The Forex market is the largest financial market in the world, amassing a daily global trading volume of $7.5bn. Although Forex trading can be a lucrative area, it can be a confusing market to understand.

Some individuals may understand the basics of Forex trading, however, many may not understand how to prepare for unexpected geopolitical events and market announcements when protecting their investments.

Catering to the inquiries of both beginners and trading pros, the experts at Forex.com have curated most asked trading questions to provide beginners with the essential insights into Forex trading.

What is forex trading?

Forex (also known as FX) is simply the shortened name for ‘foreign exchange’, and it is the act of speculating on the movement of exchange prices by buying one currency while simultaneously selling another.

How can I get started with forex trading?

For a beginner to get started with forex trading, it is important that they choose a well-established broker, educate themselves on the basics, develop a clear trading plan and practice trades on a demo account before using their own money.

What are the working hours of the forex market?

You can trade forex 24-hours a day, five days a week – from 10pm (UTC) on a Sunday evening to 10pm (UTC) on a Friday night.

What is the best time to trade forex?

One of the best times to trade forex is when the market is most active – this is when you will get the narrowest spreads and best chance of executing a trade at your desired levels. The forex market is usually most active when the market hours overlap between sessions, as this is when the number of traders buying and selling each currency increases.

How much money do I need to start trading forex?

With most brokers, the minimum initial deposit required is at least 100 of your selected base currency. It is important to note that while investing larger amounts may offer the potential for higher returns, it also involves increased risk. As a result, we recommend that beginner traders carefully consider their risk tolerance and start with an initial deposit that aligns with their financial comfort level and trading experience.

How can I manage risk when trading forex?

You can manage risk by thoroughly educating yourself on forex risk and trading, setting stop-loss orders to limit potential losses, using proper position sizing and diversifying your trading portfolio. Never risk more than you can afford to lose.

Please be aware that setting contingent orders does not necessarily guarantee that your losses will be limited to the intended amounts. Market conditions, such as rapid price movements or gaps, can sometimes result in executions at prices different from your intended levels. It is essential to regularly monitor your positions and be prepared to adapt your trading strategy as needed to manage risk effectively

What is a currency pair?

A currency pair is the price quotation of the exchange rate of the two currencies traded. Forex trading involves the purchase of one currency and the sale of another.

What are the major, minor and exotic currency pairs?

Major currency pairs

Typically referred to as “The Majors”, these six currency pairs make up about 85% of the total daily FX trading volume. [KR2]

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- AUD/USD (Australian Dollar/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- USD/CAD (US Dollar/Canadian Dollar)

Minor currency pairs

Also referred to as ‘cross currency pairs’, the minor currency pairs account for all the other combinations of major markets such as EUR/GBP, EUR/CHF and GBP/JPY.

Exotic currency pairs

Exotic currency pairs involve one major currency and one currency from a smaller or less frequently traded economy. These pairs tend to have lower liquidity and higher spreads, which can be risky for traders, so do this at your own risk.

Which currencies should I trade?

A good rule of thumb for traders new to the market is to focus on one or two currency pairs.

Generally, traders will choose to trade the EUR/USD or USD/JPY because there is so much information and resources available about the underlying economies. Not surprisingly, these two pairs make up much of global daily volume.

How can news and market announcements affect my trades?

While news and market announcements can indeed have a significant impact on trades, it is essential to recognize that their effects can be multifaceted.

Central Bank Policies: Hawkish or dovish central bank news can influence currency values, but the market’s reaction may not always follow a predictable pattern. Factors like market sentiment and the degree of anticipation can also play a role.

Scheduled Economic Releases: Scheduled economic data releases do tend to cause market volatility, but the extent and direction of price movements can vary. Traders should be aware that timing, interpretation, and market sentiment can all influence outcomes.

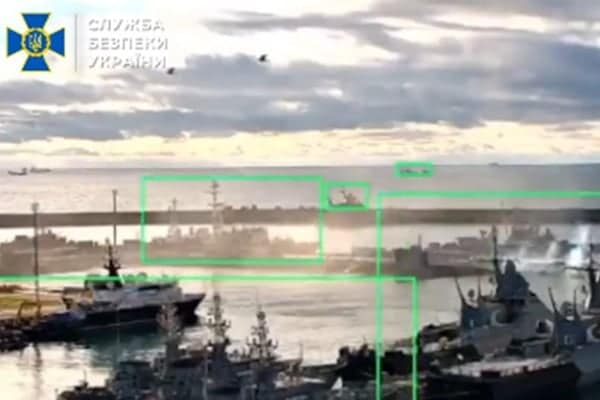

Geopolitical Events: Unforeseen geopolitical events can introduce uncertainty, and while they can result in sudden market shifts, they are by nature unpredictable. Managing risk and employing sound risk management strategies are essential aspects of trading in such conditions.

Market Sentiment and Psychology: News sentiment can impact market psychology, but it is important to remember that market sentiment is influenced by a multitude of factors, not just news releases.

Long-Term vs. Short-Term Impact: The duration of news-driven impacts on the market can differ. Some events have short-lived effects, while others can influence market trends over more extended periods.

In trading, it is crucial to maintain a balanced perspective, acknowledge the inherent uncertainties, and use a combination of analysis techniques, risk management strategies, and ongoing education to navigate the dynamic nature of the financial markets effectively.