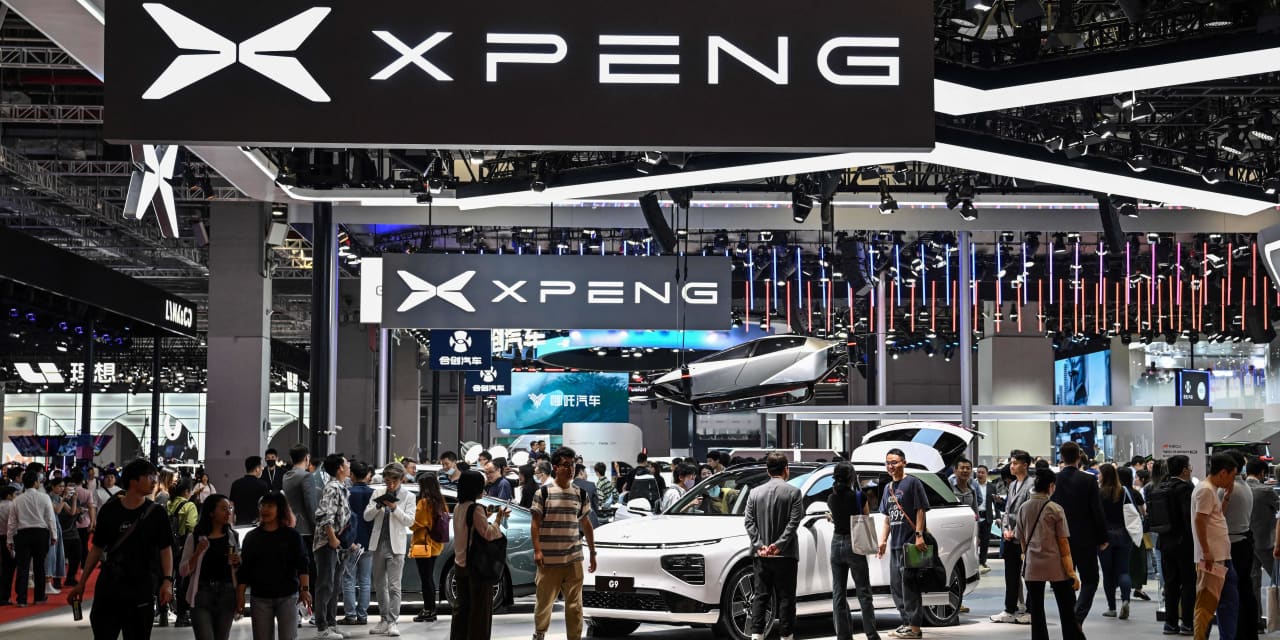

The U.S.-listed shares of XPeng Inc. dropped Wednesday after the China-based electric vehicle maker reported first-quarter results that missed expectations and provided a downbeat revenue outlook, as deliveries dropped by nearly 50%.

The disappointing results appeared to weigh on the stocks of rival EV makers, including Nio Inc. and Tesla Inc.

XPeng reported net losses for the quarter to March 31 that widened to RMB2.34 billion ($339.5 million), or RMB2.71 per American depositary share (ADS), from RMB1.70 billion, or RMB2.00 per ADS, in the same period a year ago.

Excluding nonrecurring items, the adjusted per-ADS loss of RMB2.57 was wider than the FactSet loss consensus of RMB1.99, as gross margin contracted to 1.7% from 12.2%.

XPeng’s stock

XPEV,

dropped 5.6% in premarket trading, putting it on track to open at the lowest price seen during regular-session hours since March 20.

Revenue declined 45.9% to RMB4.03 billion ($587.3 million), well below the FactSet consensus of RMB4.99 billion.

Total deliveries of 18,230 vehicles were down 47.3% from 34,561 a year ago, and were down 17.9% from 22,204 in the fourth quarter.

For the second quarter, the company expects revenue of between RMB4.5 billion and RMB4.7 billion, well below the current FactSet consensus of RMB6.79 billion, and expects deliveries of between 21,000 and 22,000 vehicles.

In sympathy, shares of Shanghai-based Nio

NIO,

fell 2.2%. The stock had slipped 0.5% on Tuesday, after running up 12.4% the previous two sessions. The company is expected to report first-quarter results on or about June 9.

Shares of Texas-based Tesla

TSLA,

which generated 21% of its first-quarter revenue from China, slid 1.6%. The stock had 1.6% on Tuesday, to snap a five-day win streak in which it had soared 13.5%.

And Beijing-based Li Auto Inc.’s stock

LI,

fell 0.8% ahead of Wednesday’s open, after shedding 2.4% on Tuesday.

Those stocks fell more than the broader market, as futures

ES00,

for the S&P 500 index

SPX,

fell 0.4%.