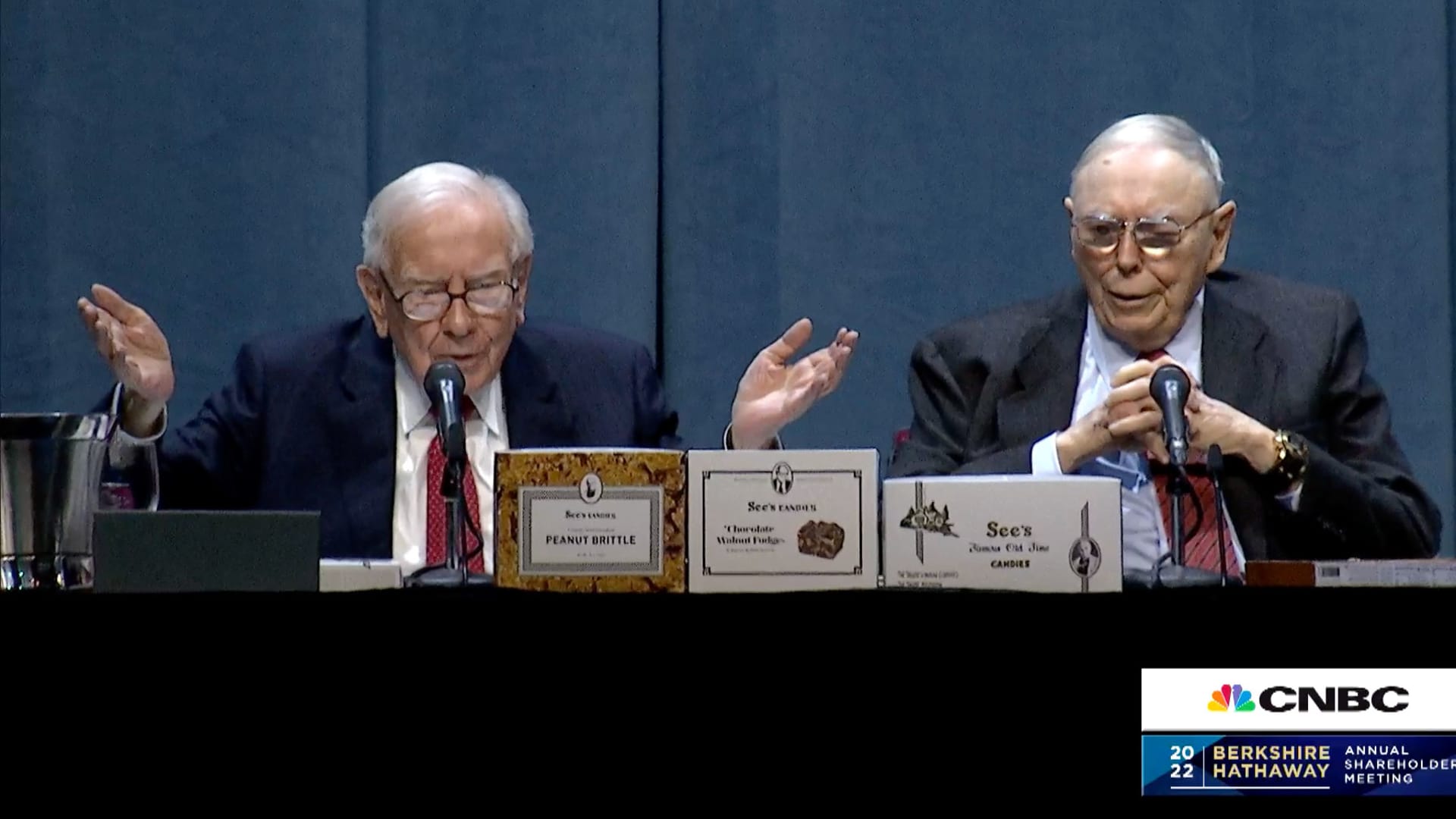

The race for eyeballs continues to intensify in the streaming industry, and according to Warren Buffett it’s a particularly tough area for investors to make money. Buffett, the “Oracle of Omaha,” believes that the industry has too many players seeking viewer dollars, causing a stiff price war. Meanwhile, there is a finite number of subscribers that all of these streamers try to compete for. “You need higher prices, or it doesn’t work,” Buffett said at Berkshire’s 2023 annual meeting. “You’ve got a bunch of companies that don’t want to quit. And who knows what pricing does under that. But anybody who tells you that they know what pricing will do in the future is kidding themselves.” Warner Bros. Discovery earlier this week reported a decline in advertising revenue, a wider-than-expected loss and lackluster streaming subscriber numbers. CEO David Zaslav called streaming a “generational disruption,” saying it’s very difficult for his company to go on offense when its streaming service is losing billions of dollars. “You don’t lock in people when you get them to join up for the streaming period when your serial runs,” Buffett said. “The eyeballs aren’t going to increase dramatically and the time they can spend is not going to increase dramatically.” Buffett said the price war going on among streamers was similar to the one he experienced in his early 20s at his local gasoline station. There was one competitor a few miles away, and the two gas stations benchmarked the gas prices based on each other’s offering. “He determined our profit, because we looked at his price every day. And if we cut the price he’d match it, and we couldn’t raise the price. And he did twice the gallonage, so he won,” Buffett said. “There’s just basic business problems that you see with certain industries that you don’t see with the other.” The Berkshire Chairman and CEO said the talent and the agents tend to make big bucks in the entertainment industry, instead of distributors who have to keep up with the supply. Still, it’s not all bad news for the industry as of late. Paramount and Netflix both recently reported stronger-than-expected earnings. Netflix posted a boost in subscriber growth, and is raising prices for its plans. Berkshire is actually Paramount’s biggest institutional investor with a stake of 15.4%, according to FactSet. The conglomerate initially took the stake in the first quarter of 2022. It was unclear if it was Buffett or one of his investing managers who bought the stock. They could also be betting on Paramount being an acquisition target.