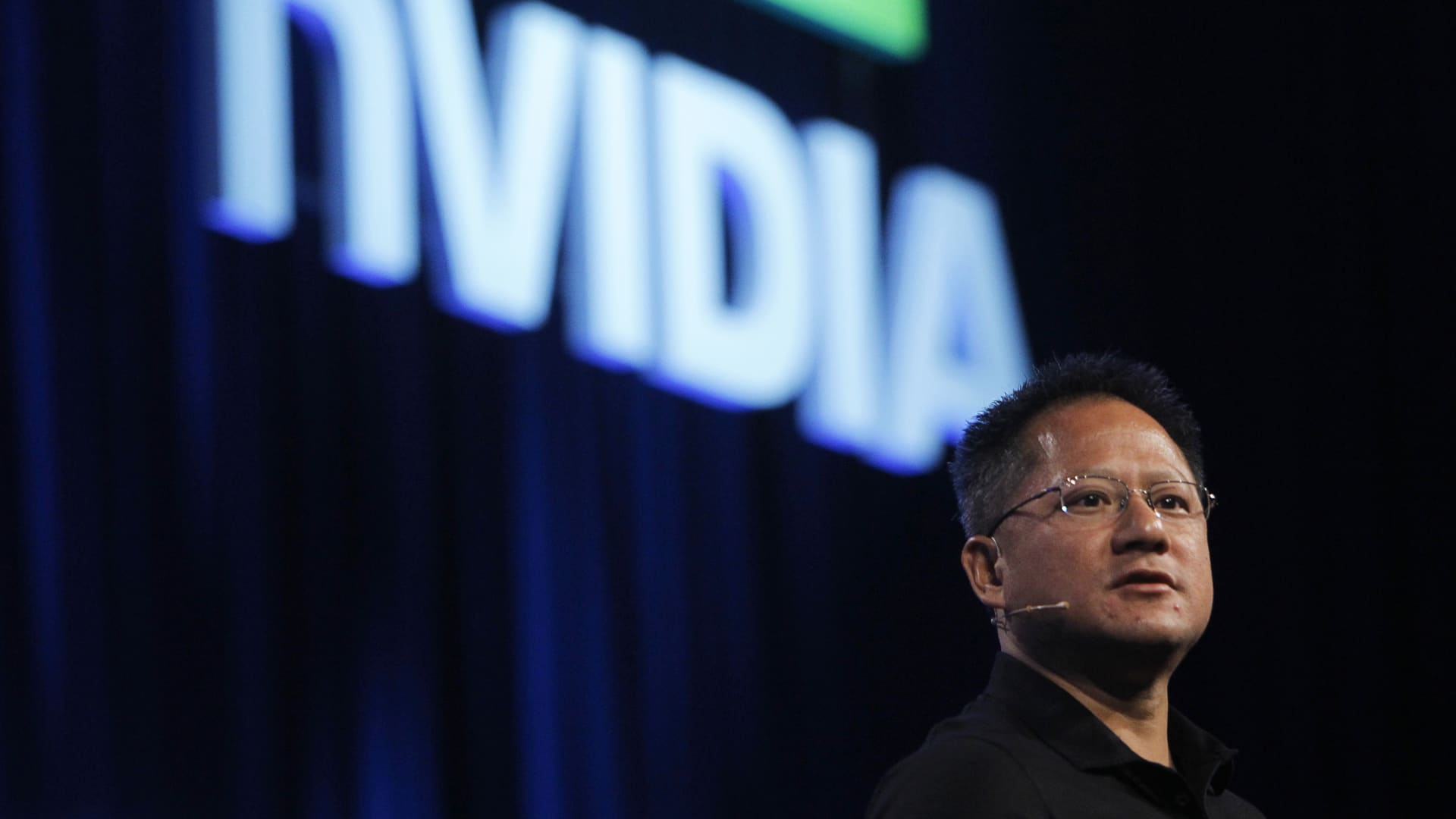

Investors are watching Nvidia as the chip giant prepares to issue earnings, but it’s not the only name worth buying ahead of results, Bank of America says. The firm said there’s still a slew of top companies that have yet to deliver quarterly reports. CNBC Pro combed through Bank of America research to find attractive stocks heading into earnings. The firm rates all of the names below as buy. They include Arista Networks, Penn Entertainment , Nvidia , Global Payments and Sweetgreen. Global Payments Analyst Jason Kupferberg is doubling down on shares of the payment processing company heading into earnings on Feb. 14 . The stock remains undervalued and underappreciated, but Kupferberg said he sees a unique buying opportunity for patient investors. Global Payments has a “competitive differentiation” with a “sizeable portfolio of owned software assets in select verticals,” according to the firm. Meanwhile, Kupferberg remains bullish on management changes announced in 2023, noting a “conservative approach to earnings, which we believe would be welcomed by [the] Street.” The company also has an upcoming analyst day that should serve as a positive catalyst for the stock, he added. With shares up 7% this year, Kupferberg said he’s standing by the stock. “GPN was a top pick in our Year Ahead ’24 report given its growth profile, competitive position, and attractive valuation,” he added. Arista Networks Even in a “weak environment,” Arista is a poised to be a standout, according to analyst Tal Liani. The cloud-networking company entered the year with some uncertainty, but the outlook has improved following strong capex commentary from the likes of Microsoft and Amazon, he said. In fact, Arista might be the right stock at the right time with consensus estimates seemingly too low, Liani said. “Arista is the only Buy-rated stock in our Networking universe,” he said, due to its cloud and artificial intelligence exposure. Liani also raised his price target to $305 per share from $265. “We remain positive on management’s ability to execute, the company’s technological differentiation, product positioning, and its TAM [total addressable market] growing to $47bn by 2025,” he said. Arista shares are up about 20% this year, and the company is scheduled to report quarterly earnings on Feb. 12 . Penn Entertainment Buy the dip in shares of Penn, analyst Shaun Kelley said recently. The firm said expectations remain muted for shares of the gambling company and that’s not necessarily a bad thing, he wrote. Kelley remains bullish on Penn’s sportsbook deal with ESPN, which is known as ESPN Bet . “If executed well, we still think integrations between ESPN’s media app and ESPN Bet could drive sustainable high-single-digit