A significant part of Tesla’s growth in gross profit last quarter came from an increase in profits from servicing Tesla’s vehicles and selling energy through its Supercharger network – things Elon Musk said Tesla wouldn’t aim to make profits from.

Back in 2016, Elon Musk was quoted saying this at a Tesla event when defending the automaker’s strategy to operate its own service centers rather than using dealerships:

Our philosophy with respect to service is not to make a profit from service. I think that it’s terrible to make a profit on service.

Musk often criticized other automakers, specifically GM, for selling “cars that then need service” at dealerships and then making a lot of profits selling replacement parts to customers through those dealerships.

The CEO is often quoted saying, “The best service is no service,” and Tesla aims to improve service by increasing the reliability of its vehicles, resulting in less need for service.

Reality is quite different. Tesla owners are often experiencing long wait times to get service appointments at Tesla and how the automaker plans to address this situation was a top question during Tesla’s earnings call yesterday.

As for the Supercharger network, Musk also said that it would “never become a profit center” for Tesla.

The CEO always said that the goal was of the charging network was to be a service for Tesla owners, and now non-Tesla owners, with the goal of revinesting revenue into growing the capacity of the network.

Tesla’s reality is changing

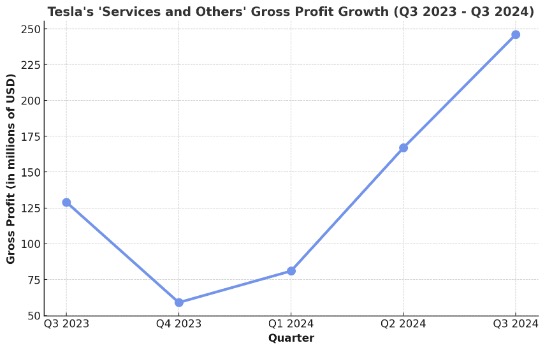

Over the last two quarters, Tesla’s profits from “services and others” have surged.

For the last few years, Tesla’s services and others were only marginally profitable, which was in line with Musk’s previously stated strategy on that front, but something has changed.

With Tesla’s Q3 2024 financial results, the automaker that “services and others” gross profits jumped to almost $250 million – a 90% increase year-over-year:

Tesla is one of the most opaque automakers when it comes to breaking down its financials. It bundles many things into “services and others, ” making it hard to know exactly what is going on inside.

The bulk of that accounting line has historically been car service and used car sales, but in Tesla’s latest financial results, which saw an important increase in profits for “services and others”, the automaker confirmed that the surge was specifically due to its Supercharger network and service margins:

The Services and Other business achieved a record gross profit in Q3, growing over 90% year-on-year. Sequential growth in gross profit was driven mostly by higher gross profit generation from supercharging, service center margin improvement and higher gross profit generation from Parts Sales and Merchandise.

Now at $~250 million, it’s still a small part of Tesla’s overall gross profits, but it does account for a significant part of the ~$800 million increase in gross profits compared to last year.

Electrek’s Take

This is something that irritates me personally because I’ve used those quotes from Elon about service to counter the hesitation of many potential Tesla buyers regarding the maintenance and service of electric vehicles.

Elon’s statement reassured them, but if that was ever really the plan, it certainly isn’t anymore based on the latest results.

Tesla’s gross margins for service and selling replacement parts are surging, and Tesla is proudly saying it in its financial results.

Myself, I have two Tesla vehicles that need service right now and Tesla is trying to sell me very expensive parts.

As for Supercharger, prices are going up.

To be fair, Tesla making money on the Supercharger network is quite new and the company is just starting to sell more charging to non-Tesla EVs. It’s very possible that Tesla might need to adjust to keep the Supercharger just marginally profitable.

It’s just the fact that Tesla writes “sequential growth in gross profit was driven mostly by higher gross profit generation from supercharging,” it’s not super encouraging.

But in the meantime, some Supercharger stations are getting quite expensive. Hopefully, Tesla gets those prices into control