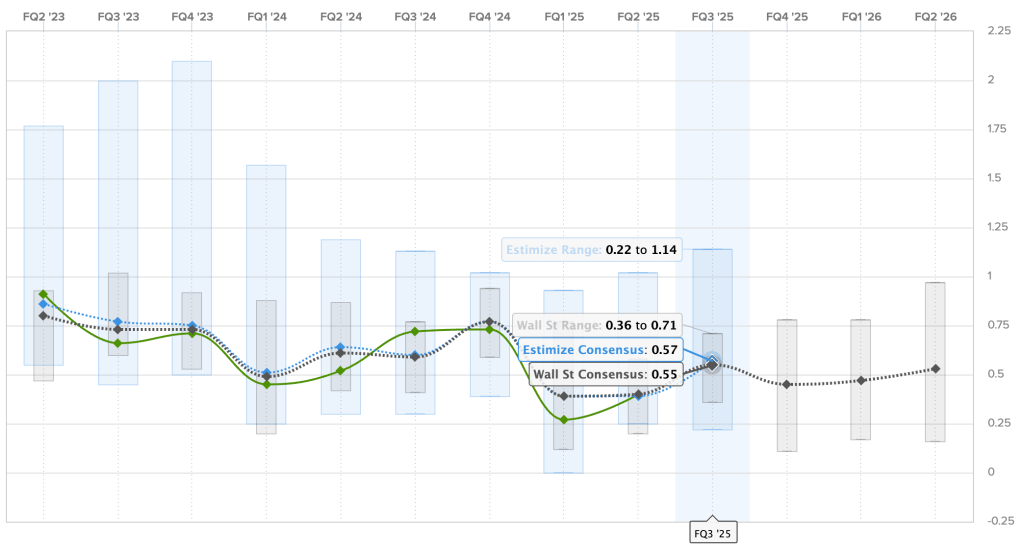

For Q3 2025, the Wall Street consensus is a gain of $0.55 per share and Estimize’s crowdsourced prediction is a little higher at $0.57.

Here are the earnings per share over the last two years, where Estimize predictions are in blue, Wall Street consensus is in gray, and actual results are in green:

As you can see, Tesla’s estimated record revenue is not expected to translate into record earnings, as the company has reduced prices in response to increased competition.

Tesla reported earnings of $072 per share during the same period last year.

In short, analysts are expecting Tesla’s earnings downtrend to continue despite record revenues.

Other expectations for the TSLA shareholder’s letter, analyst call, and special ‘company update’

I think we should expect a very bullish management call in Q3. We have been reporting on this for a few months on Electrek, but Tesla pushed its shareholders meeting, which is generally held in the summer, to the first week of November for good reason.

Tesla knew that the end of the tax credit would result in demand being pulled forward into Q3, leading to a strong Q3. Even though it will mean a few very difficult quarters afterward, the company will take the time to boast about it just before shareholders vote on management through Musk’s compensation package and a few board seats in two weeks.

However, I would also expect Wall Street analysts to ask a few questions about how Tesla is expected to perform in the next few quarters, given the incentives and credits in the US.

Tesla will also take questions from retail shareholders based on the most popular ones on Say. Here are the top 5 questions and my thoughts on them:

- What are the latest Robotaxi metrics (fleet size, cumulative miles, rides completed, intervention rates), and when will safety drivers be removed? What are the obstacles still preventing unsupervised FSD from being deployed to customer vehicles?

- Musk has been wrong about self-driving timelines for a decade now, and he manages to get away with it thanks to a very lenient shareholder base that likes it when he pumps up the stock with hyperbole and crazy predictions.

However, the shorter the timeline, the harder it is to let this slide. Musk said that Tesla Robotaxi would cover half the US, and it would remove supervisors by the end of the year.

The only way this is possible is if “Robotaxi” is what Tesla launched in the Bay Area, meaning Tesla employees in the driver’s seat using FSD. If Tesla does remove the supervisor, I believe it will only be in Austin and with a lot of limitations and remote monitoring.

- Musk has been wrong about self-driving timelines for a decade now, and he manages to get away with it thanks to a very lenient shareholder base that likes it when he pumps up the stock with hyperbole and crazy predictions.

- What is demand / backlog for Megapack, Powerwall, Solar, or energy storage systems? With the current AI boom, is Tesla planning to supply power to other hyperscalers?

- I think people should expect Tesla’s growth in the energy sector to slow and stabilize at around 18 GWh next year, which is still impressive, by the way.

- What are the plans for new car models? Will Tesla build compact car models leveraging the unboxed Cybercab platform? Will Tesla build a traditional SUV and pickup truck in the Cybertruck platform?

- Generally, Tesla doesn’t answer those kind of questions during an earnings call, but I think management will try to pump the best they can ahead of the shareholders meeting.

Furthermore, after the flop that was the stripped-down Model Y and Model 3, I wouldn’t be shocked if Tesla revives plan for the compact car even though Musk poo-pooed it quite a bit over the last year.

- Generally, Tesla doesn’t answer those kind of questions during an earnings call, but I think management will try to pump the best they can ahead of the shareholders meeting.

- What are the present challenges in bringing Optimus to market considering app control software, engineering hardware, training general mobility models, training task specific models, training voice models, implementing manufacturing, and establishing supply chains?

- As we have been reporting for the last few months, the Optimus program is in shambles. I expect Musk to confirm delays in the production ramp. He previously said that Tesla would build about 5,000 Optimus robots in 2025. I think he will delay that, but he will reiterate some ridiculous long-term goals.

- What is your projection for when FSD will allow for unsupervised driving?

- He literally said by the end of the year a few months ago. He said that every year for the last 6 years. I don’t know why anyone cares to have his opinion on it at this point.

As you can see, most questions from retail investors concern Tesla’s future products and Elon’s predictions about their impact.

Meanwhile, earnings are declining because Tesla’s once-incredible core business of selling cars is rapidly deteriorating.

Tune in with Electrek after market close today to get all the latest news from Tesla’s earnings, conference call, and now also an apparent “company update.”

FTC: We use income earning auto affiliate links. More.

![Genesis GV90 gets the royal green treatment in latest appearance [Images] Genesis GV90 gets the royal green treatment in latest appearance [Images]](https://i0.wp.com/electrek.co/wp-content/uploads/sites/3/2026/02/Genesis-GV90-green-EV.jpeg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Hyundai has a new baby EV in the works: Is this our first look at the IONIQ 1? [Images] Hyundai has a new baby EV in the works: Is this our first look at the IONIQ 1? [Images]](https://i0.wp.com/electrek.co/wp-content/uploads/sites/3/2026/02/Hyundai-IONIQ-1-EV-front.jpeg?resize=1200%2C628&quality=82&strip=all&ssl=1)