Tesla’s little-known Autobidder product has already made over $330 million for energy investors.

Electrek was the first to report on Tesla’s Autobidder platform back in 2020.

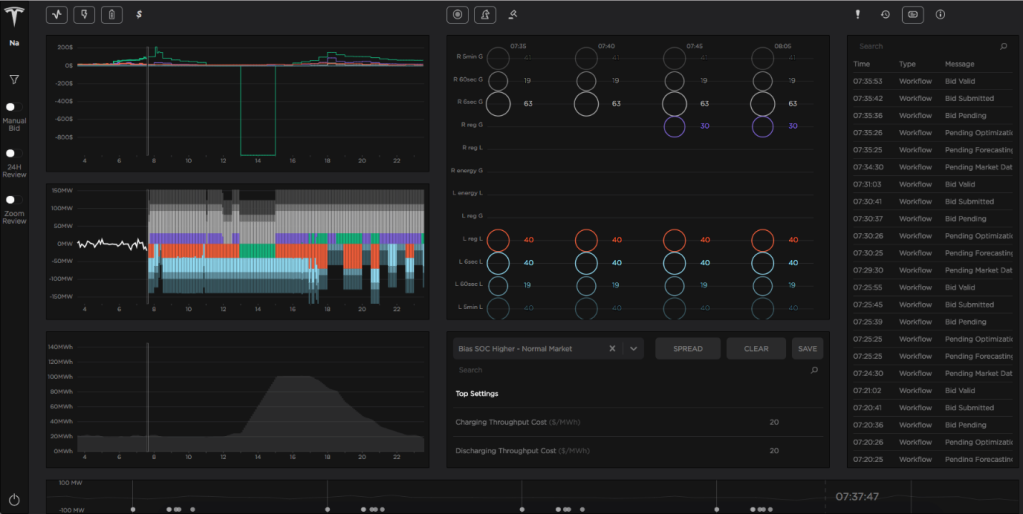

It’s a real-time trading and control platform for energy assets, like Tesla’s Powerpacks, Powerwalls, and Megapacks, optimized through machine learning to better use and more directly monetize the assets.

Tesla describes the platform:

Autobidder provides independent power producers, utilities and capital partners the ability to autonomously monetize battery assets. Autobidder is a real-time trading and control platform that provides value-based asset management and portfolio optimization, enabling owners and operators to configure operational strategies that maximize revenue according to their business objectives and risk preferences.

The company has made the platform available to owners of its energy storage products.

In 2021, we reported that over 1.2 GWh of energy storage was under management by Autobidder.

Two years later, Rohan Ma, Tesla’s lead on Autobidder and other energy optimization products, has updated the figure in a LinkedIn post – confirming that Autobidder’s portfolio has grown to 7 GWh.

He also confirmed that the platform already made over $330 million in trading profits for the users:

“Autobidder has grown its global portfolio to over 7GWh of battery storage under direct dispatch next year, and our real-time algorithms have already returned over $330 million in trading profit to early storage investors.”

That’s an impressive amount of energy capacity and profits in a relatively short amount of time for a brand-new product.

As we previously reported, Tesla’s Autobidder, combined with its energy storage products, has made electric utilities nervous as it is “changing the game” – a game that they have had complete control over for a long time.

But more recently, to not be left behind, electric utilities have themselves been investing more into energy storage products at scale, including using Tesla’s Megapack.

Electrek recently reported that Tesla has a roughly two-year backlog of Megapack orders despite ramping up production of the utility-scale battery system.

FTC: We use income earning auto affiliate links. More.