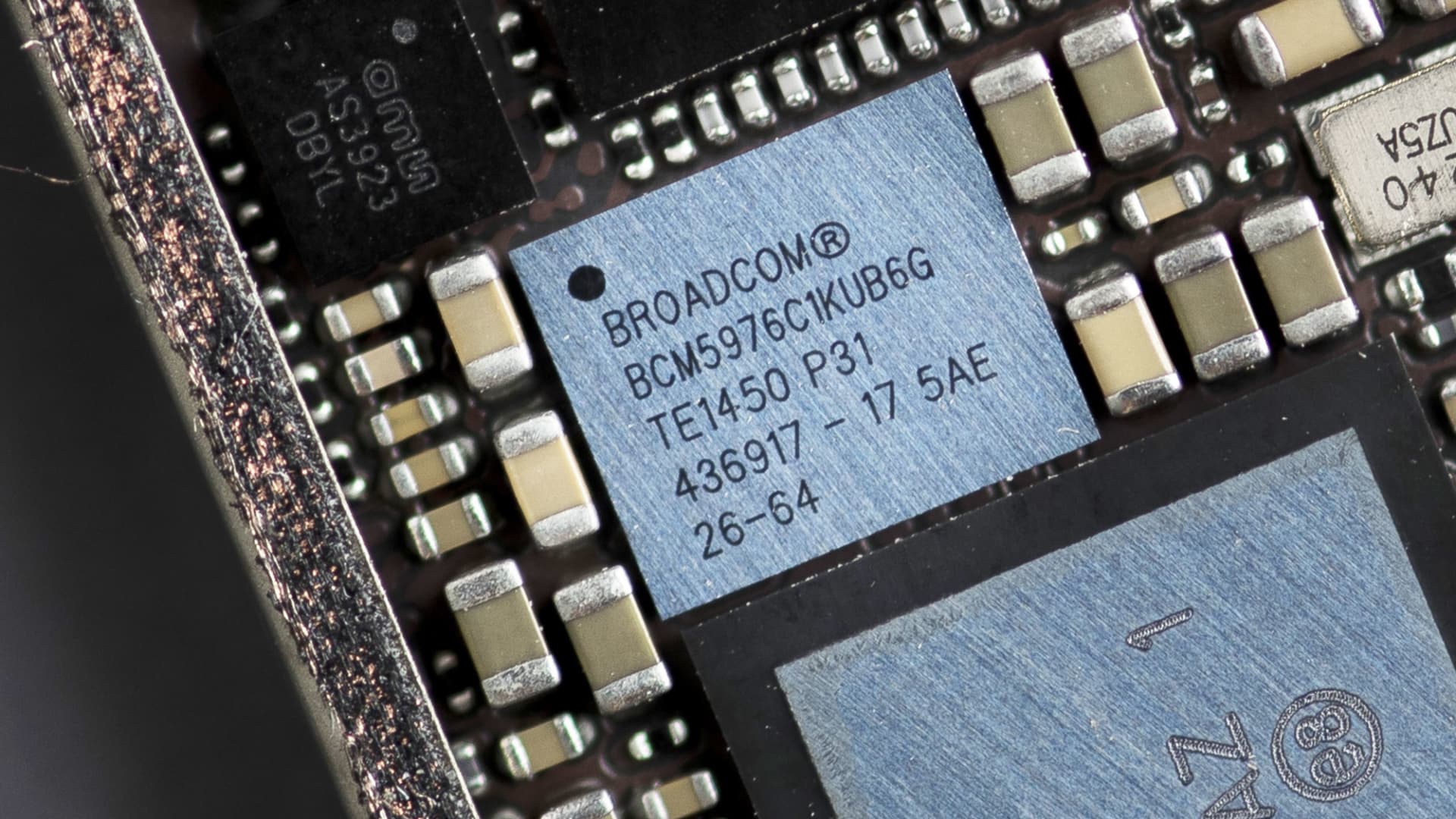

Goldman Sachs says its new stock basket has outperformed the market over the last 20 years. The firm’s portfolio strategy desk recently introduced two new baskets based on corporate asset intensity, which was defined as “the ratio of assets, less cash and intangibles, to revenues.” Asset-light stocks can be thought of as “lean” companies — having few assets, but strong growth. The asset-light stocks had a ratio of 0.3, and the asset-heavy group had a ratio of 1.5. Each basket contains 50 stocks drawn from the S & P 500, but are sector-neutral to one another. By backtesting the baskets, Goldman found that the asset-light cohort has outperformed the high-asset intensity group since 2002 by 40 percentage points. “Superior return on equity (22% vs. 15%) helps to explain this long-term outperformance. During the same period, S & P 500 capex as a share of total cash use has declined from 46% to 29%,” strategist Jenny Ma wrote in a note on Feb. 28. To be sure, Ma said the asset-heavy class could potentially outperform by around 100 basis points over the next 12 months as the cost of capital falls. Greater-than-expected capital expenditures would also be a tailwind for the asset-heavy class, Ma added. Take a look at some of the lean stocks that made Goldman’s screener, and where analysts see them headed next. Semiconductor giant Nvidia has an asset intensity ratio of just 0.5, according to Goldman. Nvidia has the highest year-to-date return on the list, at 73.1%, as well as the largest market cap. The consensus 2024 earnings per share growth for Nvidia is 87%, the firm says. Wall Street remains bullish on the stock; 51 out of 55 analysts covering Nvidia have issued either a buy or strong buy rating, per LSEG data. However, the average price target implies share prices are at their peak. NVDA 1Y mountain Nvidia shares over the last year Another chipmaker in the basket is Broadcom . Shares are up 27% in 2024. The stock has a calculated asset intensity ratio of 0.3, and consensus earnings per share growth this year is expected to be a 19% jump from 2023. The majority of analysts covering the stock also give it a strong buy or buy rating, according to LSEG. However, Wall Street’s average price target suggests shares are due for nearly a 13% pullback from their current levels. Online dating platform operator Match Group is another asset-light company featured. Shares are down 4% in 2024 and more than 11% over the last 12 months, but analysts surveyed by LSEG believe the stock could rally 25.5%. Match Group has a 0.3 asset intensity ratio. Live Nation Entertainment is a lean company that has outperformed in the last 12 months, surging 36%. Average per-share 2024 earnings estimates predict a 44% climb year-over-year, per Goldman. The company has an asset intensity ratio of 0.4. All but two of the 19 analysts who cover Live Nation rate it a strong buy or buy, per LSEG. The stock could continue its gains and rise an additional 18.3%, its average price target suggests. LYV 1Y mountain Live Nation shares over the last 12 months On the other hand, some asset-heavy companies in the S & P 500 include chipmakers Micron Technology , Intel and On Semiconductor . Telecommunication services names AT & T , Verizon and T-Mobile were also featured. —CNBC’s Michael Bloom contributed to this report.