You might also like

The decision reflects the MPC’s view that, although inflation has peaked, further evidence is needed to confirm a sustained return to the 2% target.

The latest ONS figures show CPI at 3.8% in September, broadly in line with BCC’s forecast of 3.7%.

The IMF also expects the UK to record the highest inflation in the G7 this year and next. So, the key question is: will UK inflation stay higher for longer, and will interest rates remain higher to control it?

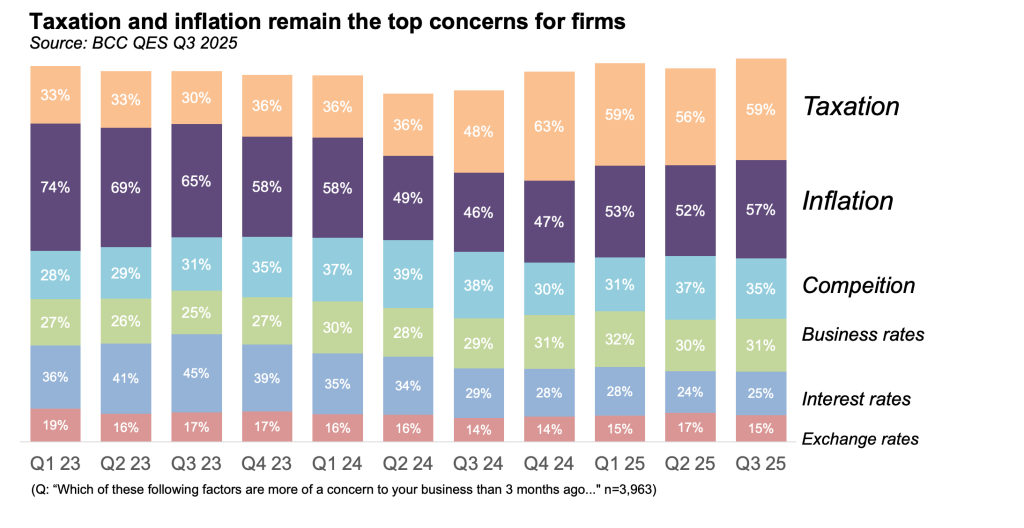

BCC’s latest Quarterly Economic Survey shows that concern about inflation has been rising again, cited by 57% of firms – the second biggest issue for firms after taxation, cited by 59%.

Over the past year, businesses have told BCC that the rise in employer National Insurance Contributions and National Minimum Wage has fed directly into price pressures, with the labour costs remaining the top cost pressure, cited by 72% of firms.

Services inflation remains strong despite a looser labour market, with prices for sectors like hospitality, transport, and healthcare still rising. The labour market faces a conundrum – businesses continue to report record high levels of recruitment difficulties but they also cite labour costs as their biggest cost pressure.

Another major factor is the increasing global trade barriers. Post-Brexit frictions with the EU continue to add significant cost pressure to imported goods and services. Firms reported to the BCC that rising shipping and labour costs are putting pressure on their operations. Many said they are seeking financial assistance, tax incentives, or government support to help offset the costs and risks of exporting.

The BoE faces a dilemma: cutting interest rates too soon could cause inflation to spike again, while keeping rates higher for longer risks slowing growth, putting pressure on households and businesses. Given persistent inflation and geopolitical uncertainty, the BCC expects rates to remain at 4% through 2025, before easing gradually to 3.5% by the end of 2026.

The BoE’s approach also reflects how the UK differs from other major economies. While, the European Central Bank has already begun to ease its monetary policy, the US Federal Reserve has moved far more cautiously and is only now coming closer in line with its UK counterpart. The BoE’s decision to hold back underlines the impact of high inflation in an unpredictable economy.

The BoE expects inflation to fall to close to 3% early next year before gradually returning towards to the 2% target over the subsequent year. That is broadly in line with BCC forecast which expects inflation to ease to 2.5% in Q4 2026 and 2.1% by the end of 2027.

Financial markets had previously priced in a modest interest rate reductions from this summer. However, the market now expects the BoE to prioritise bringing inflation under control before implementing significant further reductions.

High economic uncertainty remains, and the risks point in two directions:

- Upside risks: inflation could rise again due to cost pressures from the Employment Rights Bill and potential tax rises in the upcoming UK Budget. Another energy price shock, caused by geopolitical tensions, along with ongoing trade frictions, could add to further push prices higher.

- Downside risks: inflation could fall faster than expected if global demand for UK exports weakens, domestic spending slows as households tighten their budgets, or a stronger pound that makes imports cheaper.

The BoE now faces a balancing act – bringing inflation back to target without further weakening growth. Strong wage growth, and post-Brexit trade barriers suggest that bringing inflation back to target will remain a gradual process.

The Government must be ready for unexpected economic shocks. With global supply chains still vulnerable, ongoing geopolitical uncertainty, and persistent inflationary pressures, the UK economy faces significant exposure to instability. It is essential Government implements clear policies that help businesses adapt and remain resilient.

This month’s Budget will be crucial in charting the UK’s economic course. Further tax increases on business will hit growth. Unlocking the UK’s economy requires decisive action from Government to encourage exports, infrastructure, and AI adoption.