Nvidia shares hit a fresh all-time high today, and its gains may still be in the early innings, according to VanEck CEO Jan van Eck.

Van Eck, whose firm runs the largest U.S. semi exchange-traded fund, points to a first-mover edge in the race to fabricate artificial intelligence chips that could bolster the performance of stocks including Nvidia.

“It’s just that these companies have huge competitive advantages, almost quasi-monopolies,” he told CNBC’s “ETF Edge” on Monday.

Nvidia is up 216% over the past year and 41% since Jan. 1, as of Wednesday’s close.

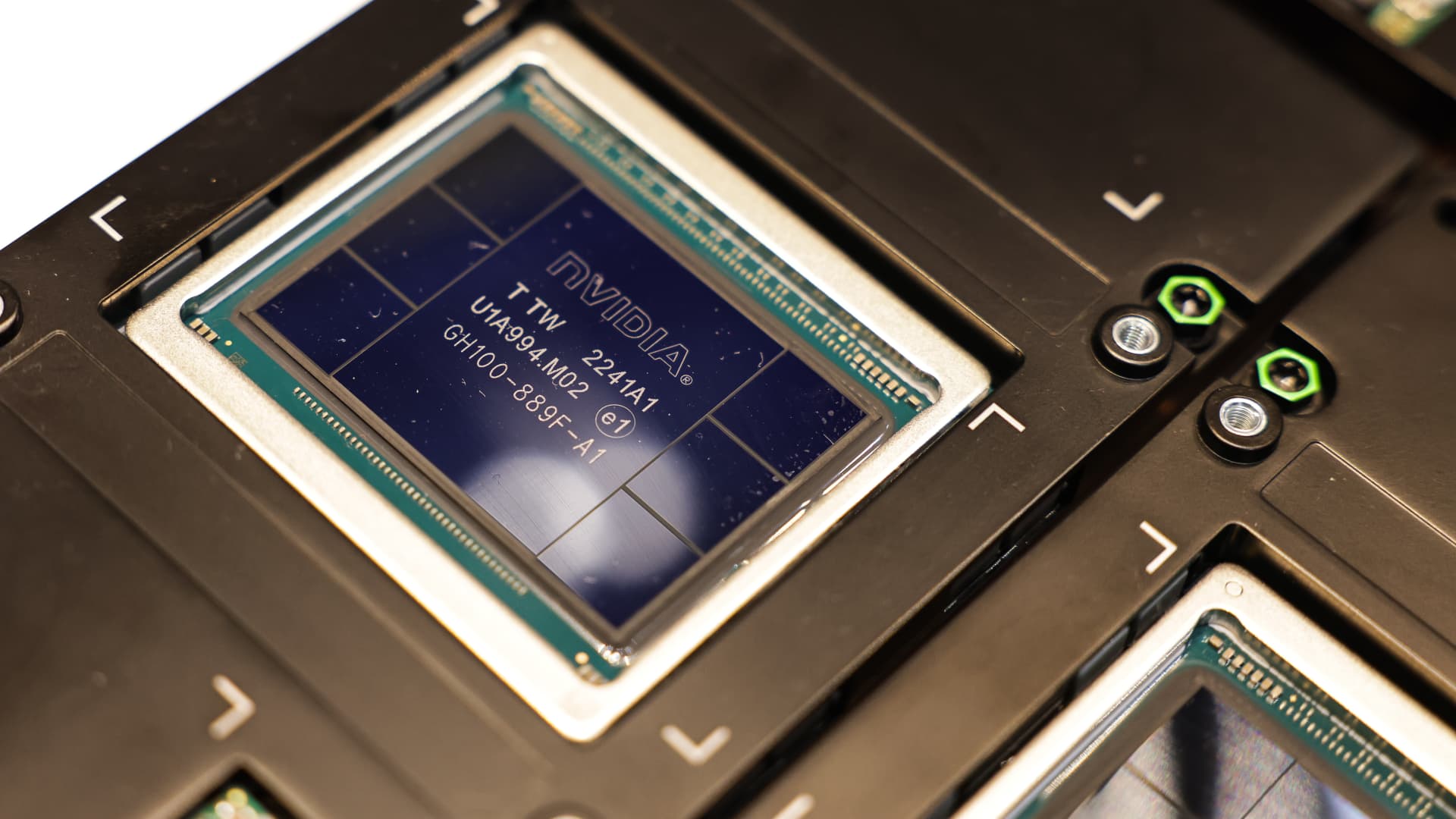

“Who competes against Nvidia for GPUs [graphics processing units]?” he questioned. “They’ve got great pricing power. They’ve got AI.”

Nvidia is the VanEck Semiconductor ETF‘s top holding. The fund tracks 25 of the largest semiconductor companies weighted by market cap. According to FactSet, Nvidia accounts for almost a quarter of the fund’s assets.

“[Nvidia’s] lead is so big,” van Eck added. “The return on equity is huge.”

He suggests as more competitors enter the AI GPU space, Nvidia’s more advanced capabilities could buffer the company’s current status as the most valuable semiconductor stock.

“They’re trying to build their moat by now having software services, and now they’re building a cloud solution,” van Eck said. “But who can really compete with them?”

The VanEck Semiconductor ETF’s top holdings as of Wednesday are Nvidia, Taiwan Semiconductor and Broadcom. The ETF is up more than 12% this year.

Disclaimer