The US failing to raise the debt ceiling and defaulting on its financial obligations would be the “ultimate gift” for China, affirms the CEO and founder of deVere Group, one of the world’s largest independent financial advisory, asset management and fintech organisations.

Nigel Green’s comments come as President Joe Biden, House Speaker Kevin McCarthy and other congressional leaders are planning to meet Tuesday to discuss budget negotiations to avoid what could be an unprecedented default that would rock the global financial system.

Biden has been reluctant to give details about terms of the negotiation but said at the weekend that he believed a deal could be reached.

The standoff is down to Democrats demanding a “clean” increase without conditions to pay debts resulting from spending and tax cuts approved by Congress. Meanwhile, Republicans are saying they will not authorise any additional borrowing without an agreement to cut spending.

According to the Treasury, the US may default as soon as June 1, causing a global economic catastrophe, if the limit is not raised by Congress before then.

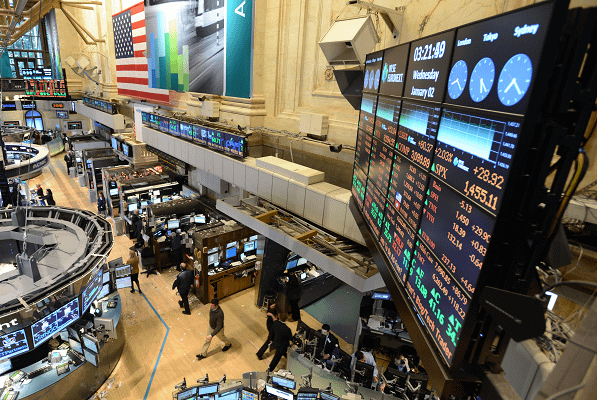

The deVere Group CEO says: “A default would upend the global financial system and would likely be worse than the 2008 crash.

“It would cause upheaval on an unprecedented level. However, there would be a major beneficiary of the economic and financial fallout: China.”

He continues: “The US failing to raise the debt ceiling and defaulting on its financial obligations would be the ultimate gift for China as it seeks global economic and financial dominance.

“A default would lead to a decline in the value of the US dollar and a loss of confidence in the US financial system. As such, investors would seek alternative destinations for their capital.

“China would move to position itself as a more stable and attractive investment option, attracting more international investment and capital inflows. In turn, this would boost the Chinese economy and financial markets.”

If Congress is unable to agree and raise the debt ceiling there would be a depreciation of US asset prices, including real estate, companies, and infrastructure. “China, with its significant foreign exchange reserves, would likely take advantage of the situation by purchasing these assets at discounted prices.

“Beijing would, we expect, acquire strategic assets in sectors like technology, energy, or manufacturing, which could enhance its economic and technological capabilities.”

The strengthening of the yuan’s position would also be a major advantage for China, notes Nigel Green. “The US dollar’s status as the world’s primary reserve currency could be undermined in the event of a default. This would be an opportunity for China to promote the internationalisation of its own currency.”

Beijing has been pushing for the use of the yuan in global trade, investment, and as a reserve currency, aiming to reduce reliance on the US dollar and enhance the influence of its currency – and a default would be a huge help for China in this regard.

Last week, in a media statement, the deVere CEO said that even if there is a last-minute agreement and a default is diverted, the drama will have eroded some of the current global reserve currency’s credibility and reputation as a ‘safety asset’.

“In addition, we expect that China would seize the opportunity to strengthen its trade partnerships with other countries, offering more attractive trade terms and position itself as a reliable trading partner. This could lead to increased market access and trade opportunities for Chinese firms.”

Nigel Green concludes: “Whatever happens in debt ceiling talks this week between Democrats and Republicans, China’s massive PR machine is already spinning the narrative that the US is a declining power.”