market share,” he said. Penn is also undergoing a series of management changes in its interactive division, which Kelley sees as a long-term positive for shares. “The next catalysts for PENN include new interactive leadership which could be announced in the next few weeks, and Q4 earnings on February 15 ,” he wrote. Shares of the company are down 10% this year, but Kelley urged investors to remain calm. “We are Buy rated on PENN given stable regional gaming trends and upside opportunity from ESPN Bet,” Kelley wrote. Sweetgreen “Sweetgreen is a digitally native, high growth fast casual concept with a distinct urban core market. Based on our saturation analysis, we see potential for SG to achieve its 1,000 LT store growth target. SG has high unit-level returns (40% in Yr-2) and store productivity (over $1,000/sq ft). We see upside to unit economics as SG continues to leverage investments in labor optimization technology (including automation).” Nvidia “AI demand in infancy, becoming essential to operations. … Expect NVDA to maintain dominance in AI inference also. … Enterprise genAI adoption has yet to kick off and become more material in CY25, with NVDA benefitting from its widespread availability on public clouds & unique partnerships with NOW, SAP, VMWare, Dell, HPE & others. … NVDA is one the rare large-cap tech stocks trading at 31x/25x CY24/25E PE, below its 45% CY23-25E EPS CAGR.” Penn Entertainment “After the close, Penn Ent. announced a leadership change in its Interactive division. … While disappointing at face, turnarounds are never a straight line and we think investor expectations for PENN & ESPN Bet remain low. The next catalysts for PENN include new interactive leadership which could be announced in the next few weeks, and Q4 earnings on February 15. … We are Buy rated on PENN given stable regional gaming trends and upside opportunity from ESPN Bet.” Arista Networks “Peer results signal a weak environment … Arista is the only Buy-rated stock in our Networking universe,. … Street expectations are low, with comps easing in 2H24. … We remain positive on management’s ability to execute, the company’s technological differentiation, product positioning, and its TAM [total addressable management] growing to $47bn by 2025.” Global Payments “We believe that GPN’s technology-led offerings & distribution, sizeable portfolio of owned software assets in select verticals, & a high concentration of more lucrative SMB volume represents a source of competitive differentiation. … GPN was a top pick in our Year Ahead ’24 report given its growth profile, competitive position, and attractive valuation of 11.4x ’24 P/E. … For initial ’24 guide, we expect new CEO to take a conservative approach, which we believe would be welcomed by Street.”