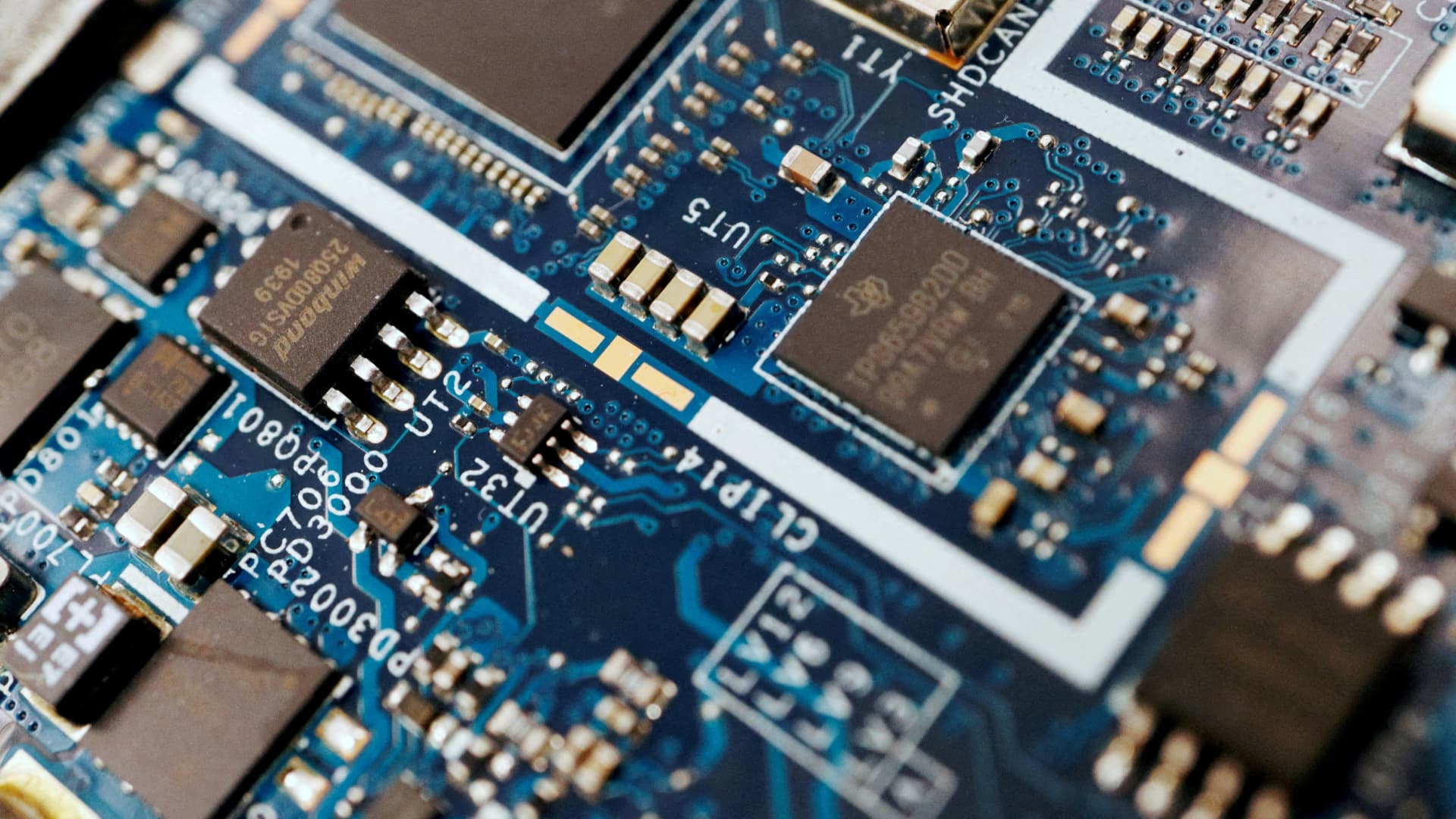

China is starting to show what sway it has in the semiconductor supply chain, and stocks are only starting to react. Yunnan Lincang Xinyuan Germanium Industrial’s shares rose by more than 30% over the past five trading days. About a week ago on July 3 , China’s Commerce Ministry announced export restrictions on germanium and gallium would take effect on Aug. 1. The two metals, which China produces most of the world’s supply of, are used in the manufacture of chips, fiber optics or solar panels. A significant amount goes overseas. Between 2018 and 2021, just over half of U.S. imports of the metals came from China, according to the U.S. Geological Survey. On the Shenzhen stock exchange, Yunnan Germanium shares hit the 10% upper trading limit for three days straight. That’s despite the company warning on day three of a loss in the first half of the year. It’s a signal of the growth potential in some Chinese chip subsectors once investors catch on, or new export rules come into play. And it’s those materials in the upstream part of the semiconductor supply chain that early-stage investment firm WestSummit Capital Management is looking for opportunities, said managing director Bo Du. “In China, firms are making more money from investing in the supply chain, not in artificial intelligence,” Du said in Mandarin, translated by CNBC. He pointed out that the supply of high-end chips needed to power AI training models are more sensitive to U.S. restrictions, while there’s a greater market for less advanced chips — found in products used day-to-day. For that category of “mature” chips, Du expects China can build up its own production equipment and materials in about two to three years. WestSummit claims about 20 billion yuan ($2.77 billion) in assets under management. Du said valuations of chip-related deals in China’s primary market have fallen recently, and that the firm is looking to invest more in the sector through the end of the third quarter. China’s latest export curbs follow sweeping U.S. export restrictions in October to limit Chinese businesses’ access to advanced semiconductor technology. Other than a few companies, there’s “no real impact on the business for most of the semiconductor companies either for China or the U.S.,” said Greg Ye, co-founder and managing partner of Delta Capital, which claims about 7 billion yuan in assets under management. “The real impact is really on the psychology of some investors,” Ye said in an interview last month. “This scares some investors away. Many of them are coming back to the sector.” One of Delta’s investments, Shanghai New Vision Microelectronics, raised just over 1 billion yuan in an initial public offering on Shanghai’s Star board on June 1. Shares of the company, which produces chips for screen display, are up by about 55% from the IPO price. More export controls ahead? The political environment indicates China may hunker down on its chip capabilities. The latest export controls are just the beginning , Wei Jianguo, a former vice minister of commerce, told state media in a report Wednesday. Wei didn’t respond to a CNBC request for further comment. “It’s not unreasonable to think that many China hawks in Washington are looking at Beijing’s gallium and germanium export restrictions as an aggressive move that warrants even stronger tech export restrictions on chips, chipmaking equipment, chip design, and renewed calls to pull out manufacturing,” said Brian Tycangco, analyst at Stansberry Research. That could prompt Beijing to respond with more restrictions, he said. “As a result, I don’t think we’ve seen the end of the surge in the rare earth space,” Tycangco said. “There’s still something brewing underneath the surface.” He said notable names in the sector traded outside of mainland China include Lynas Rare Earths, MP Materials and China Rare Earth Holdings.